Answered step by step

Verified Expert Solution

Question

1 Approved Answer

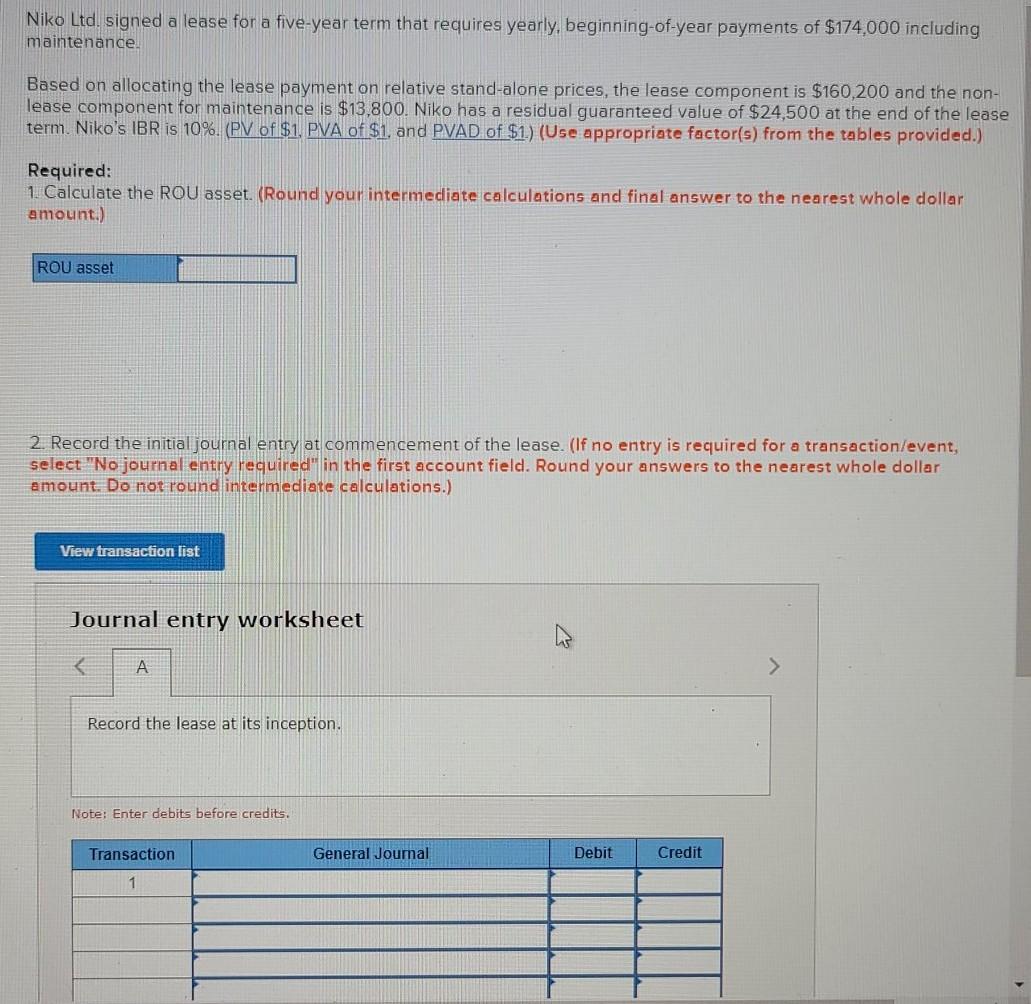

Niko Ltd. signed a lease for a five-year term that requires yearly, beginning-of-year payments of $174,000 including maintenance! Based on allocating the lease payment on

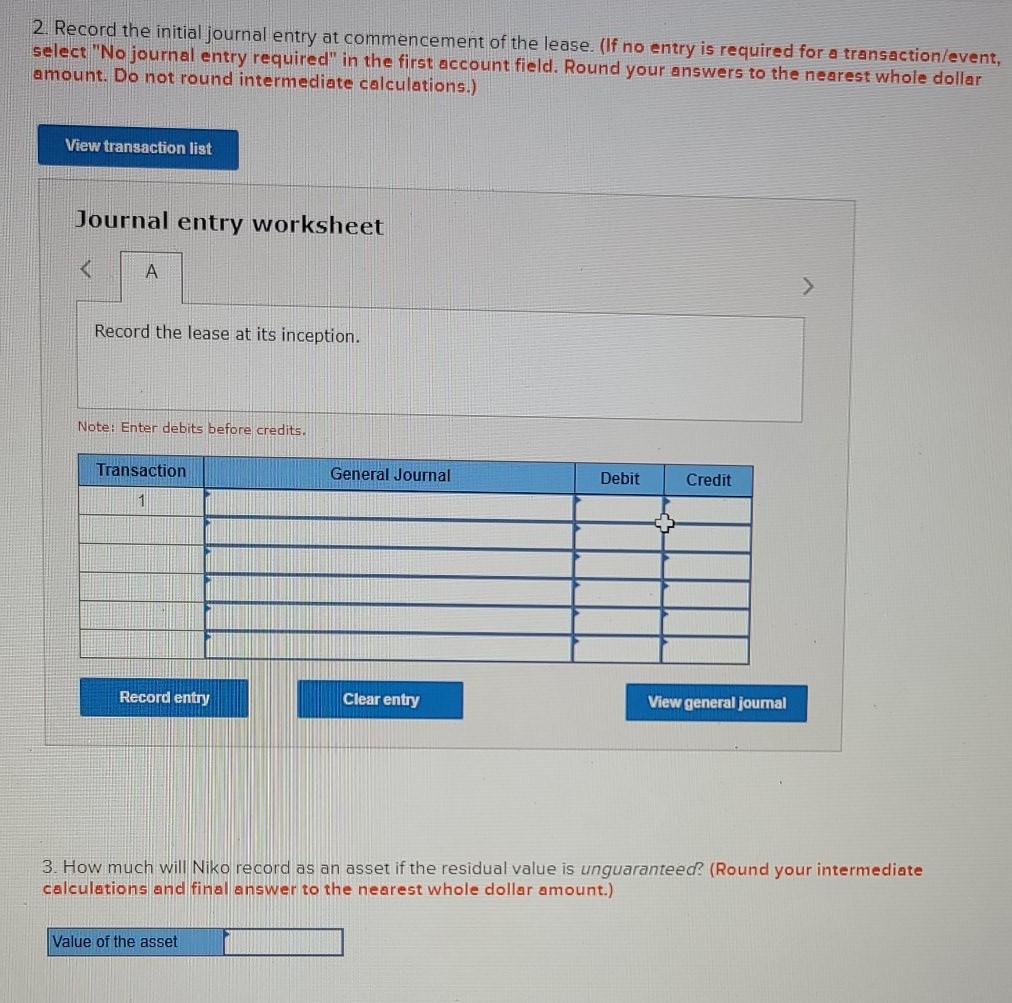

Niko Ltd. signed a lease for a five-year term that requires yearly, beginning-of-year payments of $174,000 including maintenance! Based on allocating the lease payment on relative stand-alone prices, the lease component is $160,200 and the non- lease component for maintenance is $13,800. Niko has a residual guaranteed value of $24,500 at the end of the lease term. Niko's IBR is 10%. (PV of $1. PVA of $1, and PVAD of $1.) (Use appropriate factor(s) from the tables provided.) Required: 1. Calculate the ROU asset. (Round your intermediate calculations and final answer to the nearest whole dollar amount.) ROU asset 2. Record the initial journal entry at commencement of the lease. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round your answers to the nearest whole dollar amount. Do not round intermediate calculations.) View transaction list Journal entry worksheet Record the lease at its inception. Note: Enter debits before credits. Transaction General Joumal Debit Credit 1 2. Record the initial journal entry at commencement of the lease. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round your answers to the nearest whole dollar amount. Do not round intermediate calculations.) View transaction list Journal entry worksheet 3 A > Record the lease at its inception. Note: Enter debits before credits. Transaction General Journal Debit Credit 1 Record entry Clear entry View general joumal 3. How much will Niko record as an asset if the residual value is unguaranteed? (Round your intermediate calculations and final answer to the nearest whole dollar amount.) Value of the asset

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started