Answered step by step

Verified Expert Solution

Question

1 Approved Answer

no additional info WISE Title: 24-My paper CASTELLEN Cost of Capital (20 points) You are asked to estimate the cost of capital for a privately

no additional info

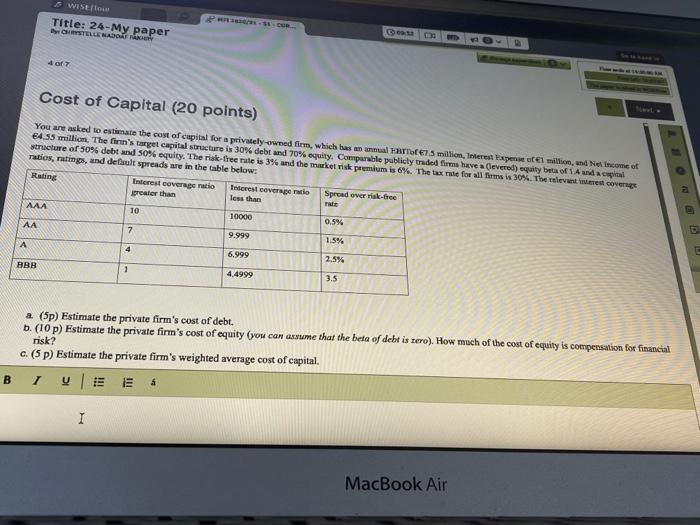

WISE Title: 24-My paper CASTELLEN Cost of Capital (20 points) You are asked to estimate the cost of capital for a privately owned firm, which has an annual RTCE15 million, Interests of million, Income of 435 million. The fin's target capital structure is 30% debt and 70% equity. Comparable publicly traded flims have a levered equity be of Ancial structure of 50% debt and 50% equity. The risk-free rule is 3% and the market risk premium is 6%. The tax rate for all firms is 30%. The relevant cong ratios, ratings, and default spreads are in the table below: Rating Interest covo Interest overset Spread over risk-free less than greater than AAA 10 10000 AA 0.5% 7 9.999 1.5% A 4 6.999 2.5% BBB 1 4.4999 3.5 risk? a (5p) Estimate the private firm's cost of debt. D. (10p) Estimate the private firm's cost of equity (you can assume that the beta of debt is zero). How much of the cost of equity is compensation for financial C. (5p) Estimate the private firm's weighted average cost of capital. BUE E I MacBook Air WISE Title: 24-My paper CASTELLEN Cost of Capital (20 points) You are asked to estimate the cost of capital for a privately owned firm, which has an annual RTCE15 million, Interests of million, Income of 435 million. The fin's target capital structure is 30% debt and 70% equity. Comparable publicly traded flims have a levered equity be of Ancial structure of 50% debt and 50% equity. The risk-free rule is 3% and the market risk premium is 6%. The tax rate for all firms is 30%. The relevant cong ratios, ratings, and default spreads are in the table below: Rating Interest covo Interest overset Spread over risk-free less than greater than AAA 10 10000 AA 0.5% 7 9.999 1.5% A 4 6.999 2.5% BBB 1 4.4999 3.5 risk? a (5p) Estimate the private firm's cost of debt. D. (10p) Estimate the private firm's cost of equity (you can assume that the beta of debt is zero). How much of the cost of equity is compensation for financial C. (5p) Estimate the private firm's weighted average cost of capital. BUE E I MacBook Air Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started