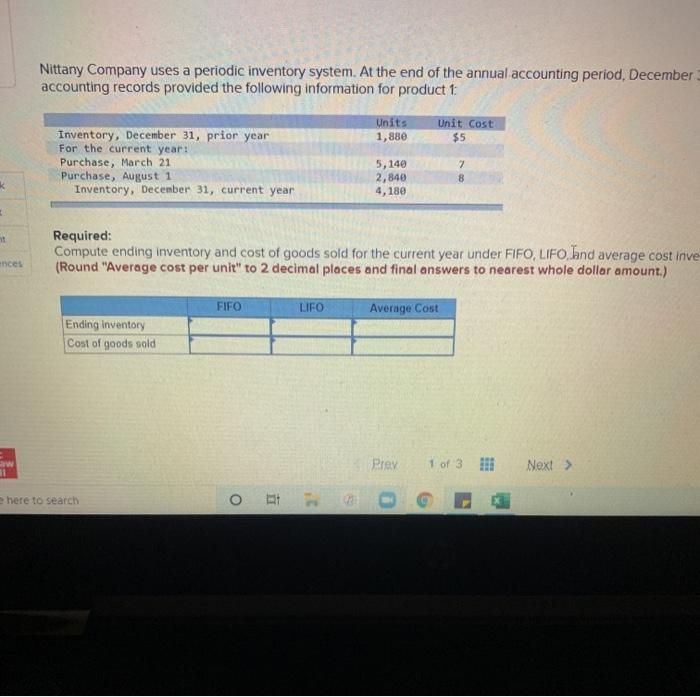

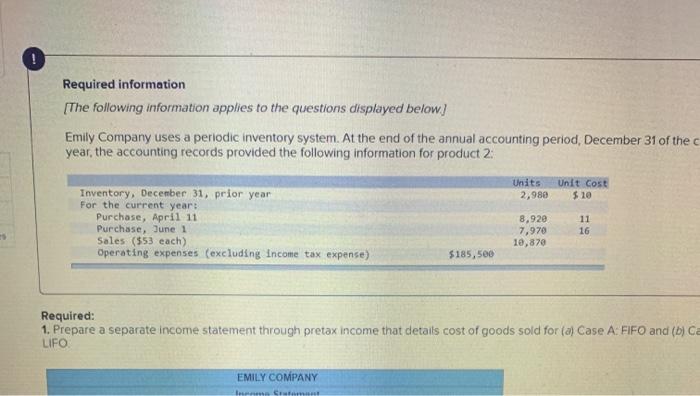

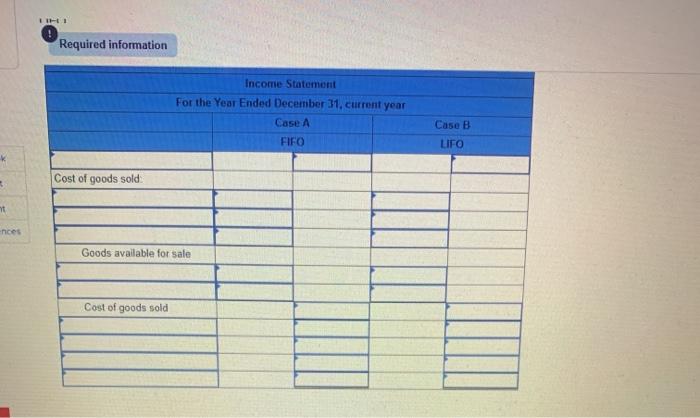

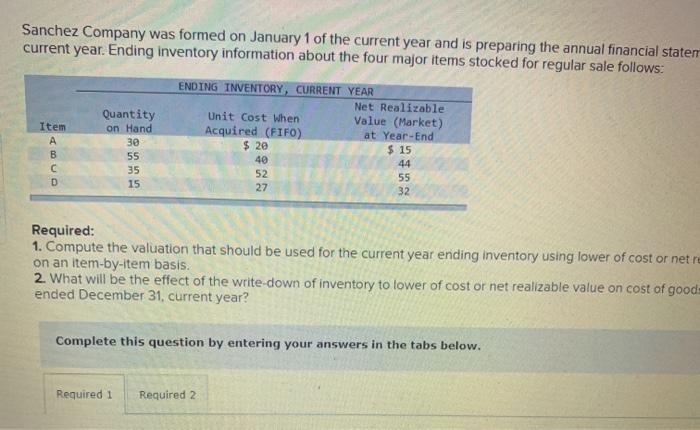

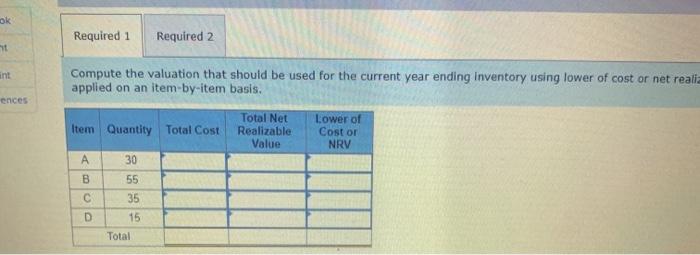

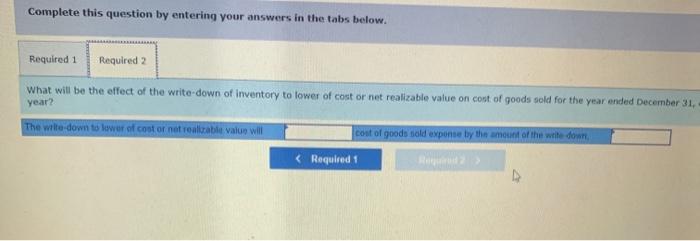

Nittany Company uses a periodic inventory system. At the end of the annual accounting period, December accounting records provided the following information for product 1: Units 1,880 Unit Cost $5 Inventory, December 31, prior year For the current year! Purchase, March 21 Purchase, August 1 Inventory, December 31, current year 5,140 2,840 4,180 7 8 k Required: Compute ending inventory and cost of goods sold for the current year under FIFO, LIFO, hand average cost inve (Round "Average cost per unit" to 2 decimal places and final answers to nearest whole dollar amount.) ences FIFO LIFO Average Cost Ending inventory Cost of goods sold Prev 1 of 3 Hii 31 Next > here to search o Required information [The following information applies to the questions displayed below! Emily Company uses a periodic inventory system. At the end of the annual accounting period, December 31 of the c year , the accounting records provided the following information for product 2: Units 2,980 Unit Cost $10 Inventory, December 31, prior year For the current year: Purchase, April 11 Purchase, June 1 Sales (553 each) Operating expenses (excluding income tax expense) 8,920 7,970 10,870 11 16 $185,500 Required: 1. Prepare a separate income statement through pretax income that details cost of goods sold for (a) Case A FIFO and (b) Ca LIFO EMILY COMPANY Cu THI ! Required information Income Statement For the Year Ended December 31, current year Case A Case B LIFO FIFO Cost of goods sold ht -nces Goods available for sale Cost of goods sold Sanchez Company was formed on January 1 of the current year and is preparing the annual financial statem current year. Ending inventory information about the four major items stocked for regular sale follows: Item A B Quantity on Hand 3e 55 35 15 ENDING INVENTORY, CURRENT YEAR Net Realizable Unit Cost When Value (Market) Acquired (FIFO) at Year-End $ 20 $ 15 40 44 52 55 27 32 D Re ed: 1. Compute the valuation that should be used for the current year ending inventory using lower of cost or netre on an item-by-item basis. 2. What will be the effect of the write-down of inventory to lower of cost or net realizable value on cost of good ended December 31, current year? Complete this question by entering your answers in the tabs below. Required 1 Required 2 ok Required 1 Required 2 int Compute the valuation that should be used for the current year ending Inventory using lower of cost or net reali applied on an item-by-item basis. ences Item Quantity Total Cost Total Net Realizable Value Lower of Cost or NRV B 30 55 35 15 Total D Complete this question by entering your answers in the tabs below. Required 1 Required 2 What will be the effect of the write-down of inventory to lower of cost or net realizable value on cost of goods sold for the year ended December 31, year? The wite down to lower of cost or not realizable value will cost of goods sold expone by the end of the write down