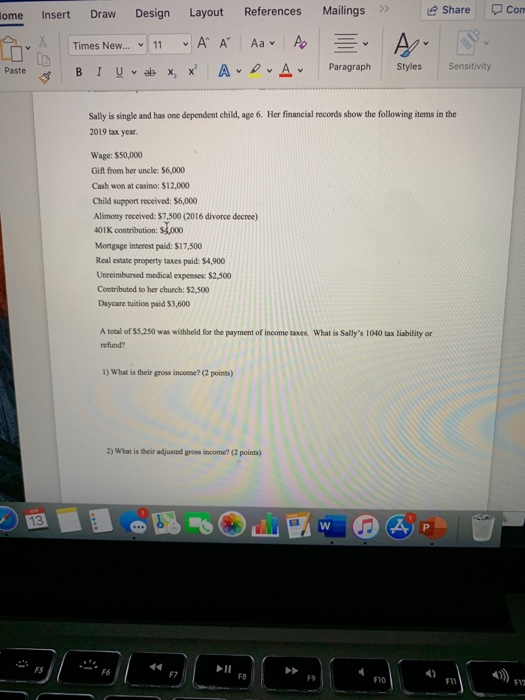

no clue where to start anything would be appreciated.

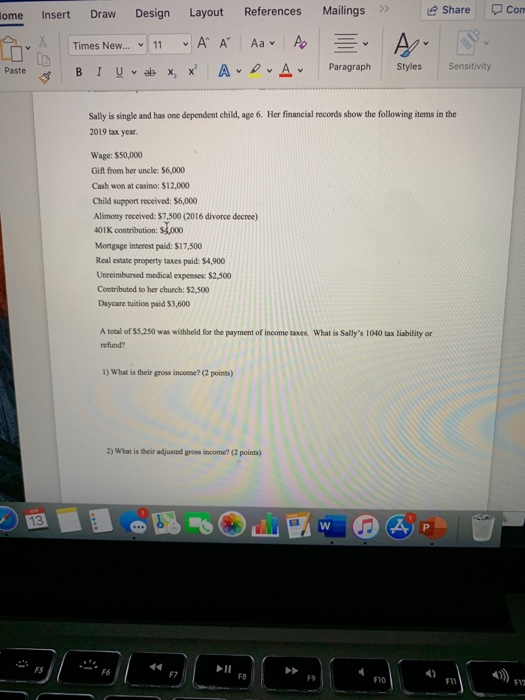

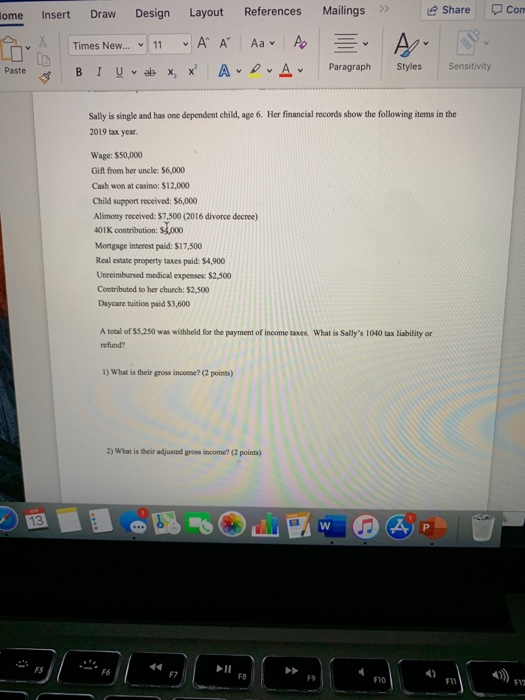

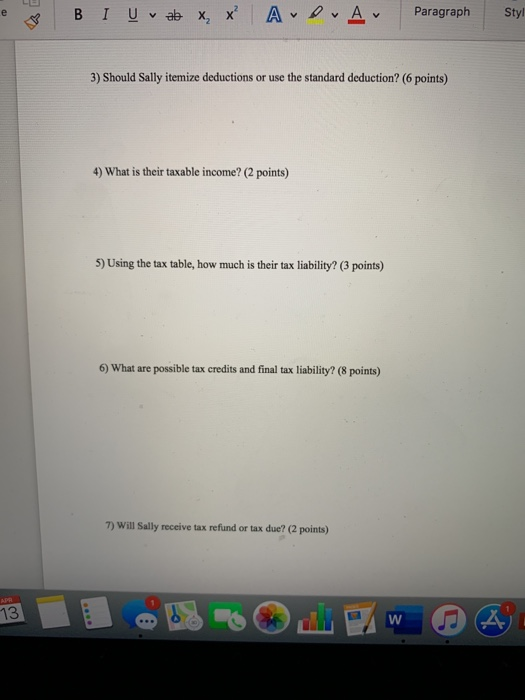

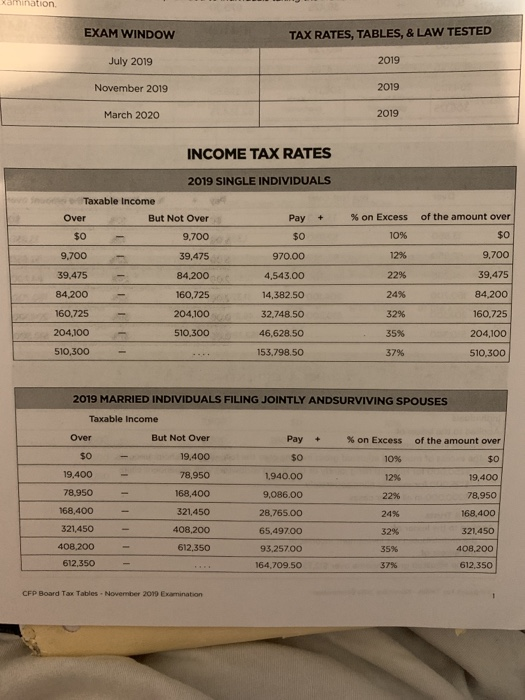

Home Insert Draw Design Layout References Mailings >> Share con A Times New... 11 A A A A BI U rab x x AdvA- Paste Paragraph Styles Sensitivity Sally is single and has one dependent child, age 6. Her financial records show the following items in the 2019 tax year Wage: $50,000 Gift from her uncle: $6,000 Cash won at casino: $12,000 Child support received: $6,000 Alimony received: $7,500 (2016 divorce decree) 401K contribution: 54.000 Mortgage interest paid: $17,500 Real estate property taxes paid: 54,900 Unreimbursed medical expenses: $2,500 Contributed to her church: $2,500 Daycare tuition paid $3,600 A total of $5,250 was withheld for the payment of income taxes. What is Sally's 1040 tax liability or refund? 1) What is their gross income? (2 points) 2) What is their adjusted gross income? (2 points) & B I U vab x X Av . Av Paragraph Styl 3) Should Sally itemize deductions or use the standard deduction? (6 points) 4) What is their taxable income? (2 points) 5) Using the tax table, how much is their tax liability? (3 points) 6) What are possible tax credits and final tax liability? (8 points) 7) Will Sally receive tax refund or tax due? (2 points) mination EXAM WINDOW TAX RATES, TABLES, & LAW TESTED July 2019 2019 November 2019 2019 March 2020 2019 INCOME TAX RATES 2019 SINGLE INDIVIDUALS + of the amount over Pay $0 970.00 % on Excess 10% 12% 22% 9,700 Taxable income Over But Not Over 50 - 9,700 9.700 - 39,475 39,475 - 84.200 84,200 160,725 160.725 - 204,100 204,100 510,300 510,300 - 4 ,543.00 39,475 14,382.50 24% 32% 32.748.50 46,628.50 153,798.50 84,200 160,725 204,100 510,300 35% 37% 2019 MARRIED INDIVIDUALS FILING JOINTLY ANDSURVIVING SPOUSES Taxable income Over But Not Over Pay % on Excess of the amount over so - 19.400 50 10% 19,400 - 78,950 1940.00 19,400 78.950 - 168,400 9.086.00 22% 78.950 168,400 - 321,450 28.765.00 24% 168.400 321,450 - 408.200 65,497.00 321.450 408.200 - 612,350 93.257.00 35% 408.200 612,350 - 164.709.50 37% 612,350 CFP Board Tax Tables November 2019 Examination Home Insert Draw Design Layout References Mailings >> Share con A Times New... 11 A A A A BI U rab x x AdvA- Paste Paragraph Styles Sensitivity Sally is single and has one dependent child, age 6. Her financial records show the following items in the 2019 tax year Wage: $50,000 Gift from her uncle: $6,000 Cash won at casino: $12,000 Child support received: $6,000 Alimony received: $7,500 (2016 divorce decree) 401K contribution: 54.000 Mortgage interest paid: $17,500 Real estate property taxes paid: 54,900 Unreimbursed medical expenses: $2,500 Contributed to her church: $2,500 Daycare tuition paid $3,600 A total of $5,250 was withheld for the payment of income taxes. What is Sally's 1040 tax liability or refund? 1) What is their gross income? (2 points) 2) What is their adjusted gross income? (2 points) & B I U vab x X Av . Av Paragraph Styl 3) Should Sally itemize deductions or use the standard deduction? (6 points) 4) What is their taxable income? (2 points) 5) Using the tax table, how much is their tax liability? (3 points) 6) What are possible tax credits and final tax liability? (8 points) 7) Will Sally receive tax refund or tax due? (2 points) mination EXAM WINDOW TAX RATES, TABLES, & LAW TESTED July 2019 2019 November 2019 2019 March 2020 2019 INCOME TAX RATES 2019 SINGLE INDIVIDUALS + of the amount over Pay $0 970.00 % on Excess 10% 12% 22% 9,700 Taxable income Over But Not Over 50 - 9,700 9.700 - 39,475 39,475 - 84.200 84,200 160,725 160.725 - 204,100 204,100 510,300 510,300 - 4 ,543.00 39,475 14,382.50 24% 32% 32.748.50 46,628.50 153,798.50 84,200 160,725 204,100 510,300 35% 37% 2019 MARRIED INDIVIDUALS FILING JOINTLY ANDSURVIVING SPOUSES Taxable income Over But Not Over Pay % on Excess of the amount over so - 19.400 50 10% 19,400 - 78,950 1940.00 19,400 78.950 - 168,400 9.086.00 22% 78.950 168,400 - 321,450 28.765.00 24% 168.400 321,450 - 408.200 65,497.00 321.450 408.200 - 612,350 93.257.00 35% 408.200 612,350 - 164.709.50 37% 612,350 CFP Board Tax Tables November 2019 Examination