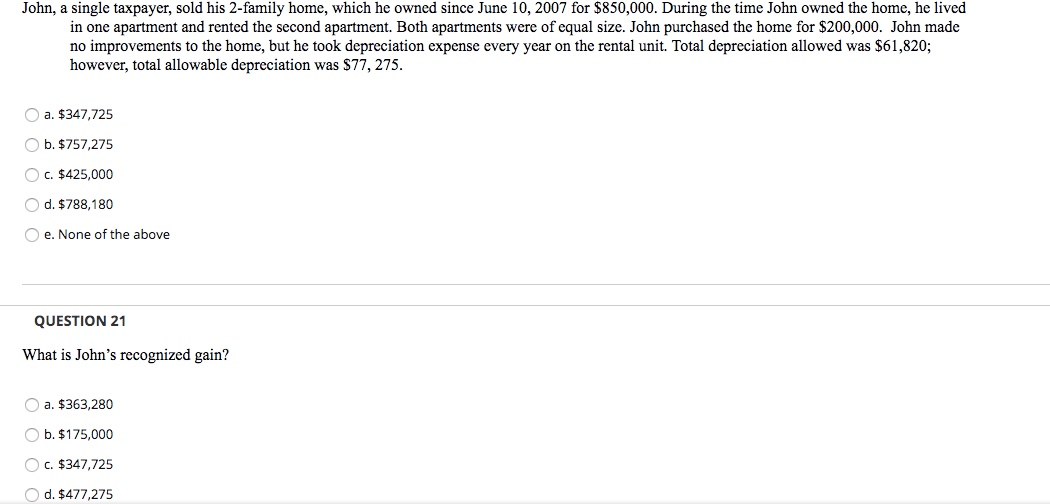

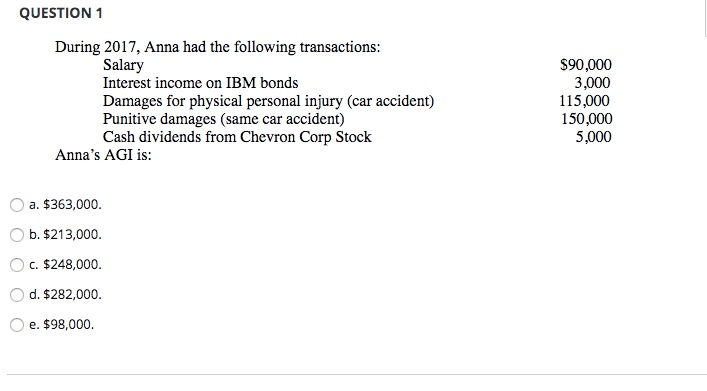

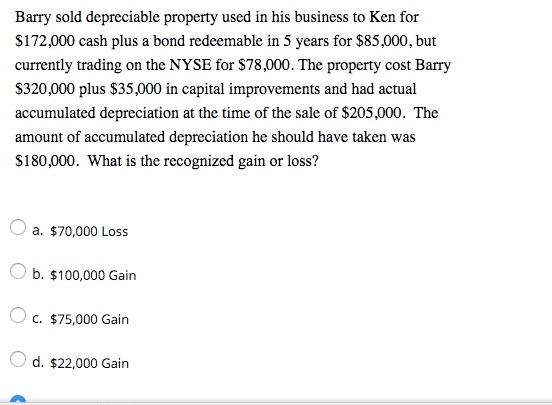

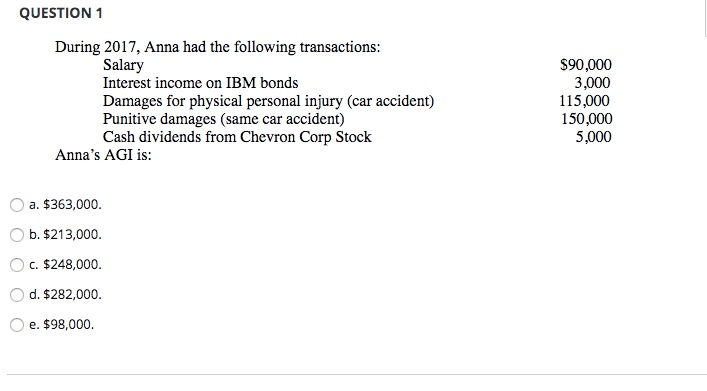

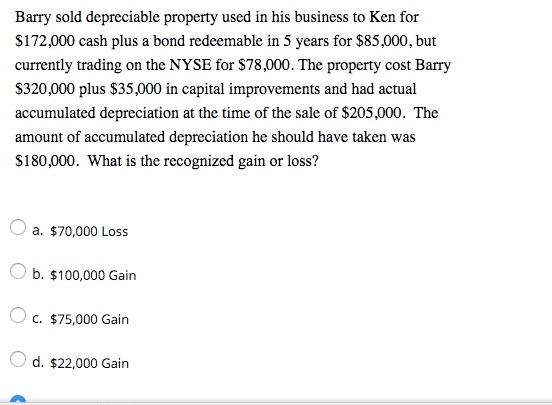

nily home, which he owneda varements were of equal sizetalamit. John, a single taxpayer, sold his 2-family home, which he owned since June 10, 2007 for $850,000. During the time John owned the home, he lived in one apartment and rented the second apartment. Both apartments were of equal size. John purchased the home for $200,000. John made no improvements to the home, but he took depreciation expense every year on the rental unit. Total depreciation allowed was $61,820; however, total allowable depreciation was $77, 275. O a. $347,725 O b. $757,275 O c. $425,000 O d. $788,180 e. None of the above QUESTION 21 What is John's recognized gain? O a. $363,280 O b. $175,000 O c. $347,725 d. $477,275 QUESTION 1 During 2017, Anna had the following transactions: Salary Interest income on IBM bonds Damages for physical personal injury (car accident) Punitive damages (same car accident) Cash dividends from Chevron Corp Stock Anna's AGI is: $90,000 3,000 115,000 150,000 5,000 a. $363,000. O b. $213,000. O c. $248,000. d. $282,000. e. $98,000. Barry sold depreciable property used in his business to Ken for $172,000 cash plus a bond redeemable in 5 years for $85,000, but currently trading on the NYSE for $78,000. The property cost Barry $320,000 plus $35,000 in capital improvements and had actual accumulated depreciation at the time of the sale of $205,000. The amount of accumulated depreciation he should have taken was $180,000. What is the recognized gain or loss? a. $70,000 Loss b. $100,000 Gain c. $75,000 Gain d. $22,000 Gain nily home, which he owneda varements were of equal sizetalamit. John, a single taxpayer, sold his 2-family home, which he owned since June 10, 2007 for $850,000. During the time John owned the home, he lived in one apartment and rented the second apartment. Both apartments were of equal size. John purchased the home for $200,000. John made no improvements to the home, but he took depreciation expense every year on the rental unit. Total depreciation allowed was $61,820; however, total allowable depreciation was $77, 275. O a. $347,725 O b. $757,275 O c. $425,000 O d. $788,180 e. None of the above QUESTION 21 What is John's recognized gain? O a. $363,280 O b. $175,000 O c. $347,725 d. $477,275 QUESTION 1 During 2017, Anna had the following transactions: Salary Interest income on IBM bonds Damages for physical personal injury (car accident) Punitive damages (same car accident) Cash dividends from Chevron Corp Stock Anna's AGI is: $90,000 3,000 115,000 150,000 5,000 a. $363,000. O b. $213,000. O c. $248,000. d. $282,000. e. $98,000. Barry sold depreciable property used in his business to Ken for $172,000 cash plus a bond redeemable in 5 years for $85,000, but currently trading on the NYSE for $78,000. The property cost Barry $320,000 plus $35,000 in capital improvements and had actual accumulated depreciation at the time of the sale of $205,000. The amount of accumulated depreciation he should have taken was $180,000. What is the recognized gain or loss? a. $70,000 Loss b. $100,000 Gain c. $75,000 Gain d. $22,000 Gain