Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Nine month call options on Range Resources at 170 on a stock sell for 24.484. Nine month put options on the same stock at 170

Nine month call options on Range Resources at 170 on a stock sell for 24.484. Nine month put options on the same stock at 170 sell for 14.002. The interest rate is 3%. You can go long or short 400 units of any asset. How much money using put-call parity arbitrage will you make in nine months if the stock price today is 172? 175?

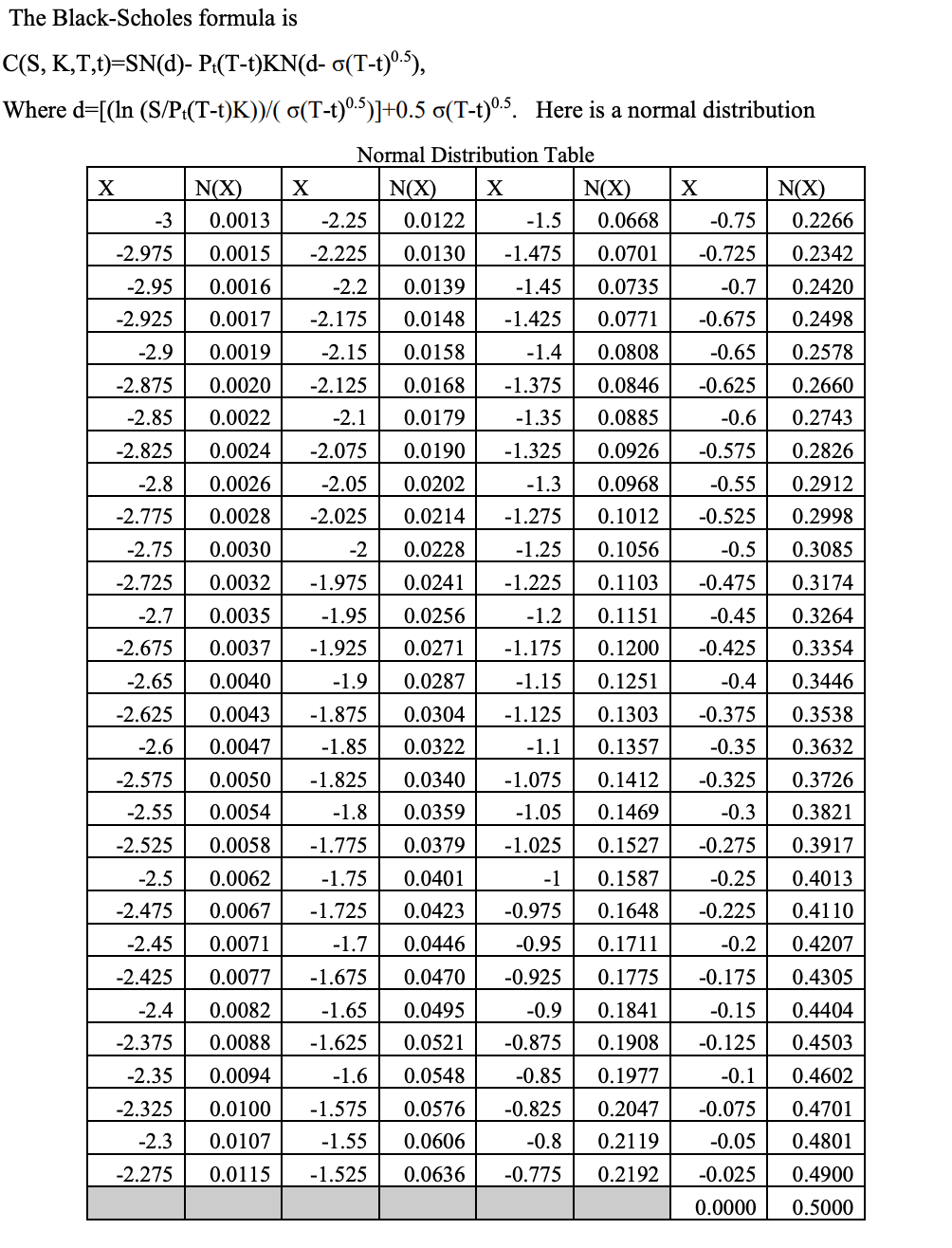

The Black-Scholes formula is C(S, K,T,t)=SN(d)- P{(T-t)KN(d- o(T-t).5), Where d=[(In (S/P+(T-t)K))/( (T-t).5)]+0.5 (T-t).5. Here is a normal distribution Normal Distribution Table N(X) X X N(X) N(X) X N(X) X -3 0.0013 -2.25 0.0122 -1.5 0.0668 -0.75 0.2266 -2.975 0.0015 -2.225 0.0130 -1.475 0.0701 -0.725 0.2342 -2.95 0.0016 -2.2 0.0139 -1.45 0.0735 -0.7 0.2420 -2.925 0.0017 -2.175 0.0148 -1.425 0.0771 -0.675 0.2498 -2.15 0.0158 -1.4 0.0808 -0.65 0.2578 -2.9 0.0019 -2.875 0.0020 -2.125 0.0168 -1.375 0.0846 -0.625 0.2660 -0.6 0.2743 -2.85 0.0022 -2.1 -2.825 0.0024 -2.075 0.0179 -1.35 0.0190 -1.325 0.0885 0.0926 -0.575 0.2826 -1.3 0.0968 -0.55 0.2912 -2.8 0.0026 -2.05 -2.775 0.0028 -2.025 0.0202 0.0214 -1.275 0.1012 -0.525 0.2998 -2.75 0.0030 -2 0.0228 0.1056 -0.5 0.3085 -1.25 -1.225 0.1103 -0.475 -2.725 0.0032 -1.975 0.0241 0.3174 -2.7 0.0035 -1.95 0.0256 -1.2 0.1151 -0.45 0.3264 -2.675 0.0037 -1.925 0.0271 -1.175 0.1200 -0.425 0.3354 -2.65 0.0040 -1.9 0.0287 -1.15 0.1251 -0.4 0.3446 -2.625 0.0043 -1.875 0.0304 -1.125 0.1303 -0.375 0.3538 -1.85 0.0322 -1.1 0.1357 -0.35 0.3632 -2.6 0.0047 -2.575 0.0050 -1.825 0.0340 -1.075 0.1412 -0.325 0.3726 -2.55 0.0054 -1.8 0.0359 -1.05 0.1469 -0.3 0.3821 -2.525 0.0058 -1.775 0.0379 -1.025 0.1527 -0.275 0.3917 -2.5 0.0062 -1.75 0.0401 -1 0.1587 -0.25 0.4013 -2.475 0.0067 -1.725 0.0423 -0.975 0.1648 -0.225 0.4110 0.4207 -2.45 0.0071 -1.7 0.0446 -0.95 0.1711 -0.2 -2.425 0.0077 -1.675 0.0470 -0.925 0.1775 -0.175 0.4305 0.0495 -0.9 0.1841 0.4404 -2.4 -2.375 -2.35 0.0094 0.0082 -1.65 0.0088 -1.625 -0.15 0.1908 -0.125 0.4503 0.0521 -0.875 -0.1 0.4602 -1.6 -2.325 0.0100 -1.575 0.0548 -0.85 0.1977 0.0576 -0.825 0.2047 -0.075 0.4701 -0.05 0.4801 -2.3 0.0107 -1.55 0.0606 -0.8 0.2119 -2.275 0.0115 -1.525 0.0636 -0.775 0.2192 -0.025 0.4900 0.0000 0.5000

Step by Step Solution

★★★★★

3.48 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

As per Put Call Parity the prices of options with same strike price expiry date are as follows Price of Call PV of Exercise Price Spot Price Current S...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started