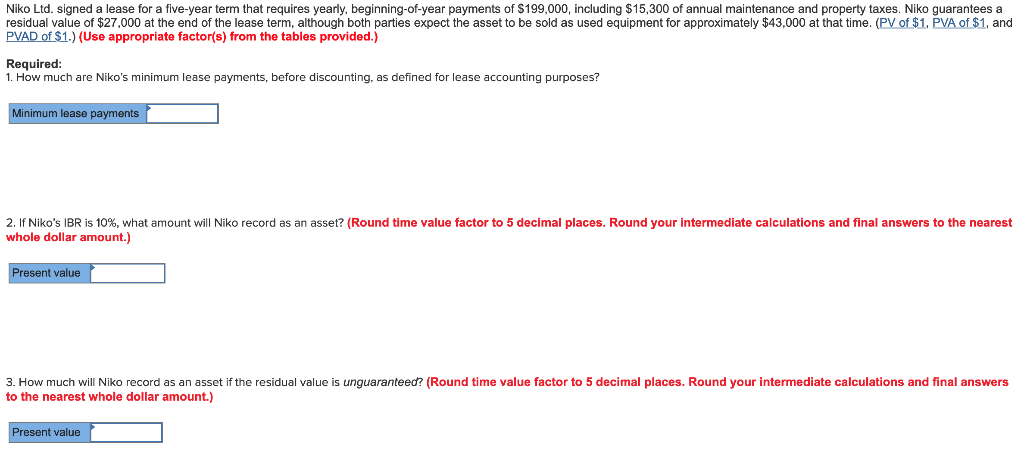

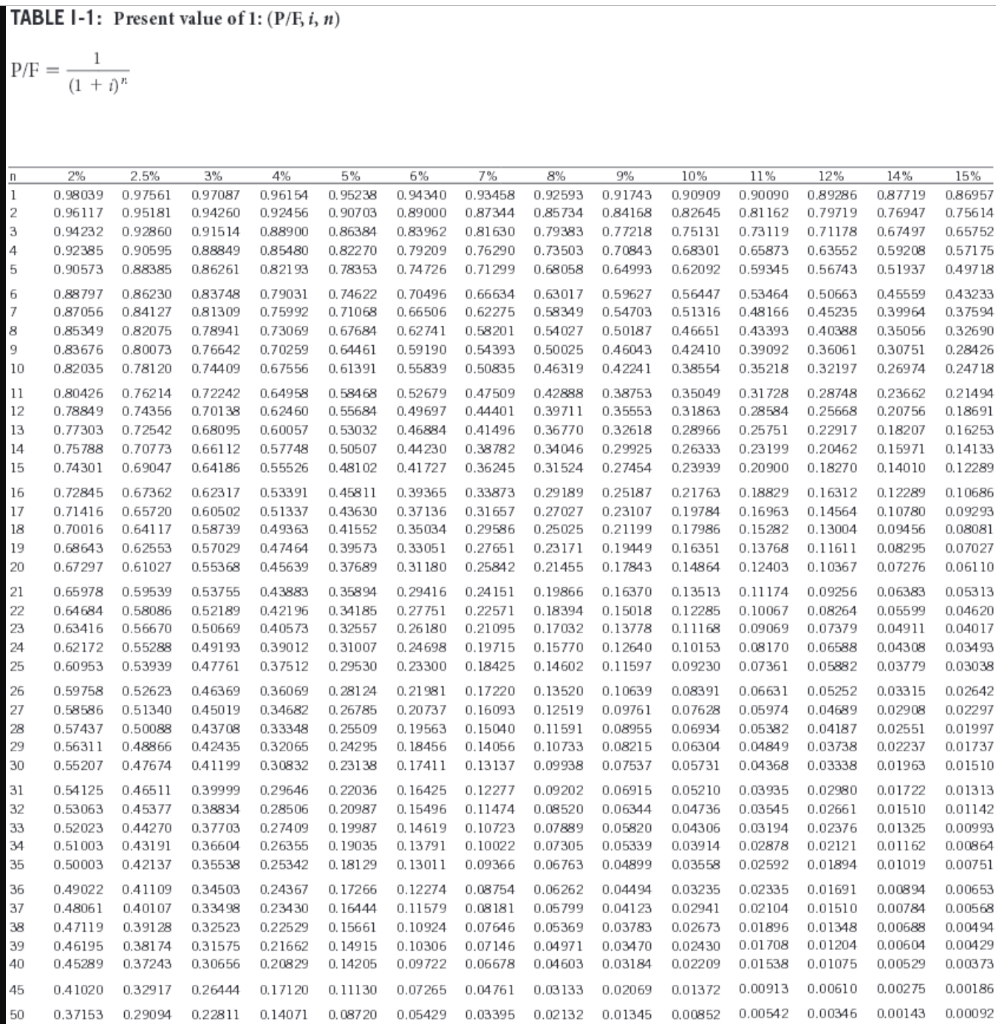

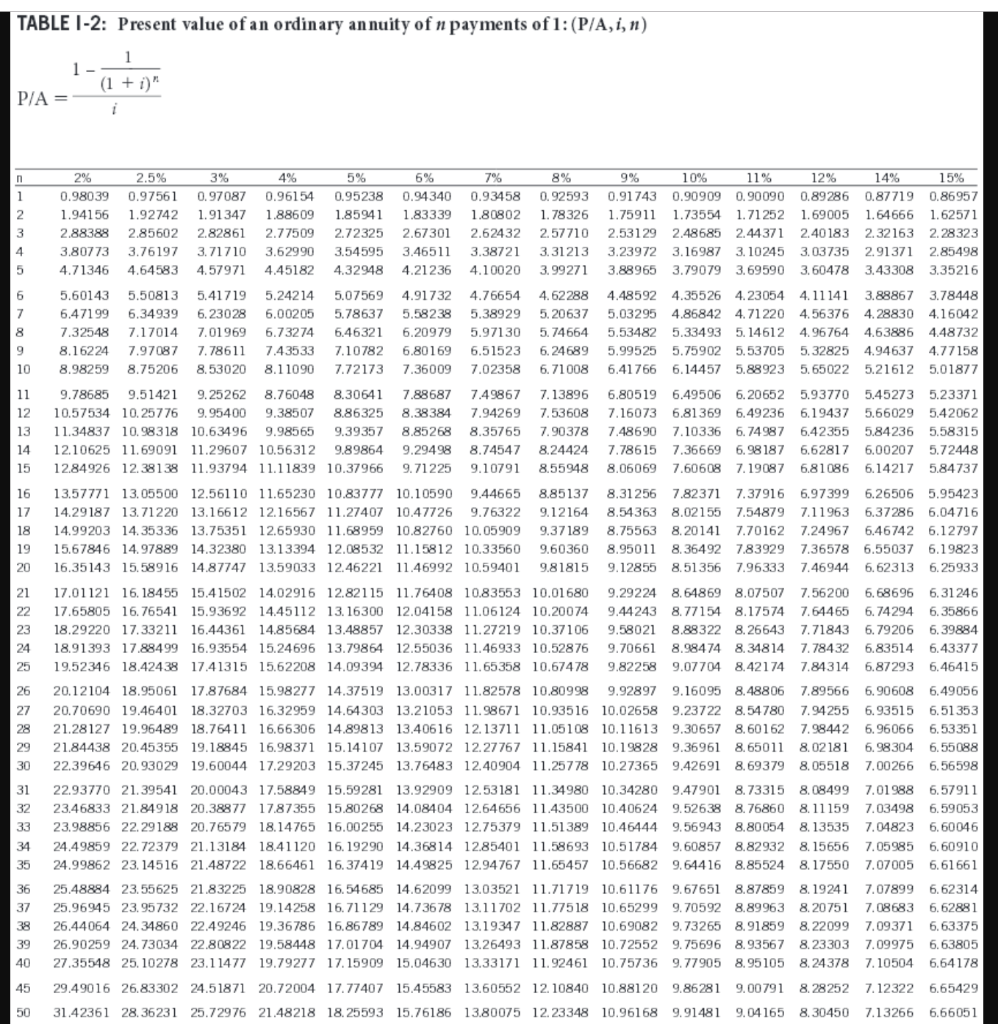

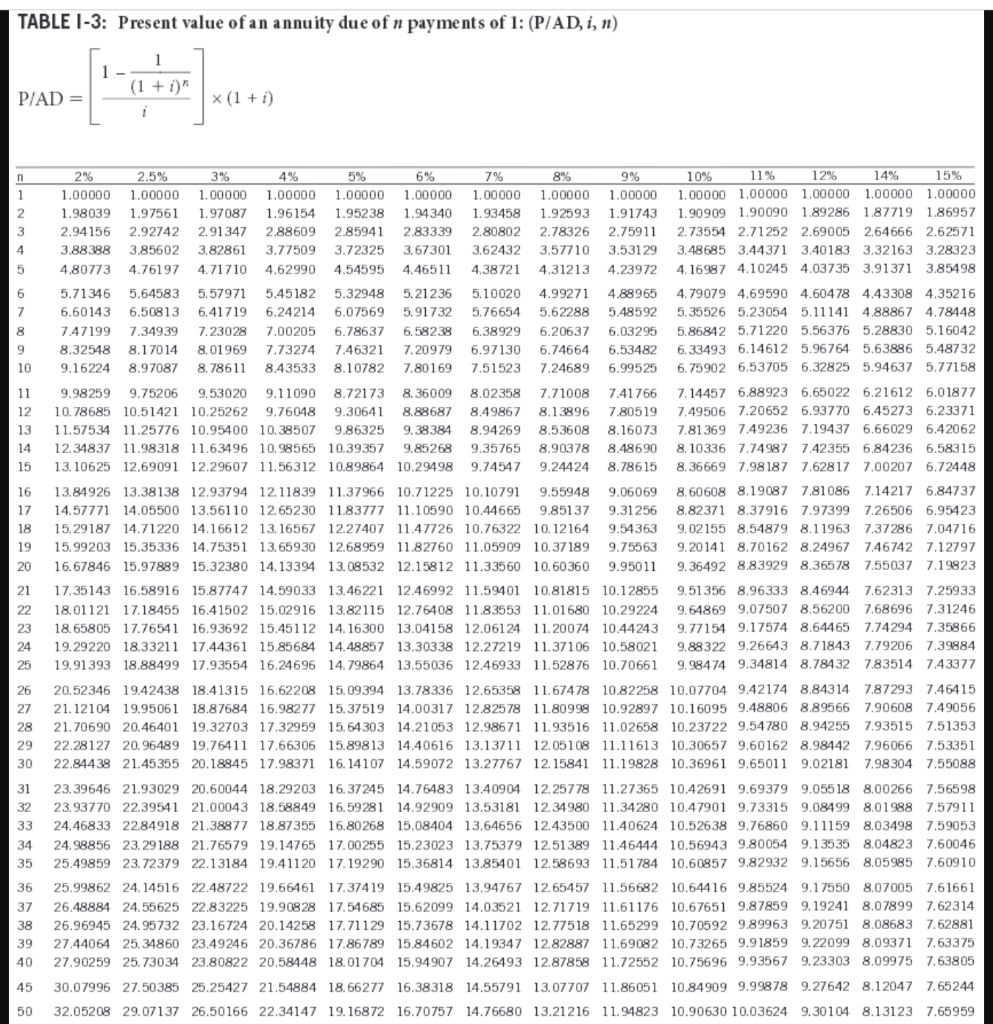

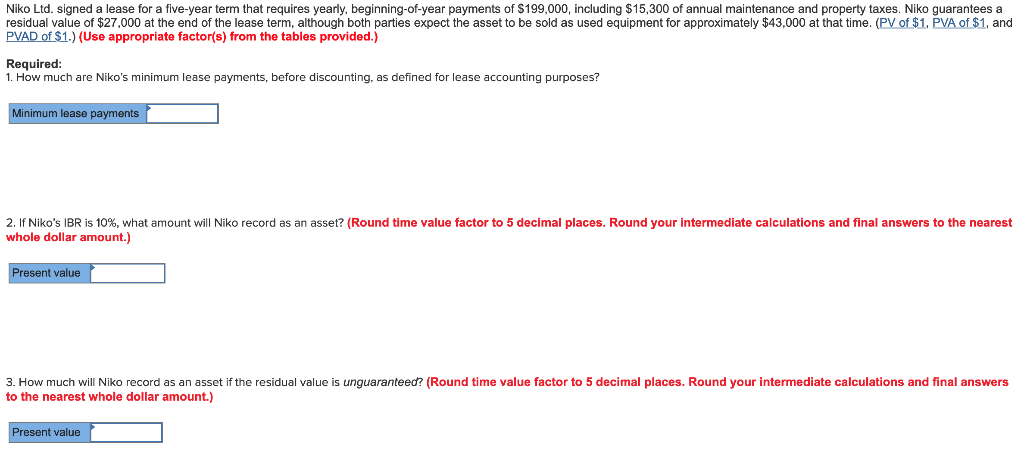

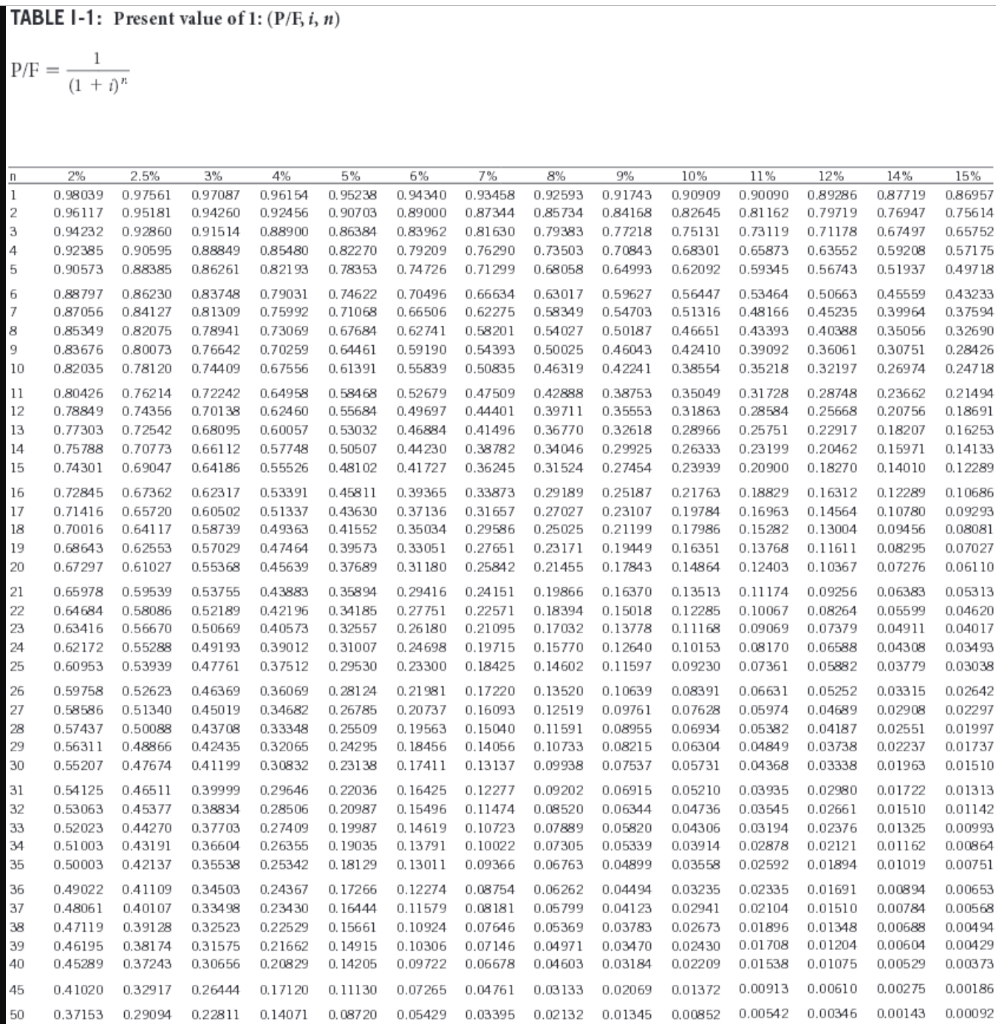

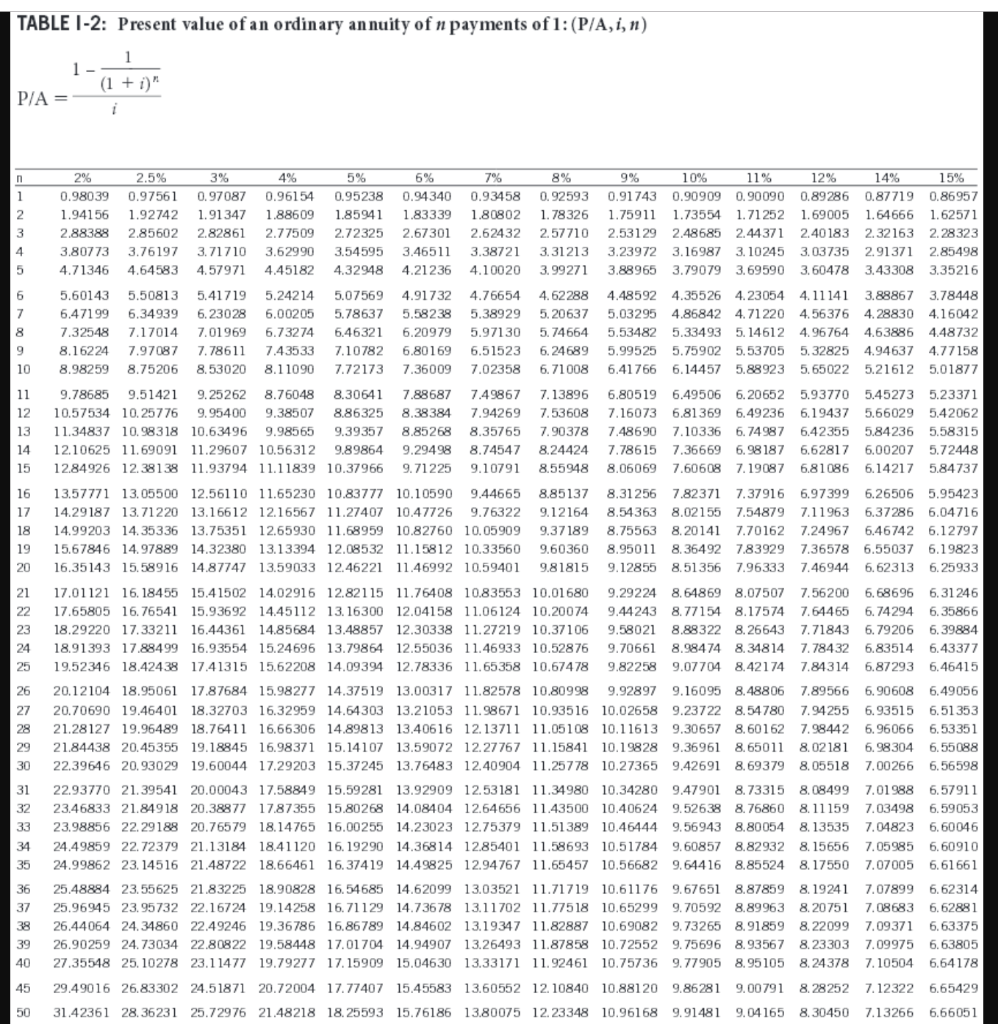

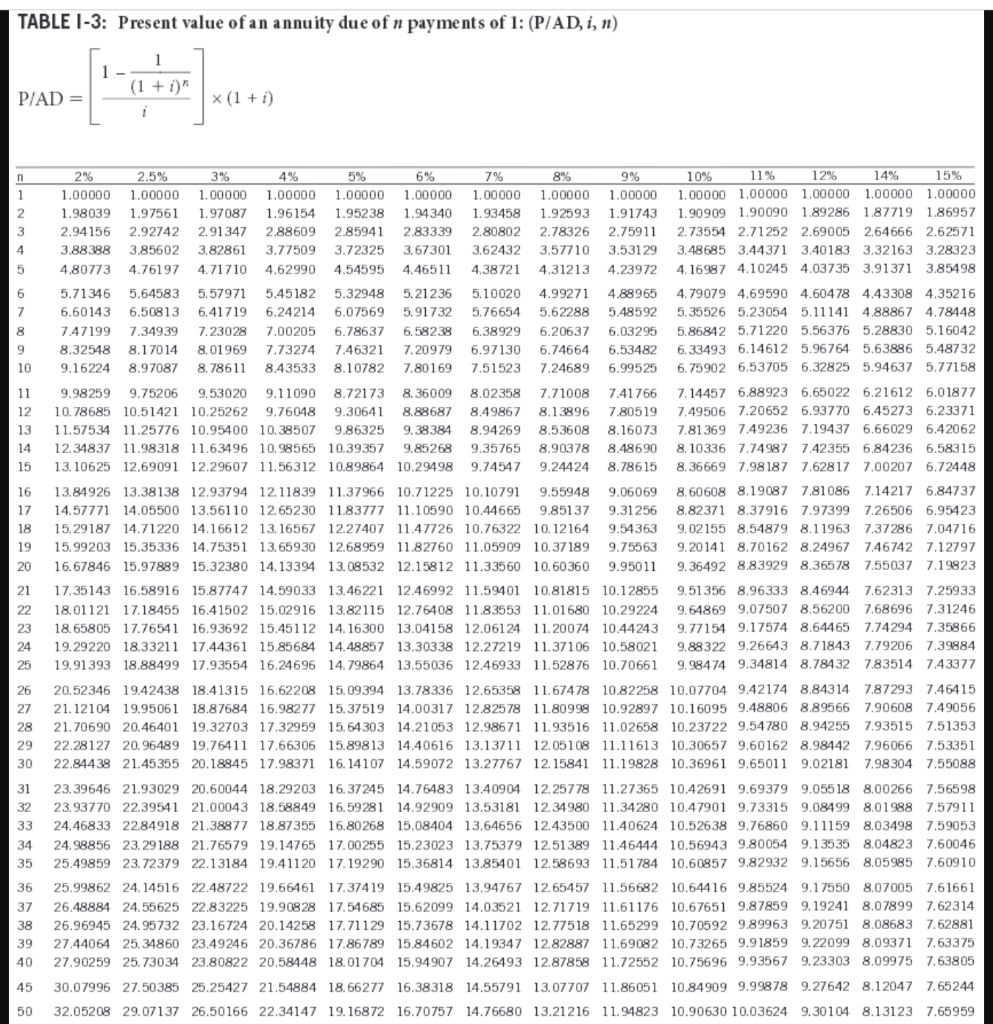

Niko Ltd. signed a lease for a five-year term that requires yearly, beginning-of-year payments of $199,000, including $15,300 of annual maintenance and property taxes. Niko guarantees a residual value of $27,000 at the end of the lease term, although both parties expect the asset to be sold as used equipment for approximately $43,000 at that time. (PV of $1, PVA of $1, and PVAD of S1.) (Use appropriate factor(s) from the tables provided.) Required: 1. How much are Niko's minimum lease payments, before discounting, as defined for lease accounting purposes? Minimum lease payments 2. Niko's BRIs 0% what amount will Niko record as an asset? Round time value whole dollar amount.) actor to 5 deci a places. Round your terme ate a cu ations and naanswers to e nearest resent value 3. How much will Niko record as an asset if the residual value is unguaranteed? (Round time value factor to 5 decimal places. Round your intermediate calculations and final answers to the nearest whole dollar amount.) resent value TABLE 1-1: Present value of 1: (P/E i, n) 25% 3% 4% 5% 6% 1% 10% 11% 12% 14% 15% 0.98039 0.97561 0.97087 0.96154 0.95238 0.94340 0.93458 0.92593 0.91743 0.90909 0.90090 0.89286 0.87719 086957 0.96117 0.95181 0.94260 0.92456 0.907030,89000 0.87344 0.85734 0.84168 0.82645 0.81162 0.79719 0.76947 0.75614 0.94232 0.92860 0.91514 0.88900 0.86384 0.83962 0.81630 0.79383 0.77218 0.75131 0.73119 0.71178 0.67497 0.65752 0.92385 0.90595 088849 0.85480 0.82270 0.79209 0.76290 0.73503 0.70843 0.68301 0.65873 0.63552 0.59208 0.57175 0.90573 0.88385 0.86261 0.82193 0.78353 0.74726 0.71299 0.68058 0.64993 0.62092 0.59345 0.56743 0.51937 0.49718 0.88797 0.86230 0.83748 0.79031 0.74622 0.704960.66634 0.63017 0.596270.56447 0.53464 0.50663 045559 0.43233 0.87056 0.84127 0.81309 0.75992 0.710680.66506 0.62275 0.58349 0.54703 0.51316 0.48166 0.45235 0,39964 0.37594 0.85349 0.82075 0.78941 0,73069 0.67684 0.62741 0.58201 0.54027 0.50187 04665 0.43393 0.40388 0,35056 0.32690 0.83676 0.80073 0.76642 0.70259 0.6446 0.59190 0.54393 0.50025 0.46043 042410 0.39092 0.36061 0,3075 0.28426 10 0.82035 0.78120 0.74409 0.67556 0.61391 0.55839 0.50835 0.46319 0.4224 0.38554 0.35218 0.32197 0.26974 0.24718 11 0.80426 0.76214 0.72242 0.64958 0.58468 0.52679 0.47509 0.42888 0.38753 0.35049 0.31728 0.28748 0.23662 0.21494 12 0.78849 0.74356 0.70138 0.62460 0.55684 0.49697 0.44401 0.39711 0.35553 0.31863 0.28584 0.25668 0.20756 0.18691 13 0.77303 0.72542 0.68095 0,60057 0.53032 0,46884 0.41496 0.36770 0.32618 0.28966 0.25751 0.22917 0.18207 0.16253 14 0.75788 0.70773 0.66112 0,57748 0.50507 0,44230 0.38782 0.34046 0.29925 0.26333 0.23199 0.20462 0.15971 0.14133 15 0.74301 0.69047 0.64186 0,55526 0.48102 0,41727 0.36245 0.31524 0.27454 0.23939 0.20900 0.18270 0.14010 0.12289 16 0.72845 0.67362 0.62317 0.53391 0.45811 0.39365 0.33873 0.29189 0.25187 0.21763 0.18829 0.16312 0.12289 0.10686 17 0.71416 0.65720 0.60502 0.51337 0.43630 0.37136 0.31657 0.27027 0.23107 0.19784 0.16963 0.14564 0.10780 0.09293 18 0.70016 0.64117 0.58739 0.493630.41552 0.35034 0.29586 0.25025 0.21199 0.17986 0.15282 0.13004 0.094560.08081 19 0.686430.62553 0.57029 0.474640.39573 0.33051 0.2765 0.23171 0.19449 0.163510.13768 0.11611 0,08295 0.07027 20 0.67297 0.61027 0.55368 0.45639 0.37689 0.31180 0.25842 0.21455 0.17843 0.1486 0.12403 0.10367 0.07276 0.06110 21 0.65978 0.59539 0.53755 0.43883 0.35894 0.29416 0.24151 0.19866 0.16370 0.13513 0.11174 0.09256 0,06383 0.05313 22 0.64684 0.58086 0.52189 0,42196 0.34185 0.27751 0.22571 0.18394 0.15018 0.12285 0.10067 0.08264 0.05599 0.04620 23 0.634160.56670 0.50669 040573 0.32557 0.26180 0.21095 0.17032 0.13778 0.11168 0.09069 0.07379 0.04911 0.04017 24 0.62172 0.55288 049193 0.39012 0.31007 0.24698 0.19715 0.15770 0.12640 0.10153 0.08170 0.06588 0.04308 0.03493 25 0.60953 0.53939 0.47761 0.37512 0.29530 0.23300 0.184250.14602 0.11597 0.09230 0.07361 0.05882 0.037790.03038 26 0.59758 0.52623 046369 0.36069 0.28124 0.21981 0.17220 0.13520 0.10639 0.08391 0.06631 0.05252 0.03315 0.02642 27 0.58586 0.51340 045019 0.34682 0.26785 0.20737 0.16093 0.12519 0.09761 0.07628 0.05974 0.04689 0,02908 0.02297 28 0.57437 0.50088 0,43708 0.33348 0.25509 0.19563 0.15040 0.11591 0.08955 0.06934 0.05382 0.04187 0,02551 0.01997 2 5 6 29 0.56311 0.48866 042435 0.32065 0.24295 0. 18456 0.14056 0.10733 0.08215 0.06304 0.04849 0.03738 0.0223 30 0.552070.47674 0.41199 0.30832 0.23138 0 0.01 0.1 0.09938 0.07537 0.05731 0.04368 0.03338 0.01963 0.01510 31 0.54125 0.46511 0.39999 0.29646 0.22036 0.16425 0.122770.09202 0.06915 0.05210 0.03935 0.02980 0.01722 0.01313 32 0.53063 0.4537 0.38834 0.28506 0.20987 0.15496 0. 74 0.08520 0.06344 0.04736 0.03545 0.02661 0,01510 0.011 33 0.52023 0.44270 0.37703 0.27409 0.19987 0.14619 0.10723 0,07889 0.05820 0,04306 0,03194 0.02376 0,01325 0.00993 34 0.51003 0.43191 0.366040,26355 0.19035 0.13791 0.10022 0.07305 0.05339 0.03914 0.02878 0.02121 0,01162 0.00864 35 0.50003 0.42137 0.35538 0.25342 0.18129 0.13011 0.09366 0.06763 0.04899 0.03558 0.02592 0.01894 0.01019 0.00751 36 0.49022 0.41109 0.34503 0.24367 0.17266 0.12274 0.08754 0.06262 0.04494 0.03235 0.02335 0.01691 0.00894 0.00653 79 0.08181 0.05799 0.04123 0.02941 0.02104 0.01510 0.007840.00568 38 0.471190.39128 0.32523 0.22529 0.15661 0.10924 0.07646 0.05369 0.03783 0.02673 0.01896 0.01348 0,00688 0.00494 39 0.46195 0.38174 0.31575 0.21662 0.14915 0.10306 0.07146 0.04971 0.03470 0.02430 0.01708 0.01204 0.00604 0.00429 40 0.45289 0.37243 0.30656 0.20829 0. 14205 0,09722 0.06678 0,04603 0.03184 0,02209 0.01538 0.01075 0,00529 0.00373 0.26444 0.17120 0.11130 0.07265 0.04761 0.03133 0.02069 0.01372 0.00913 0.00610 0,00275 0.00186 50 0.37153 0.29094 0.22811 0.1407 0.08720 0.05429 0.03395 0.02132 0.01345 0.00852 0.00542 0.00346 0.00143 0.00092 0.4806 0,40107 0.33498 0.23430 0.16444 0.1 45 0.41020 0.3291 TABLE 1-3: Present value ofan annuity due of n payments of1: (P/AD, i, ) 00000 1.00000 1.00000 1.00000 91743 1.90909 1.90090 189286 1.87719 18695 2.94156 2.92742 2.91347 2.88609 2.85941 2.83339 2.80802 2.78326 2.75911 2.73554 2.71252 2.69005 2.64666 2.62571 3.88388 3.85602 3.82861 3.77509 3.72325 3.6730 362432 3.57710 3.53129 3,48685 3.44371 3.40183 3.32163 3.28323 3872 4.31213 4.23972 4.16987 4.10245 4.03735 3.91371 3.85498 5.45182 5.32948 5.21236 5.10020 4.9927 4.88965 4.79079 4.69590 4.60478 4.43308 4.35216 6.07569 5.91732 5.76654 5.62288 5.48592 5.35526 5.23054 5.11141 4.88867 4.78448 .47199 7.34939 7.23028 7.00205 6.78637 6.58238 6.38929 6.20637 6.03295 5.86842 5.71220 5.56376 5.28830 5.16042 8.32548 8.17014 8.01969 7.73274 7.4632 7.20979 6.97130 6.74664 6.53482 6.33493 6.14612 5.96764 5.63886 5.48732 2 9.55948 9.06069 8.60608 8.19087 7.81086 7.14217 6.847 17 14.5777114.05500 13.56110 12.65230 11.83777 11.10590 10.44665 9.85137 9.31256 8.82371 8.37916 7.97399 20 16.67846 15.97889 15.32380 14.13394 13.08532 12.15812 11.33560 10.60360 9.95011 9.36492 8.83929 8.36578 7.55037 7.19823 24 19.29220 18.33211 17.44361 15.85684 14.48857 13.30338 12.27219 11.37106 10.58021 9.88322 9.26643 8.71843 7.79206 7.39884 25 19.91393 18.88499 17.93554 16.24696 14.79864 13.55036 12.46933 11.52876 10.70661 998474 9.34814 8.78432 7.83514 7.43377 26 20.5234619.42438 18.41315 16.62208 15.09394 104 1995061 18.87684 16.98277 15.37519 14.0031 2.82578 11.80998 10.92897 10.16095 948806 8.89566 28 21.70690 20,46401 19.32703 17.32959 15.64303 14.21053 12.98671 11.935 11.02658 10.23722 9.54780 8.94255 7.93515 7.51353 30 22.84438 21.45355 20.18845 17.98371 16.14107 14.59072 13.2776 23.39646 21.93029 20.60044 18.29203 16.37245 14.76483 13.40904 12.25778 11.27365 10.42691 9.69379 9.05518 8.00266 7.56598 33 24.46833 22.84918 21.38877 18.87355 16.80268 15.08404 13.64656 12.43500 1140624 10.52638 9.76860 9.11159 8.03498 7.59053 4 24.98856 23.29188 21.76579 19.14765 17.00255 75379 12.5138911.46444 10.56943 9.80054 9.13535 8.04823 7.60046 3 38 26.96945 24.95732 23.16724 20.14258 17.71129 15.73678 14.11702 12.77518 11.65299 10.70592 9.89963 9.20751 8.08683 7.62881 39 27.44064 25.34860 23.49246 20.36786 17.86789 15.84602 14.19347 12.82887 11.69082 10.73265 9.91859 9.22099 8.09371 7.63375 40 27.90259 25.73034 23.80822 20.58448 18.01704 15.94907 26493 12.87858 11.72552 10.75696 9.93567 9.23303 8.09975 7.63805 5 30.0799627.50385 25.25427 21.54884 18.66277 16.38318 14.55791 13.07 1.86051 10.84909 9.99878 9.27642 8.12047 7.65244 50 32.0520829.07137 26.50166 22.34147 19.16872 16.7075714.76680 13.21216 11.94823 10.90630 10.03624 9.30104 8.13123 7.65959