Answered step by step

Verified Expert Solution

Question

1 Approved Answer

nnarintial coupon. I 4 years to maturity, and an 11% YTM what is YIELD TO MATURITY A firm's bonds have a maturity of 8 years

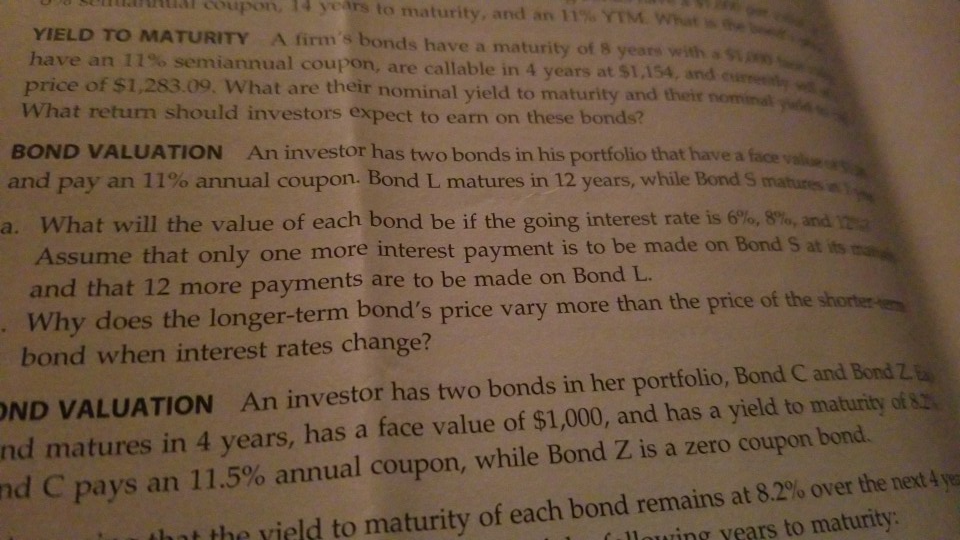

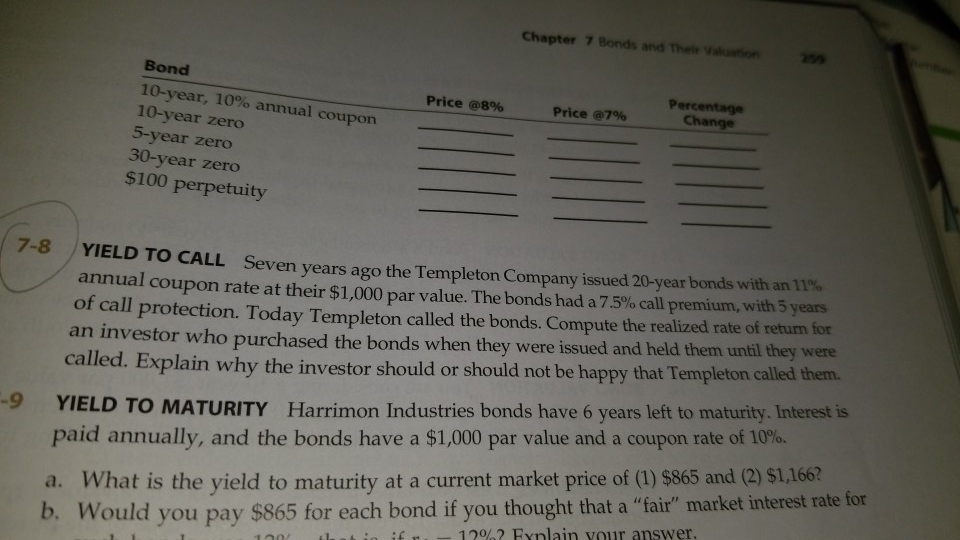

nnarintial coupon. I 4 years to maturity, and an 11% YTM what is YIELD TO MATURITY A firm's bonds have a maturity of 8 years withosions. have an 11% semiannual coupon, are callable in 4 years at $1 price of $1,283.09. What are their nominal yield to maturity and their nominal What return should investors expect to earn on these bonds? ,154, and BOND VALUATION An investor has two bonds in his portfolio that have a face vae and pay an 1 1% annual coupon. Bond L matures in 12 years, while Bonds matures a. What will the value of each bond be if the going interest rate is 6%,8%, andrea Assume that only one more interest payment is to be made on Bond S at and that 12 more payments are to be made on Bond L. Why does the longer-term bond's price vary more than the price of the shonter bond when interest rates change? ND VALUATION An investor has two bonds in her portfolio, Bond C and Bond7 nd matures in 4 years, has a face value of $1,000, and has a yield to maturity of s nd C pays an 11.5% annual coupon, while Bond Z is a zero coupon bond. that the veld to maturity of each bond remains at 8.2% over the next Ave ulluing years to maturity Chapter 7 Bonds and Their non Bond Price @8% Percentage Change Price @7% 0-year, 10% annual coupon 10-year zero 5-year 30-year zero $100 perpetuity zero 78 YIELD TO CALL annual coupon rate at their $1,000 par value. The bonds had a 75% call premium, with5 years of call protection. Today Templeton called the bonds. Compute the realized rate of returm for an investor who purchased the bonds when they were issued and called. Explain why the investor should or should not be happy that Templeton called them Seven years ago the Templeton Company issued 20-year bonds with an 11% held them until they were 9 YIELD TO MATURITY Harrimon Industries bonds have 6 years left to maturity. Interest is a. What is the yield to maturity at a current market price of (1) $865 and (2) S1,1662 b. Would you pay $865 for each bond if you thought that a "fair"' market interest rate for paid annually, and the bonds have a $1,000 par value and a coupon rate of 10%. 1202 Eynlain vour answer. nnarintial coupon. I 4 years to maturity, and an 11% YTM what is YIELD TO MATURITY A firm's bonds have a maturity of 8 years withosions. have an 11% semiannual coupon, are callable in 4 years at $1 price of $1,283.09. What are their nominal yield to maturity and their nominal What return should investors expect to earn on these bonds? ,154, and BOND VALUATION An investor has two bonds in his portfolio that have a face vae and pay an 1 1% annual coupon. Bond L matures in 12 years, while Bonds matures a. What will the value of each bond be if the going interest rate is 6%,8%, andrea Assume that only one more interest payment is to be made on Bond S at and that 12 more payments are to be made on Bond L. Why does the longer-term bond's price vary more than the price of the shonter bond when interest rates change? ND VALUATION An investor has two bonds in her portfolio, Bond C and Bond7 nd matures in 4 years, has a face value of $1,000, and has a yield to maturity of s nd C pays an 11.5% annual coupon, while Bond Z is a zero coupon bond. that the veld to maturity of each bond remains at 8.2% over the next Ave ulluing years to maturity Chapter 7 Bonds and Their non Bond Price @8% Percentage Change Price @7% 0-year, 10% annual coupon 10-year zero 5-year 30-year zero $100 perpetuity zero 78 YIELD TO CALL annual coupon rate at their $1,000 par value. The bonds had a 75% call premium, with5 years of call protection. Today Templeton called the bonds. Compute the realized rate of returm for an investor who purchased the bonds when they were issued and called. Explain why the investor should or should not be happy that Templeton called them Seven years ago the Templeton Company issued 20-year bonds with an 11% held them until they were 9 YIELD TO MATURITY Harrimon Industries bonds have 6 years left to maturity. Interest is a. What is the yield to maturity at a current market price of (1) $865 and (2) S1,1662 b. Would you pay $865 for each bond if you thought that a "fair"' market interest rate for paid annually, and the bonds have a $1,000 par value and a coupon rate of 10%. 1202 Eynlain vour

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started