Answered step by step

Verified Expert Solution

Question

1 Approved Answer

NMC Motors Pty Ltd is a registered VAT Vendor and operates in Swakopmund, the financial year end is 31 August 2018. Part A a)

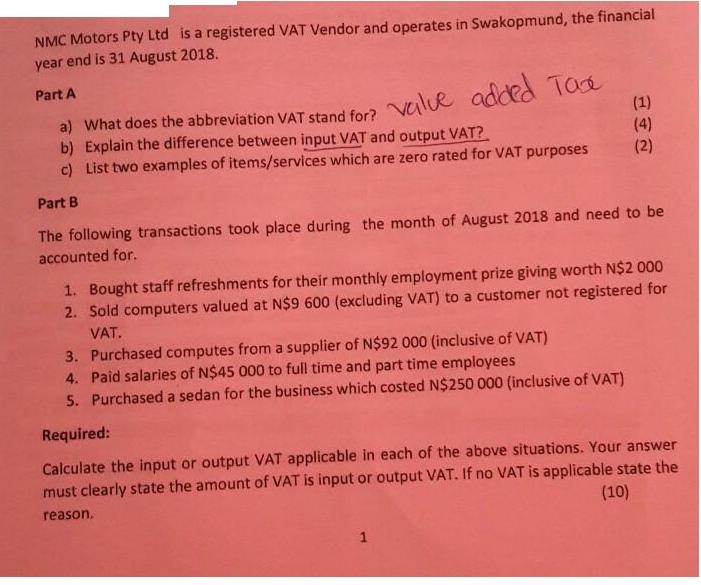

NMC Motors Pty Ltd is a registered VAT Vendor and operates in Swakopmund, the financial year end is 31 August 2018. Part A a) What does the abbreviation VAT stand for? value added Tax b) Explain the difference between input VAT and output VAT? c) List two examples of items/services which are zero rated for VAT purposes Part B The following transactions took place during the month of August 2018 and need to be accounted for. (1) (4) (2) 1. Bought staff refreshments for their monthly employment prize giving worth N$2 000 2. Sold computers valued at N$9 600 (excluding VAT) to a customer not registered for VAT. 3. Purchased computes from a supplier of N$92 000 (inclusive of VAT) 4. Paid salaries of N$45 000 to full time and part time employees 5. Purchased a sedan for the business which costed N$250 000 (inclusive of VAT) Required: Calculate the input or output VAT applicable in each of the above situations. Your answer must clearly state the amount of VAT is input or output VAT. If no VAT is applicable state the (10) reason. 1

Step by Step Solution

★★★★★

3.43 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started