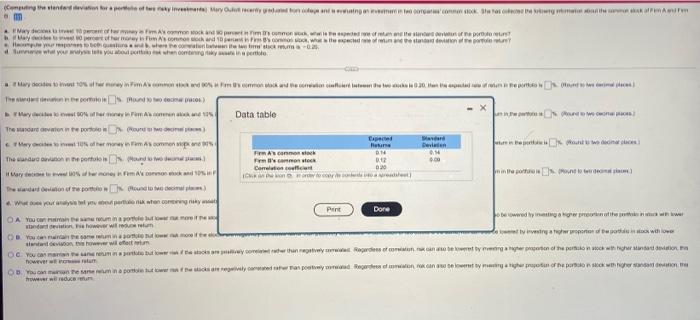

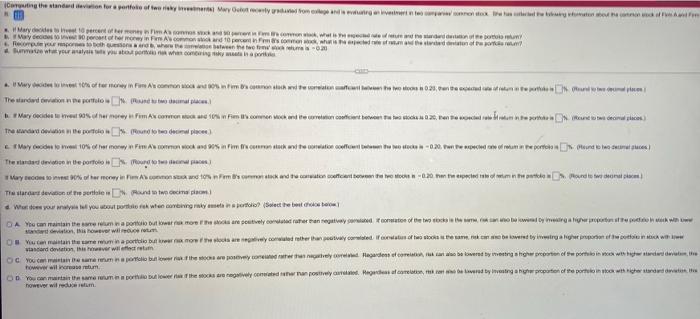

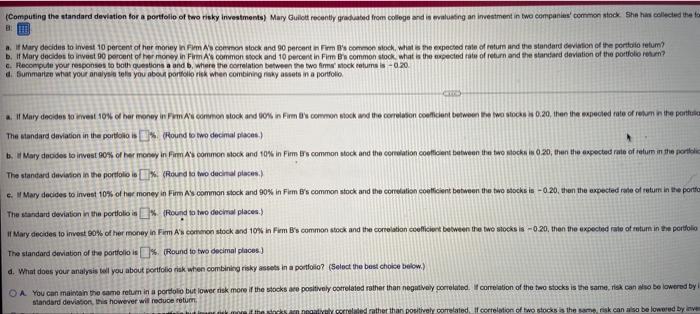

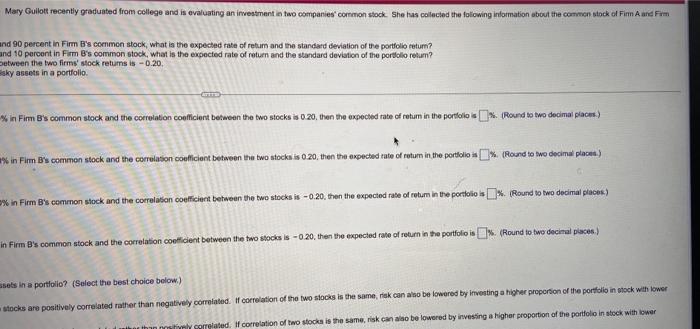

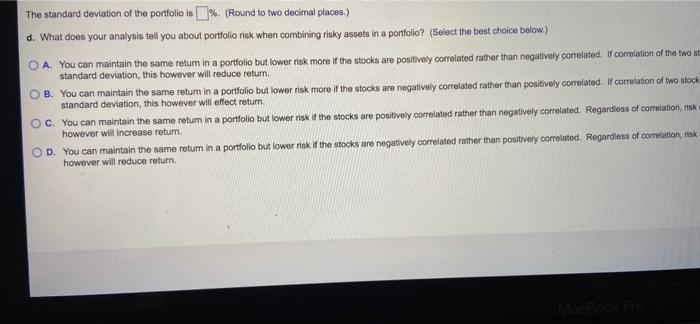

ning nende er oftest Mary Outrecery own into con conoscow Hwy wym w nim monoch, wie se way. Worry ist schon wieder Hymns in new win Data table w yenato The more intended May 10 ofers comme The curcano ne posto Hodon Mary woman want din fine Fm Ascono Pirmo 02 Correios con 020 wordt Delen 04 100 NE) Wooww Part Dore OA You can now betowwe yn www We wildern OD Y Gamint monte Infox with lower soowwww wiatru OG You can now use your doctor of the portion with the station however O man enem na con tutte lycraplyer tempot of the power to werd Couting the standard deviation for a pontos of tourist wy Gry to work as a try to be with Maryseren en continue www My Operator Asconto de menor Recome the where we were - Bure your way to my A motor termine Ascono w nim scene with The stuwd wone porno in Mary cocilin u meet sosit har merayu Fim Ax comeren tucken Famil comunen wech and the correlated content turen van het einde 0 28, Vente encontrou en hoe om n reune assura cercare le Tre mandat de ponto del per Lycie w 10% town Fim Armon works inimene on tematice collete ocks-020. el munin aporten e ho second places There we proud y come to meet ek of her mom commensa e ton nom des comments and the create ancient heren to be seen - 1.20 telefonile he meer in the parede de provene ter several bloom The devono en und noch am We www you to Dok when works in Sect the best! DA Y can aan een pontot keras more the more setely correran regulator of the window O cantante eum in a portion on the wycomed mother than worden bety wire www OG You can also be more but they come Header, that belone by the police wywards at the On You can with a mulher gran posted Madela, red by the proportion of the program won Isover will was and in this verwira harum however will rem 90% in Firm B's common stock and the correlation coefficient between the two stocks is 0.20, then the expected rate of return in the portfolio is % (RC -) Data table um in the portfolio is %. (R - 10% =) feturn in the portfolio is % 90% Expected Returns Firm A's common stock 0.14 Firm B's common stock 0.12 Correlation coefficient 0.20 (Click on the icon in order to copy its contents into a spreadsheet.) Standard Deviation 0.14 0.09 m in the portfolio is %. (RE % in F assets Print Done so be lowered by investing a hi the stod be lowered by investing a higher the stock Computing the standard deviation for a portfoiio of two rinky investments) Mary Gulott recently graduated from college and is rotulong an investment in two companies common stock Sho his collected the to Mary decides to invest 10 percent of her money in Fm As common stock and 90 percent Firm's como, what the expected rate of return and the standard deviation of the portfolio retum D. Mary decides to invest 90 percent of her money in Form A common stock and 10 percent in Firm Bn common stock what is the expected tute of return and the standard deviation of the portfolio um? c. Recompute your responses to both questions a and b, where the correlation between the two formstock returns is -0.20. Summarize what your analysis to you about portfolio risk when combining rokassets in a portfolio if Mary decides to west 10% olhar money in Form Ar common stock and 90% in Firm's common stock and the correlation coefficient between two S0.20, then the expected rate of rem in the porta The standard deviation in the portfolio Hound to wo decimal places) t. Mary decides to invest 90% of her money in Fim A common lock and 10% in Fim Eis common stock and the conolation coeficient between the two och O.20, then the expected rate of return the portie The standard devision in the portfolio i %. (Round wo decimal places c. Mary decides to invest 10% of her money in Fim As common stock and 90% in Fim b's common stock and the correlation coefficient between the two stocks is - 0 20. then the expected rate of return in the porter The standard deviation in the portfolio is % (Round to two decal places.) of Mary decides to invest 90% of her money in Fim A's comenon stock and 10% in Form B's common stock and the correlation coefficient between the two stockis -020, then the expected rate of return in the portfolio The standard deviation of the portfolios % (Round to two decimal places) d. What does your analysis tell you about portfolio risk when combining risky assets in a portfolio? (Select the best choice below.) OA You can maintain the same retum in a portfolio but lower risk more if the stocks are positively correlated rather than negatively correlated correlation of the two stocks is the same, risk can be lowered by standard deviation, this however will reduce retum are the knowled rather than positively correlated. If correlation of two stocks is the same risk can also be lowered by ve Mary Gullott recently graduated from college and is evaluating an investment in two companies common stock. She has collected the following information about the common stock of Fim A und Form and 90 percent in Firm B's common stock, what is the expected rate of retum and the standard deviation of the portfolio retum? and 10 percent in Firm B's common stock, what is the expected rate of return and the standard deviation of the portfolio retum? between the two firms stock returns is -0.20 sky assets in a portfolio in Fim B's common stock and the correlation coeficlert between the two stocks is 0.20, then the expected rate of return in the portfolio [ (Round to two decimal piacm.) % in Film Becommon stock and the correlation couficient between the two stocks is 0.20, then the expected tute of totum in the portfolio 3 [(Round to two decimal places) ex in Fim B's common stock and the correlation coefficient between the two stocks is - 0.20, then the expected rate of rotum in the portfolio s 0% (Round to two decimal places) in FirmB's common stock and the correlation coefficient between the two stocks is - 020, then the expected rate of return in the portfolio . % (Round to two decimal place) sets in a portfolio? (Select the best choice below.) stocks are positively correlated rather than negatively correlated. If correlation of the two stocks is the same, risk can also be lowered by investing a higher proportion of the portfolio in stock with lower nos correlated. If correlation of two stocks is the same, risk can also be lowered by investing a higher proportion of the portfolio in stock with lower The standard deviation of the portfolio is %. (Round to two decimal places.) d. What does your analysis tell you about portfolio risk when combining ruky assets in a portfolio? (Select the best choice below) O A. You can maintain the same retum in a portfolio but lower risk more if the stocks are positively correlated rather than negatively correlated. It correlation of the two su standard deviation, this however will reduce retum O B. You can maintain the same retum in a portfolio but lower risk more if the stocks are negatively correlated rather than positively correlated. If correlation of two stock standard deviation, this however will effect retum OC. You can maintain the same return in a portfolio but lower risk if the stocks are positively correlated rather than negatively correlated. Regardless of correlation, risk however will increase return. OD. You can maintain the same return in a portfolio but lower risk if the stocks are negatively correlated rather than positively correlated. Regardless of correlation, risk however will reduce retum