Answered step by step

Verified Expert Solution

Question

1 Approved Answer

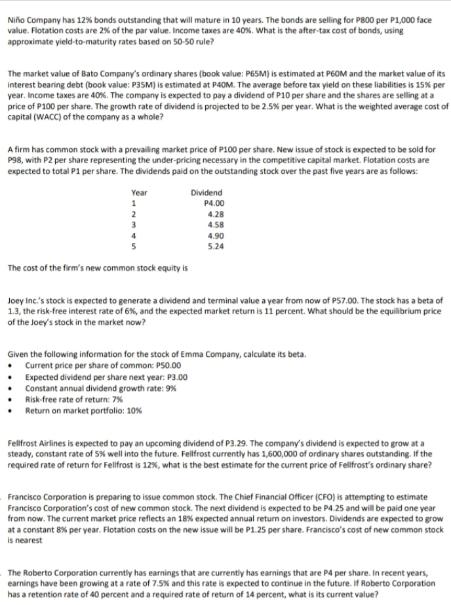

Nio Company has 12% bonds outstanding that will mature in 10 years. The bonds are selling for P800 per P1,000 face value. Flotation costs

Nio Company has 12% bonds outstanding that will mature in 10 years. The bonds are selling for P800 per P1,000 face value. Flotation costs are 25% of the par value. Income taxes are 40%. What is the after-tax cost of bonds, using approximate yield-to-maturity rates based on 50-50 rule? The market value of Bato Company's ordinary shares (book value: P65M) is estimated at P60M and the market value of its interest bearing debt (book value: P3SM) is estimated at P40M. The average before tax yield on these liabilities is 15% per year. Income taxes are 40%. The company is expected to pay a dividend of P10 per share and the shares are selling at a price of P100 per share. The growth rate of dividend is projected to be 2.5% per year. What is the weighted average cost of capital (WACC) of the company as a whole? A firm has common stock with a prevailing market price of P100 per share. New issue of stock is expected to be sold for P98, with P2 per share representing the under-pricing necessary in the competitive capital market. Flotation costs are expected to total P1 per share. The dividends paid on the outstanding stock over the past five years are as follows: Year 1 2 The cost of the firm's new common stock equity is Dividend P4.00 4.28 4.58 4.90 5.24 Joey Inc.'s stock is expected to generate a dividend and terminal value a year from now of P57.00. The stock has a beta of 1.3, the risk-free interest rate of 6%, and the expected market return is 11 percent. What should be the equilibrium price of the Joey's stock in the market now? Expected dividend per share next year: P3.00 Constant annual dividend growth rate: 9% Risk-free rate of return: 7% Return on market portfolio: 10% Given the following information for the stock of Emma Company, calculate its beta. . Current price per share of common: P50.00 Fellfrost Airlines is expected to pay an upcoming dividend of P3.29. The company's dividend is expected to grow at a steady, constant rate of 5% well into the future. Feilfrost currently has 1,600,000 of ordinary shares outstanding. If the required rate of return for Fellfrost is 12%, what is the best estimate for the current price of Fellfrost's ordinary share? Francisco Corporation is preparing to issue common stock. The Chief Financial Officer (CFO) is attempting to estimate Francisco Corporation's cost of new common stock. The next dividend is expected to be P4 25 and will be paid one year from now. The current market price reflects an 18% expected annual return on investors. Dividends are expected to grow at a constant 8% per year. Flotation costs on the new issue will be P1.25 per share. Francisco's cost of new common stock is nearest The Roberto Corporation currently has earnings that are currently has earnings that are P4 per share. In recent years, earnings have been growing at a rate of 7.5% and this rate is expected to continue in the future. If Roberto Corporation has a retention rate of 40 percent and a required rate of return of 14 percent, what is its current value?

Step by Step Solution

★★★★★

3.42 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the various financial metrics well use the following formulas Aftertax cost of bonds approximate yieldtomaturity rates based on the 5050 rule Aftertax cost of bonds Yieldtomaturity rate 1 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started