Answered step by step

Verified Expert Solution

Question

1 Approved Answer

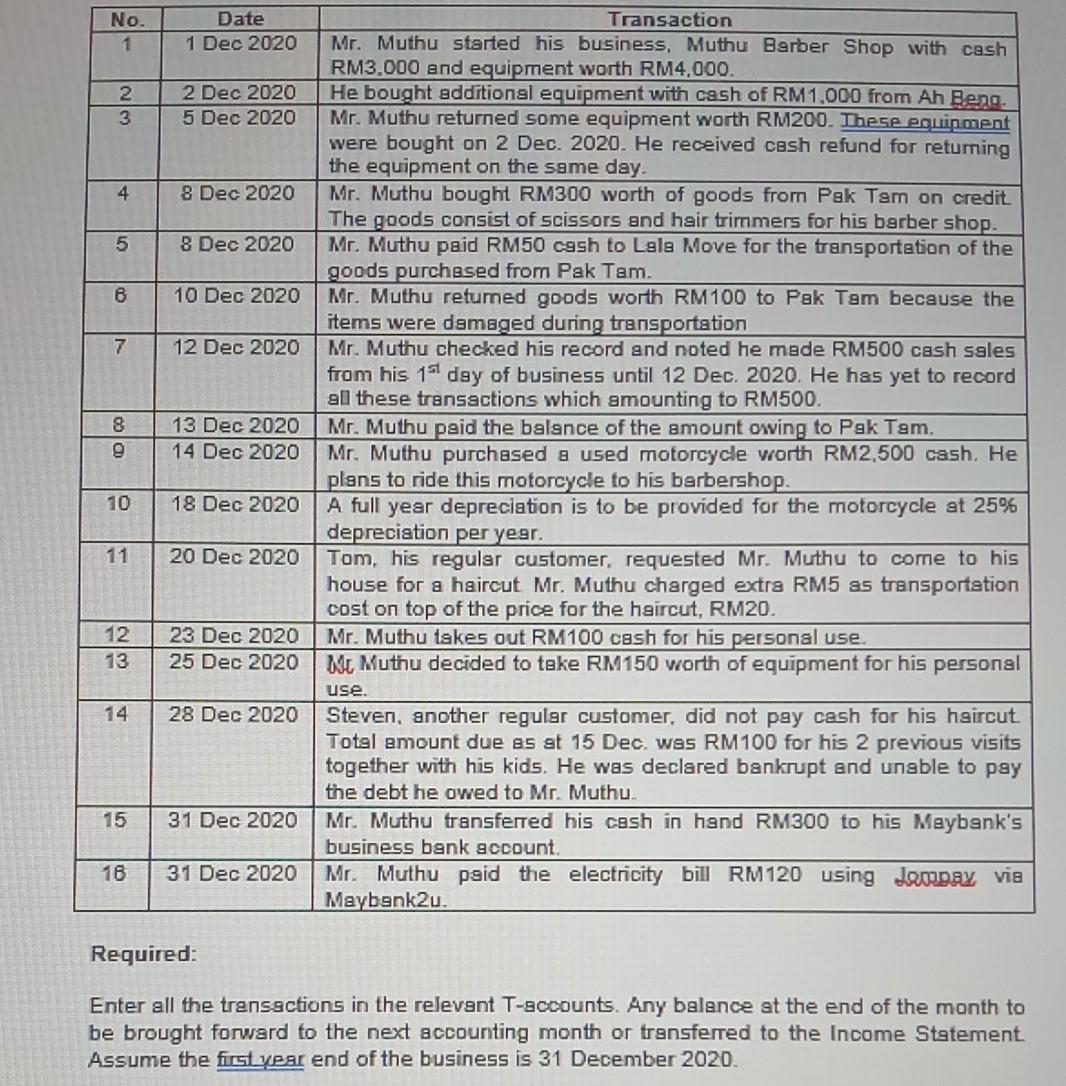

No 1 Date 1 Dec 2020 2 3 2 Dec 2020 5 Dec 2020 4 8 Dec 2020 5 8 Dec 2020 8 10 Dec

No 1 Date 1 Dec 2020 2 3 2 Dec 2020 5 Dec 2020 4 8 Dec 2020 5 8 Dec 2020 8 10 Dec 2020 7 12 Dec 2020 Transaction Mr. Muthu started his business, Muthu Barber Shop with cash RM3.000 and equipment worth RM4,000. He bought additional equipment with cash of RM1,000 from Ah Beno. Mr. Muthu returned some equipment worth RM200. These equipment were bought on 2 Dec. 2020. He received cash refund for returning the equipment on the same day. Mr. Muthu bought RM300 worth of goods from Pak Tem on credit The goods consist of scissors and hair trimmers for his barber shop. Mr. Muthu paid RM50 cash to Lala Move for the transportation of the goods purchased from Pak Tam. Mr. Muthu returned goods worth RM100 to Pak Tam because the items were damaged during transportation Mr. Muthu checked his record and noted he made RM500 cash sales from his 14 day of business until 12 Dec. 2020. He has yet to record all these transactions which amounting to RM500. Mr. Muthu paid the balance of the amount owing to Pak Tam. Mr. Muthu purchased a used motorcycle worth RM2,500 cash. He plans to ride this motorcycle to his barbershop. A full year depreciation is to be provided for the motorcycle at 25% depreciation per year. Tom, his regular customer requested Mr. Muthu to come to his house for a haircut Mr. Muthu charged extra RM5 as transportation cost on top of the price for the haircut, RM20. Mr. Muthu takes out RM100 cash for his personal use. Nu Muthu decided to take RM150 worth of equipment for his personal 8 13 Dec 2020 14 Dec 2020 10 18 Dec 2020 11 20 Dec 2020 12 13 23 Dec 2020 25 Dec 2020 use 14 28 Dec 2020 Steven, another regular customer, did not pay cash for his haircut Total amount due es at 15 Dec. was RM100 for his 2 previous visits together with his kids. He was declared bankrupt and unable to pay the debt he owed to Mr. Muthu Mr. Muthu transferred his cash in hand RM300 to his Maybank's business bank account. Mr. Muthu paid the electricity bill RM120 using Japapay via Maybenk2u. 15 31 Dec 2020 16 31 Dec 2020 Required: Enter all the transactions in the relevant T-9ccounts. Any balance at the end of the month to be brought forward to the next accounting month or transferred to the Income Statement Assume the first year end of the business is 31 December 2020

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started