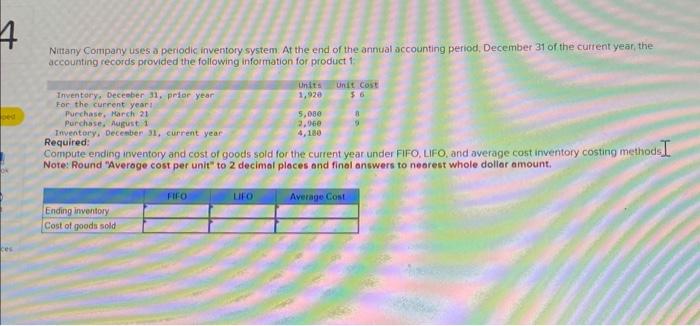

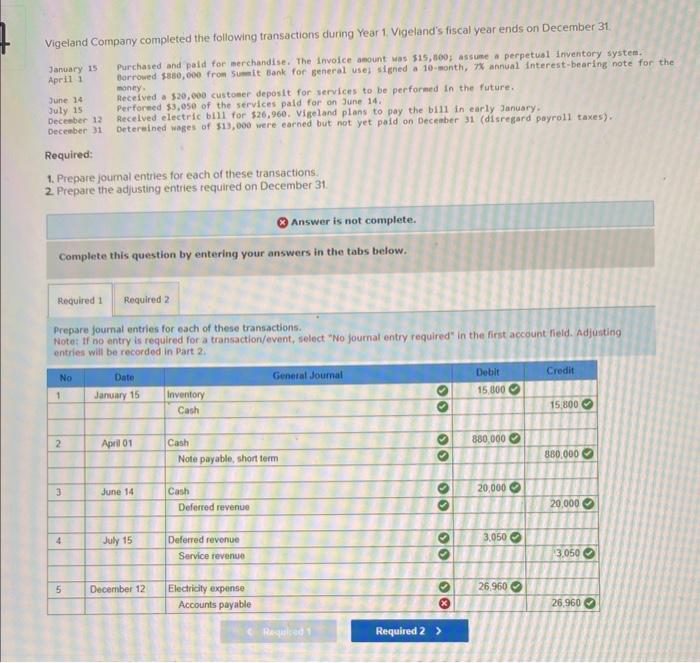

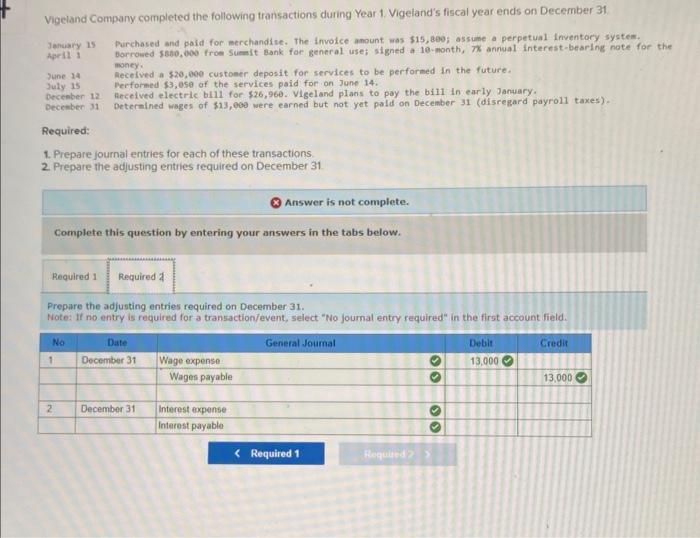

Nittany Company uses a periodic inventory system. At the end of the annual accounting period, December 31 of the cuntent year, the accounting records provided the following information for product 1 . Compute ending inventory and cost of goods sold for the current year under FiFO, LIFO, and average cost irventory costing methods 1 . Note: Round "Averoge cost per unit" to 2 decimal places and final answers to nearest whole dollar amount. Vigeland Company completed the following transactions during Year 1 Vigeland's fiscal year ends on December 31. January 15 purchased and pald for merchandise. The Invoice aeount was $15,1600; assuee a perpetual inventory system. Apri1 1 Borroved s8b0, 000 from 5umit Bank for general use) signed a 10-month, 7X annual interest-bearing note for the June 14. Recelved a 520,000 custoner deposit for services to be performed in the future. July 15 Perforned $3,050 of the services pald for on June 14, Deceaber 12 Recelved electric b111 for $26,960. vigeland plans to pay the b111 in early January. Decenber 31 ortereined wages of $13, 000 were earned but not yet paid on Deceaber 31 (disregard payrol1 taxes). Required: 1. Prepare joumal entries for each of these tansactions. 2. Prepare the adjusting entries required on December 31 . (x) Answer is not complete. Complete this question by entering your answers in the tabs below. Prepare joumal entries for each of these transactions. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Adjusting entries will be recorded in Part 2. Vigeland Company completed the following transactions during Year 1. Vigeland's fiscal year ends on December 31 January 15 Purchased and paid for merchandise. The involce amount was $15, 800; assume a perpetual Inventory system. Apel1 1 borrowed 5800,000 from Sumelt Bank for general use; signed a le-month, 70 annual interest-bearing note for the June 14 Recelved a $20,000 custoeer deposit for services to be performed in the future. July is Performed $3,05, of the services paid for on June 14 . Decenber 12 Received electrle bill for $26,96. Vigeland plans to pay the bil1 in early January. Decenber 31 Deterained wages of $13,000 were earned but not yet pald on December 31 (discegard payroll taxes). Required: 1. Prepare journal entries for each of these transactions. 2. Prepare the adjusting entries required on December 31 Answer is not complete. Complete this question by entering your answers in the tabs below. Prepare the adjusting entries required on December 31 . Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field