NNeed help with question 3 formulas and explanation on how to do the graph, please?

NNeed help with question 3 formulas and explanation on how to do the graph, please?

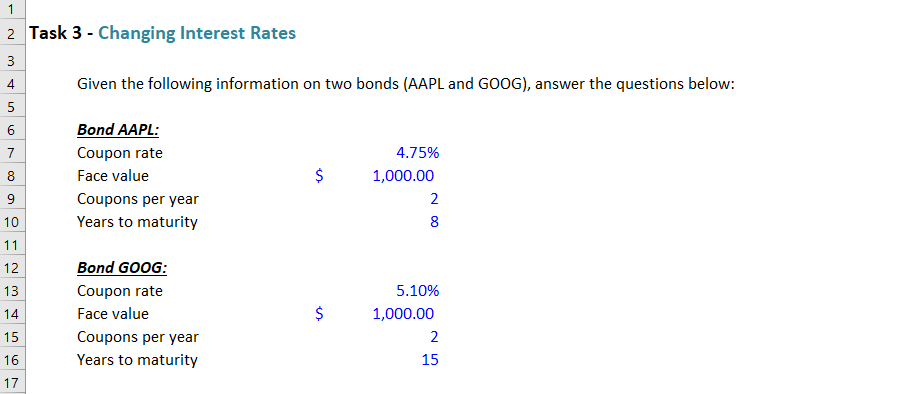

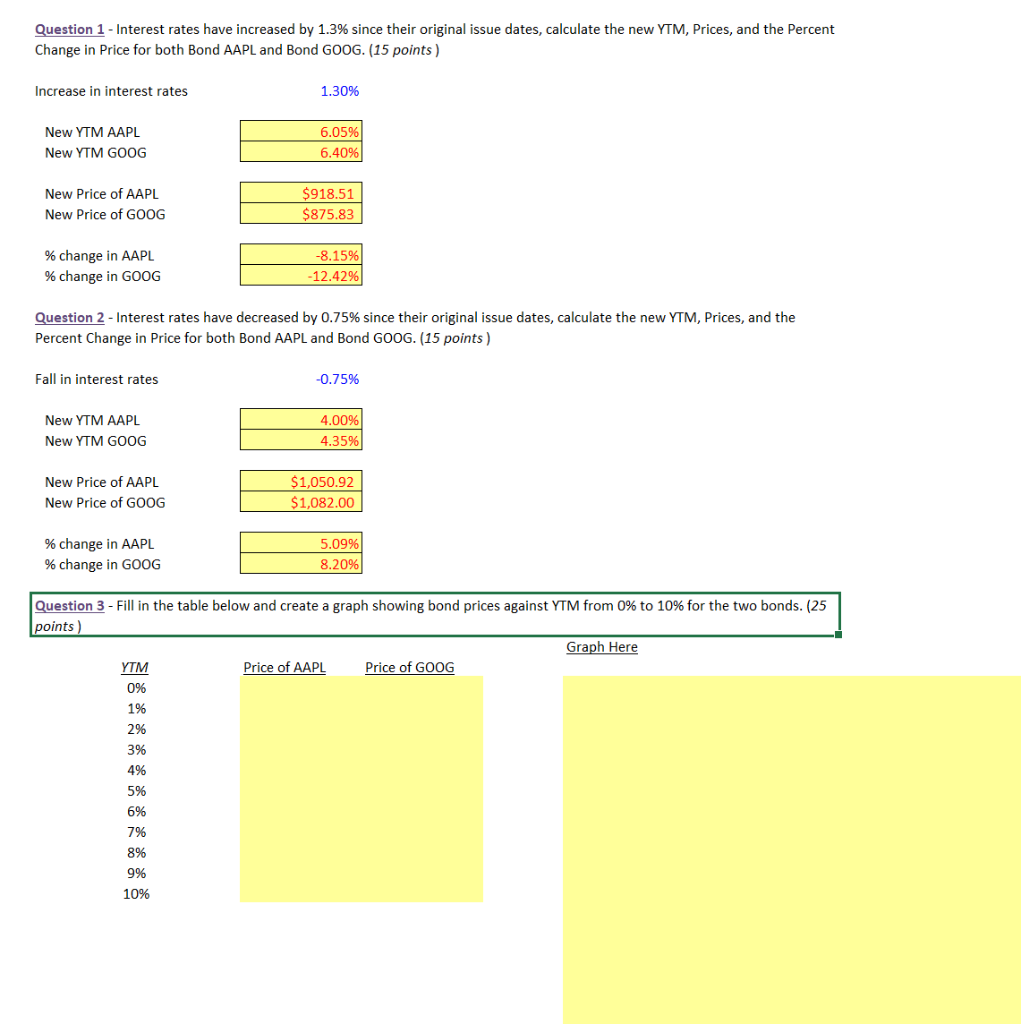

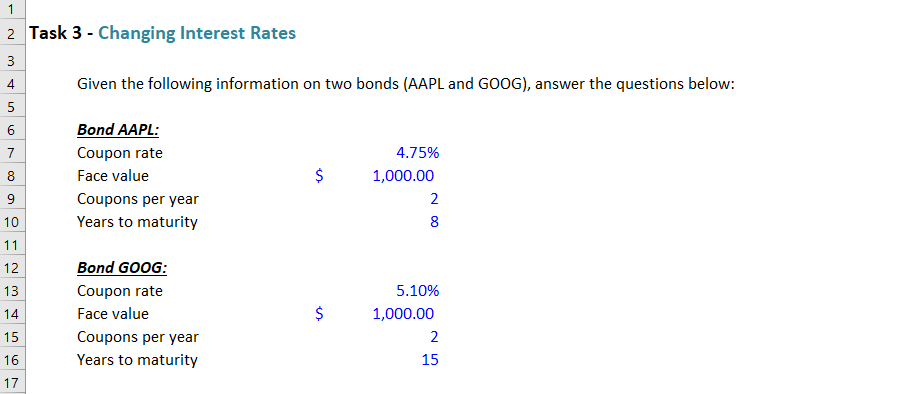

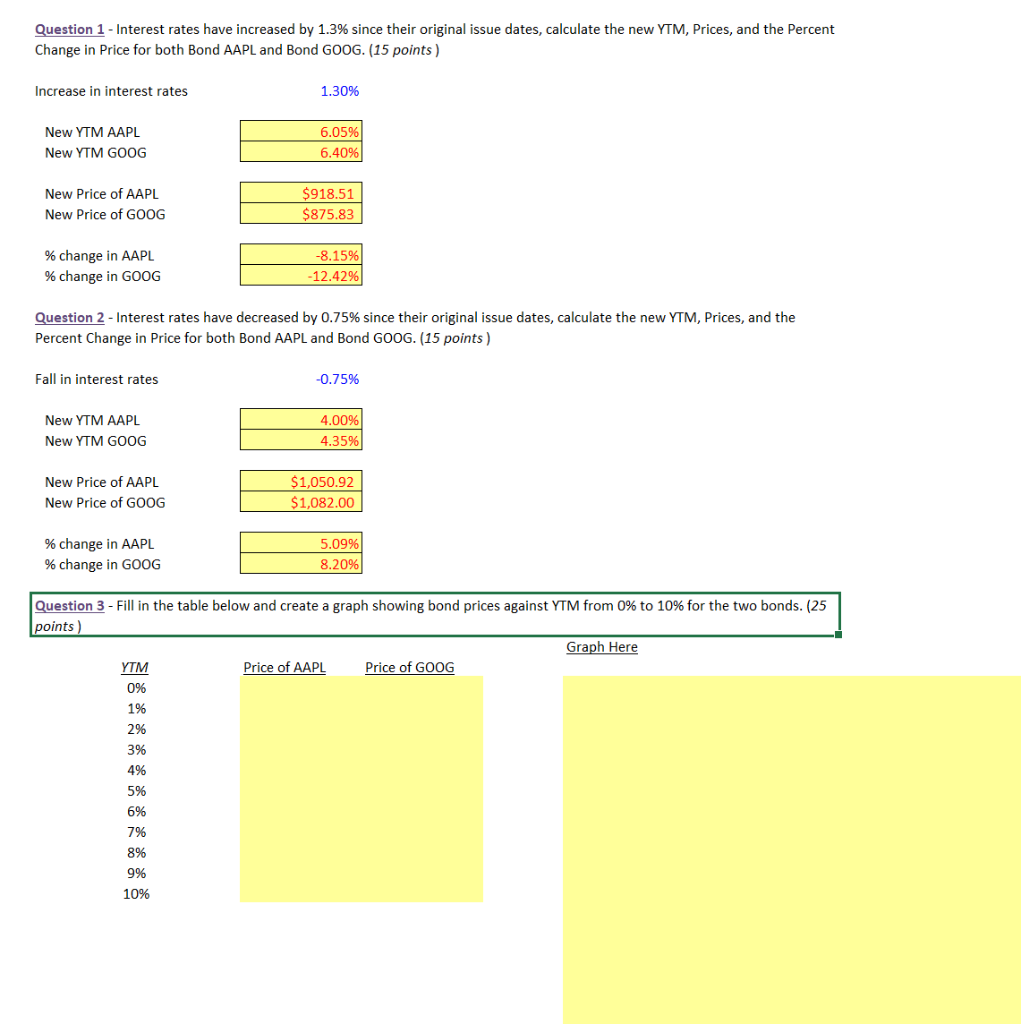

1 2 Task 3 - Changing Interest Rates 3 Given the following information on two bonds (AAPL and GOOG), answer the questions below: 5 6 Bond AAPL: 7 Coupon rate 4.75% 8 Face value $ 1,000.00 9 Coupons per year 2 10 Years to maturity 8 4 5 6 11 12 13 14 Bond GOOG: Coupon rate Face value Coupons per year Years to maturity $ 5.10% 1,000.00 2. 15 15 16 17 Question 1 - Interest rates have increased by 1.3% since their original issue dates, calculate the new YTM, Prices, and the Percent Change in Price for both Bond AAPL and Bond GOOG. (15 points) Increase in interest rates 1.30% New YTM AAPL New YTM GOOG 6.05% 6.40% New Price of AAPL New Price of GOOG $918.51 $875.83 % change in AAPL % change in GOOG -8.15% -12.42% Question 2 - Interest rates have decreased by 0.75% since their original issue dates, calculate the new YTM, Prices, and the Percent Change in Price for both Bond AAPL and Bond GOOG. (15 points) Fall in interest rates -0.75% New YTM AAPL New YTM GOOG 4.00% 4.3596 New Price of AAPL New Price of GOOG $1,050.92 $1,082.00 % change in AAPL % change in GOOG 5.09% 8.20% Question 3 - Fill in the table below and create a graph showing bond prices against YTM from 0% to 10% for the two bonds. (25 points) Graph Here YTM Price of AAPL Price of GOOG 0% 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 1 2 Task 3 - Changing Interest Rates 3 Given the following information on two bonds (AAPL and GOOG), answer the questions below: 5 6 Bond AAPL: 7 Coupon rate 4.75% 8 Face value $ 1,000.00 9 Coupons per year 2 10 Years to maturity 8 4 5 6 11 12 13 14 Bond GOOG: Coupon rate Face value Coupons per year Years to maturity $ 5.10% 1,000.00 2. 15 15 16 17 Question 1 - Interest rates have increased by 1.3% since their original issue dates, calculate the new YTM, Prices, and the Percent Change in Price for both Bond AAPL and Bond GOOG. (15 points) Increase in interest rates 1.30% New YTM AAPL New YTM GOOG 6.05% 6.40% New Price of AAPL New Price of GOOG $918.51 $875.83 % change in AAPL % change in GOOG -8.15% -12.42% Question 2 - Interest rates have decreased by 0.75% since their original issue dates, calculate the new YTM, Prices, and the Percent Change in Price for both Bond AAPL and Bond GOOG. (15 points) Fall in interest rates -0.75% New YTM AAPL New YTM GOOG 4.00% 4.3596 New Price of AAPL New Price of GOOG $1,050.92 $1,082.00 % change in AAPL % change in GOOG 5.09% 8.20% Question 3 - Fill in the table below and create a graph showing bond prices against YTM from 0% to 10% for the two bonds. (25 points) Graph Here YTM Price of AAPL Price of GOOG 0% 1% 2% 3% 4% 5% 6% 7% 8% 9% 10%

NNeed help with question 3 formulas and explanation on how to do the graph, please?

NNeed help with question 3 formulas and explanation on how to do the graph, please?