Question

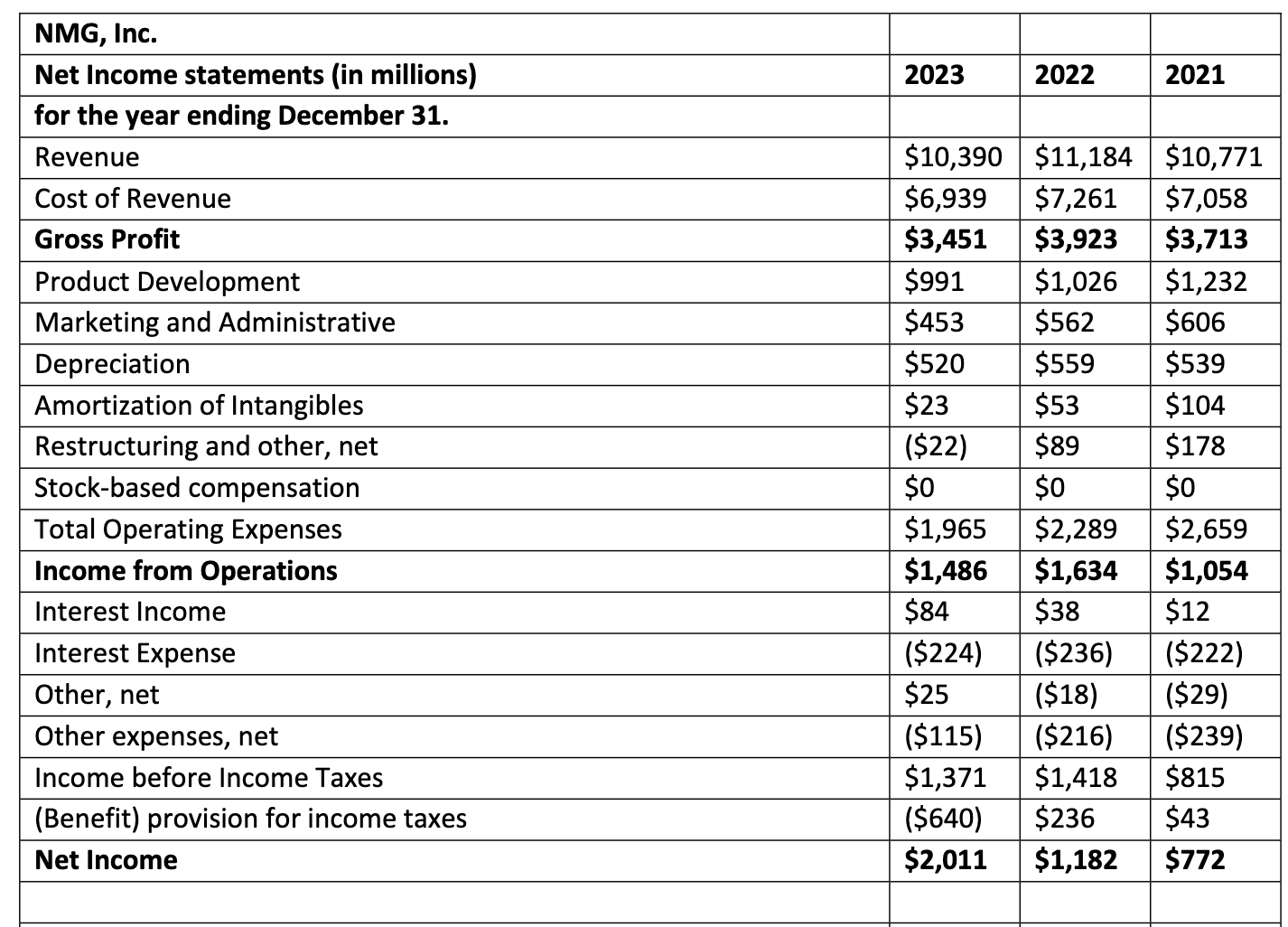

NMG, Inc. is a clothing manufacturer that designs and markets new women clothing. The company just closed Fiscal Year 2023 ending December 31st and completed

NMG, Inc. is a clothing manufacturer that designs and markets new women clothing. The company just closed Fiscal Year 2023 ending December 31st and completed the balance sheet and income statement. You are hired as a Financial Analyst and asked to perform the following tasks:

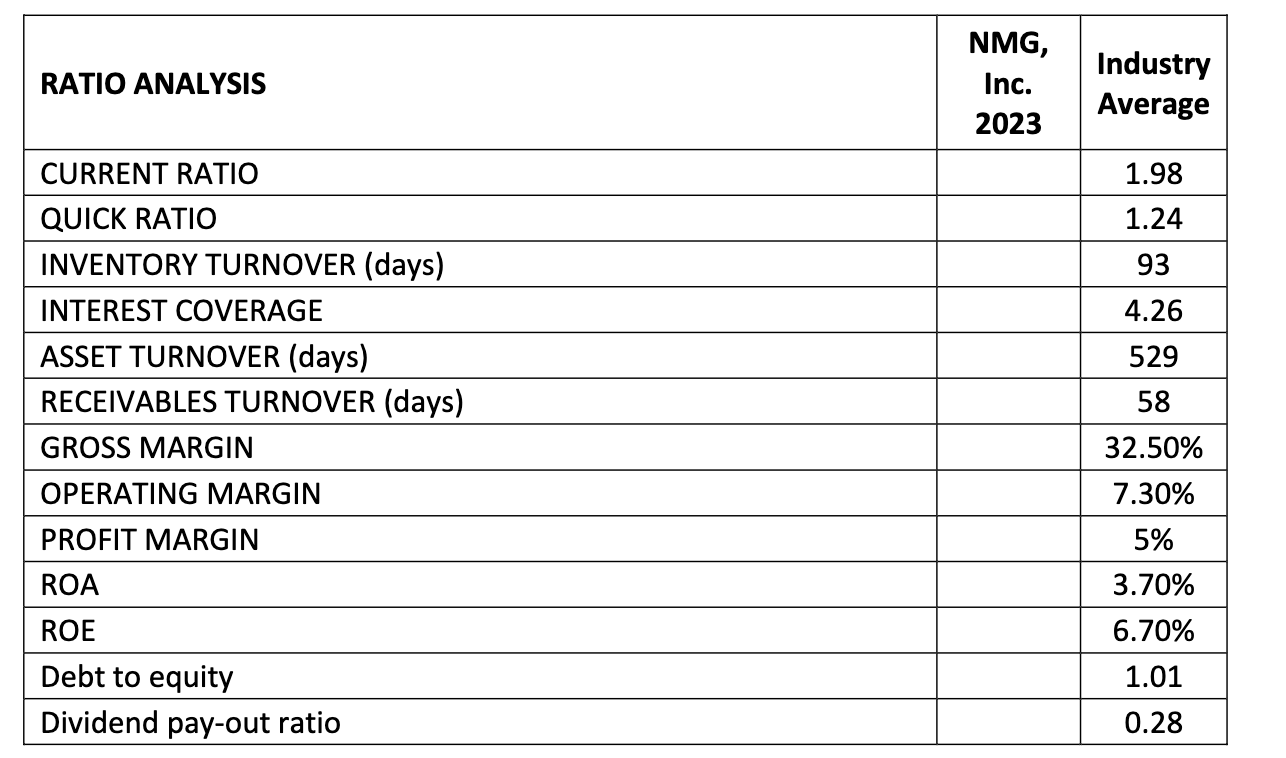

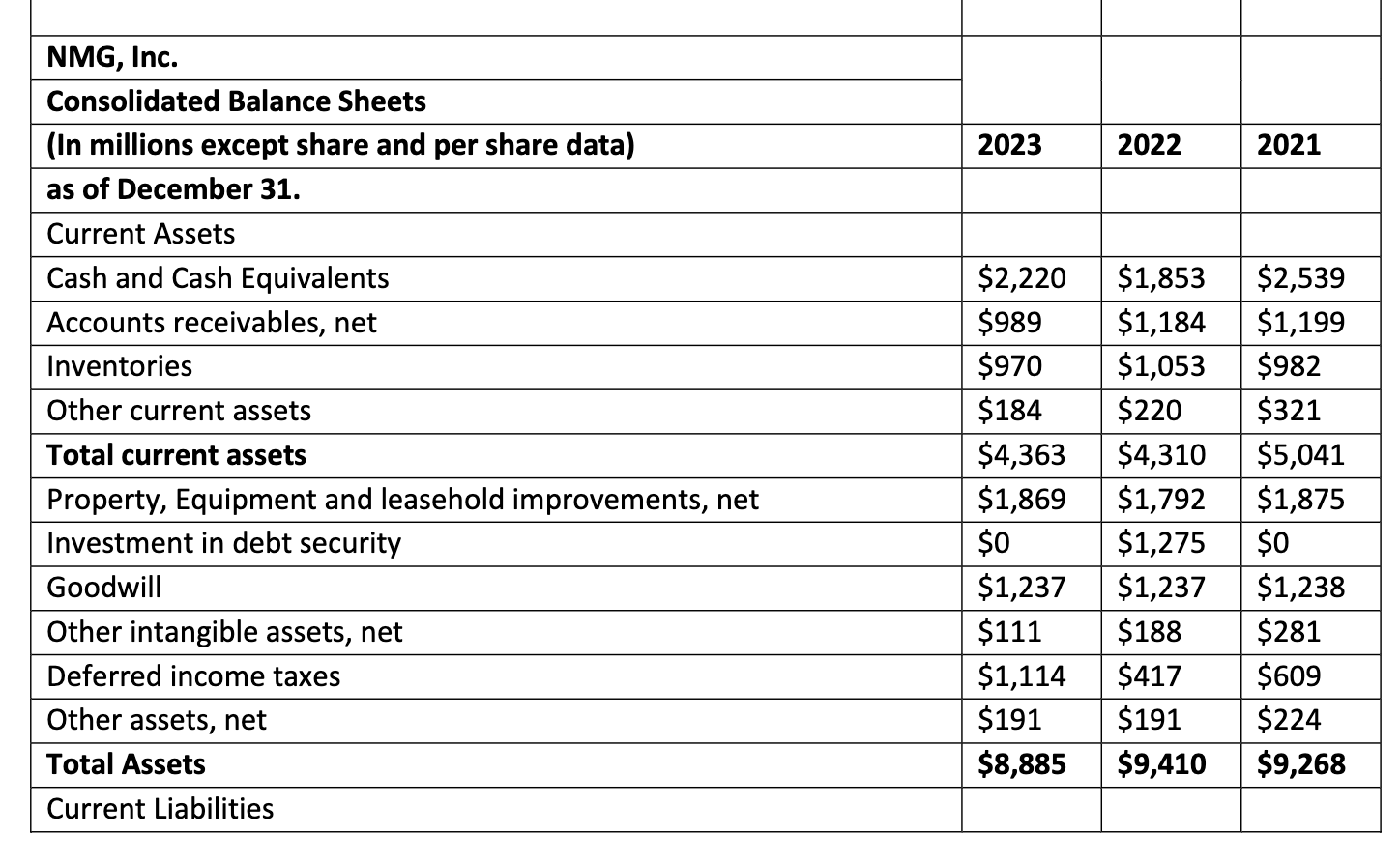

1-Prepare a forecasted income statement, balance sheet and cash flow statement for the company for 2024. (50 pts) 2- a- Calculate the listed financial ratios for 2023 (13 points). b- Using the past three years data for the company, perform financial ratio analysis. (17 points) 3-Compare and contrast the companys 2023 ratios with those of the industry. (10 points) Forecasting assumptions for 2024: 1- Revenue will grow by 10% and the tax rate will be 21%. 2- The CAPEX will be 6.5% of Revenue and Depreciation expense will be 6.2% of Property, equipment, and leasehold improvements gross at the start of the year which was $10, 985 million. 3- The company issues $105 million of stock-based compensation, and it is fully vested. Additional paid- in capital will increase by the same amount. The company includes this form of compensation in operating expenses. 4- The company has a dividend payout ratio of 25.6% of net income. 5- No change in the following income statement accounts: Amortization of intangibles, Interest income,

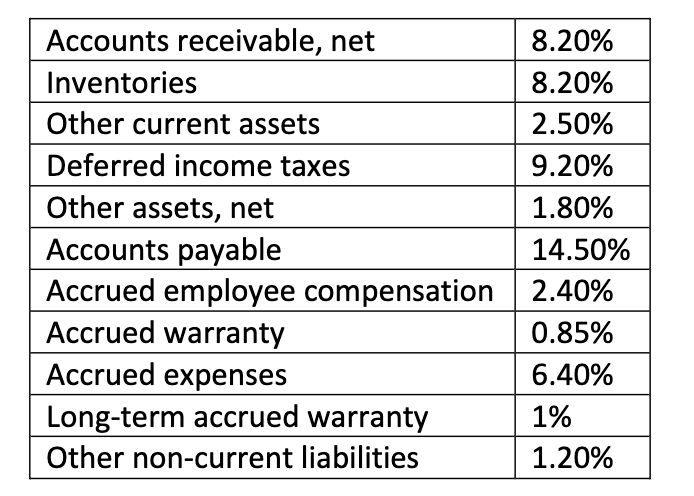

Interest expense, and Other, net. 6- No change in the following balance sheet statement accounts: Goodwill, Long-term debts less current portion, Ordinary shares, Other comprehensive loss. 7- There is no change in macroeconomic readings, including the inflation rate. 8- The Restructuring and other, net is zero. 9- Consider the following accounts increase based on the percentage of the revenue in 2024

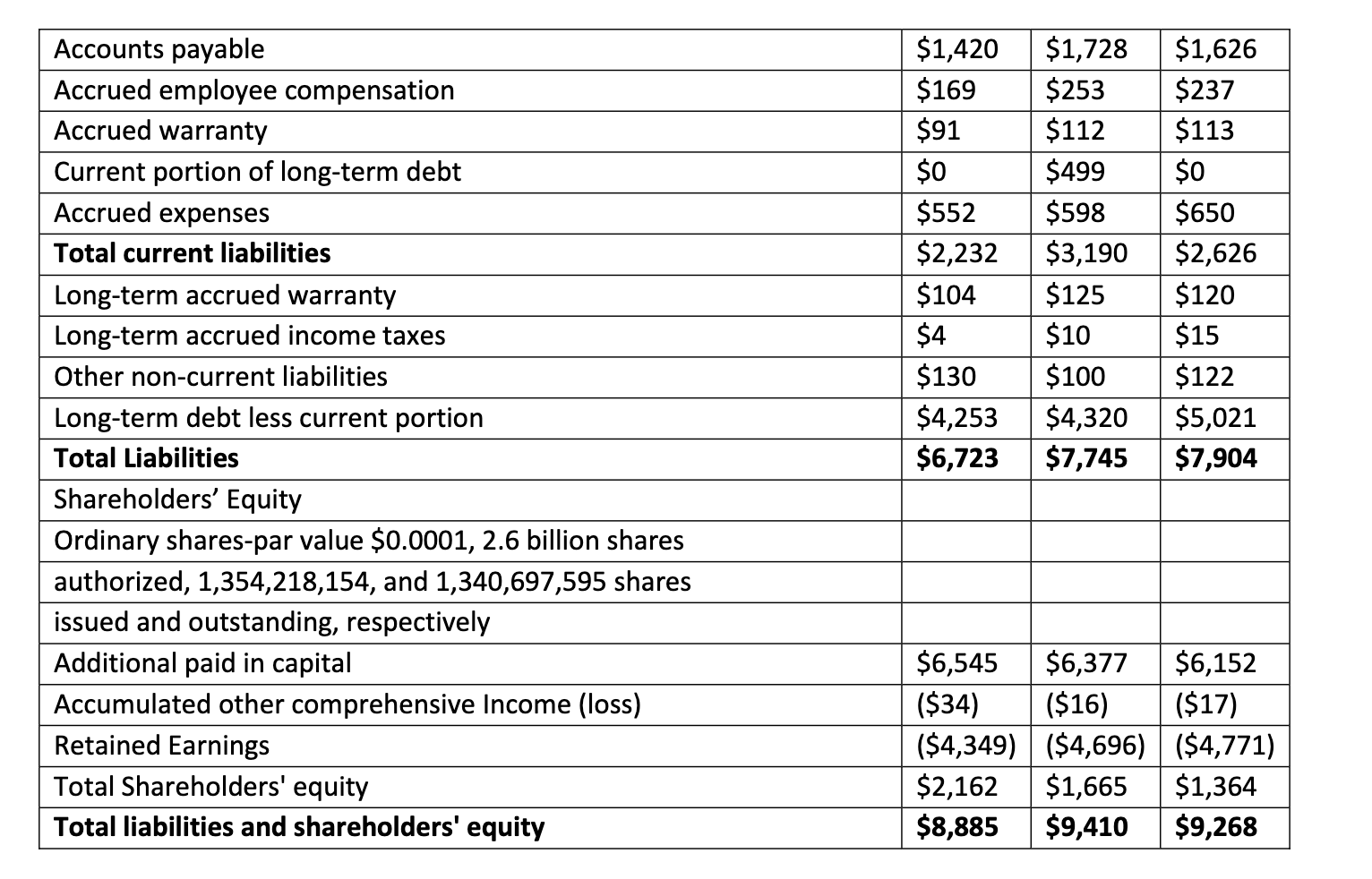

\begin{tabular}{|l|l|} \hline Accounts receivable, net & 8.20% \\ \hline Inventories & 8.20% \\ \hline Other current assets & 2.50% \\ \hline Deferred income taxes & 9.20% \\ \hline Other assets, net & 1.80% \\ \hline Accounts payable & 14.50% \\ \hline Accrued employee compensation & 2.40% \\ \hline Accrued warranty & 0.85% \\ \hline Accrued expenses & 6.40% \\ \hline Long-term accrued warranty & 1% \\ \hline Other non-current liabilities & 1.20% \\ \hline \end{tabular} \begin{tabular}{|l|c|c|} \hline RATIO ANALYSIS & NMG,Inc.2023 & IndustryAverage \\ \hline CURRENT RATIO & & 1.98 \\ \hline QUICK RATIO & & 1.24 \\ \hline INVENTORY TURNOVER (days) & & 93 \\ \hline INTEREST COVERAGE & & 4.26 \\ \hline ASSET TURNOVER (days) & & 529 \\ \hline RECEIVABLES TURNOVER (days) & & 58 \\ \hline GROSS MARGIN & & 32.50% \\ \hline OPERATING MARGIN & & 7.30% \\ \hline PROFIT MARGIN & & 3.70% \\ \hline ROA & & 6.70% \\ \hline ROE & & 1.01 \\ \hline Debt to equity & & 0.28 \\ \hline Dividend pay-out ratio & & \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|} \hline Accounts payable & $1,420 & $1,728 & $1,626 \\ \hline Accrued employee compensation & $169 & $253 & $237 \\ \hline Accrued warranty & $91 & $112 & $113 \\ \hline Current portion of long-term debt & $0 & $499 & $0 \\ \hline Accrued expenses & $552 & $598 & $650 \\ \hline Total current liabilities & $2,232 & $3,190 & $2,626 \\ \hline Long-term accrued warranty & $104 & $125 & $120 \\ \hline Long-term accrued income taxes & $4 & $10 & $15 \\ \hline Other non-current liabilities & $130 & $100 & $122 \\ \hline Long-term debt less current portion & $4,253 & $4,320 & $5,021 \\ \hline Total Liabilities & $6,723 & $7,745 & $7,904 \\ \hline Shareholders' Equity & & & \\ \hline Ordinary shares-par value \$0.0001, 2.6 billion shares & & & \\ \hline authorized, 1,354,218,154, and 1,340,697,595 shares & & & \\ \hline issued and outstanding, respectively & & & \\ \hline Additional paid in capital & $6,545 & $6,377 & $6,152 \\ \hline Accumulated other comprehensive Income (loss) & $34) & ($16) & ($17) \\ \hline Retained Earnings & $4,349) & ($4,696) & ($4,771) \\ \hline Total Shareholders' equity & $2,162 & $1,665 & $1,364 \\ \hline Total liabilities and shareholders' equity & $8,885 & $9,410 & $9,268 \\ \hline \end{tabular} \begin{tabular}{|l|l|} \hline Accounts receivable, net & 8.20% \\ \hline Inventories & 8.20% \\ \hline Other current assets & 2.50% \\ \hline Deferred income taxes & 9.20% \\ \hline Other assets, net & 1.80% \\ \hline Accounts payable & 14.50% \\ \hline Accrued employee compensation & 2.40% \\ \hline Accrued warranty & 0.85% \\ \hline Accrued expenses & 6.40% \\ \hline Long-term accrued warranty & 1% \\ \hline Other non-current liabilities & 1.20% \\ \hline \end{tabular} \begin{tabular}{|l|c|c|} \hline RATIO ANALYSIS & NMG,Inc.2023 & IndustryAverage \\ \hline CURRENT RATIO & & 1.98 \\ \hline QUICK RATIO & & 1.24 \\ \hline INVENTORY TURNOVER (days) & & 93 \\ \hline INTEREST COVERAGE & & 4.26 \\ \hline ASSET TURNOVER (days) & & 529 \\ \hline RECEIVABLES TURNOVER (days) & & 58 \\ \hline GROSS MARGIN & & 32.50% \\ \hline OPERATING MARGIN & & 7.30% \\ \hline PROFIT MARGIN & & 3.70% \\ \hline ROA & & 6.70% \\ \hline ROE & & 1.01 \\ \hline Debt to equity & & 0.28 \\ \hline Dividend pay-out ratio & & \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|} \hline Accounts payable & $1,420 & $1,728 & $1,626 \\ \hline Accrued employee compensation & $169 & $253 & $237 \\ \hline Accrued warranty & $91 & $112 & $113 \\ \hline Current portion of long-term debt & $0 & $499 & $0 \\ \hline Accrued expenses & $552 & $598 & $650 \\ \hline Total current liabilities & $2,232 & $3,190 & $2,626 \\ \hline Long-term accrued warranty & $104 & $125 & $120 \\ \hline Long-term accrued income taxes & $4 & $10 & $15 \\ \hline Other non-current liabilities & $130 & $100 & $122 \\ \hline Long-term debt less current portion & $4,253 & $4,320 & $5,021 \\ \hline Total Liabilities & $6,723 & $7,745 & $7,904 \\ \hline Shareholders' Equity & & & \\ \hline Ordinary shares-par value \$0.0001, 2.6 billion shares & & & \\ \hline authorized, 1,354,218,154, and 1,340,697,595 shares & & & \\ \hline issued and outstanding, respectively & & & \\ \hline Additional paid in capital & $6,545 & $6,377 & $6,152 \\ \hline Accumulated other comprehensive Income (loss) & $34) & ($16) & ($17) \\ \hline Retained Earnings & $4,349) & ($4,696) & ($4,771) \\ \hline Total Shareholders' equity & $2,162 & $1,665 & $1,364 \\ \hline Total liabilities and shareholders' equity & $8,885 & $9,410 & $9,268 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started