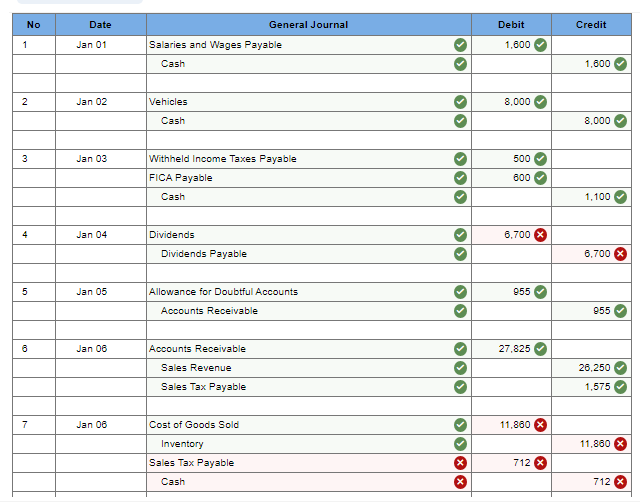

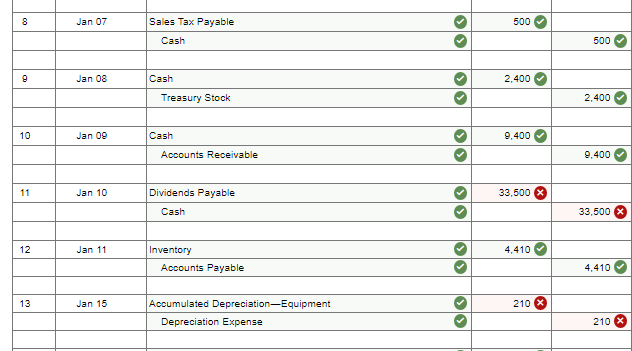

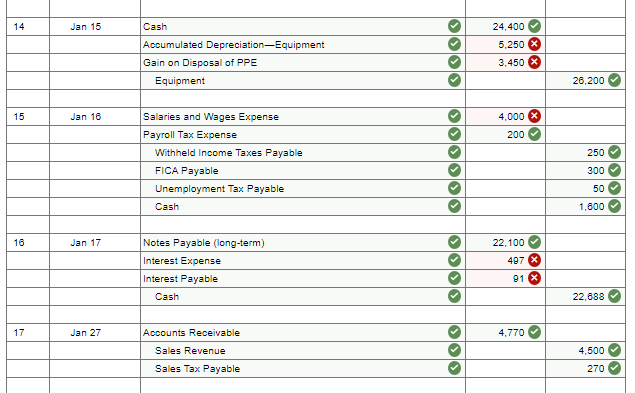

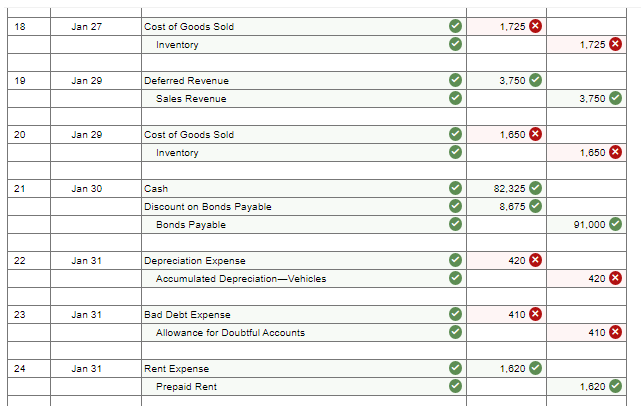

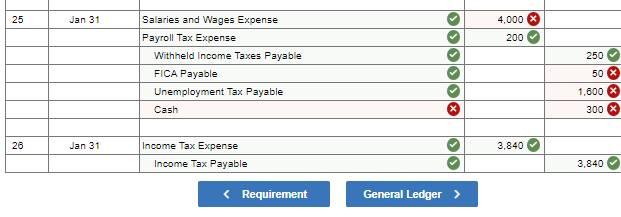

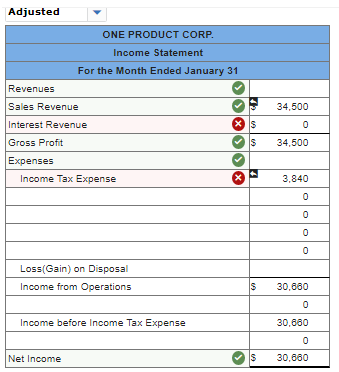

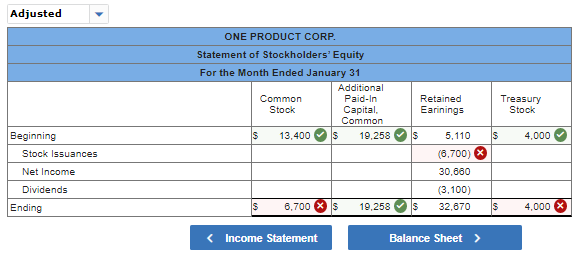

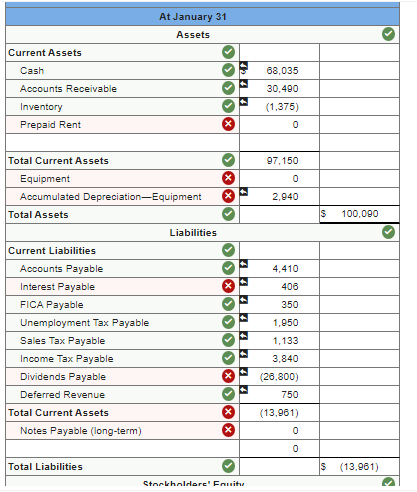

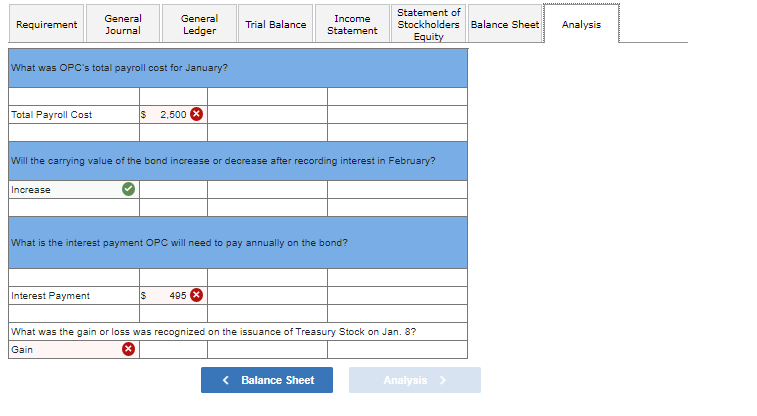

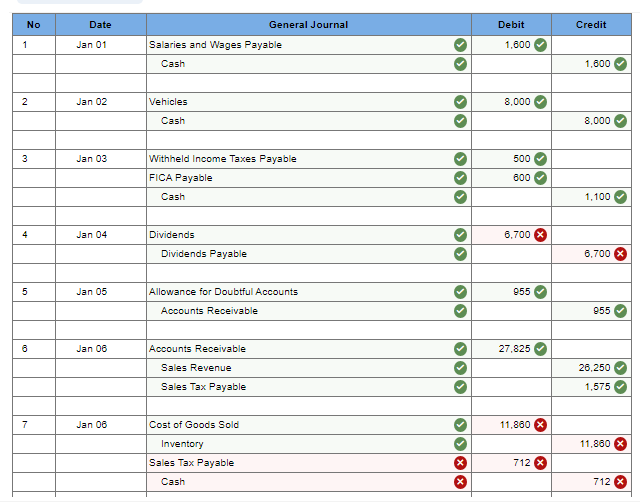

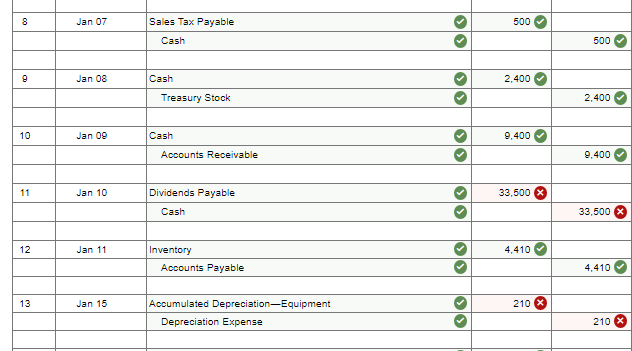

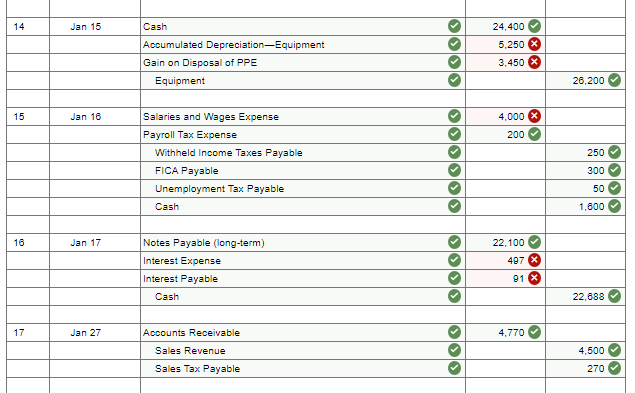

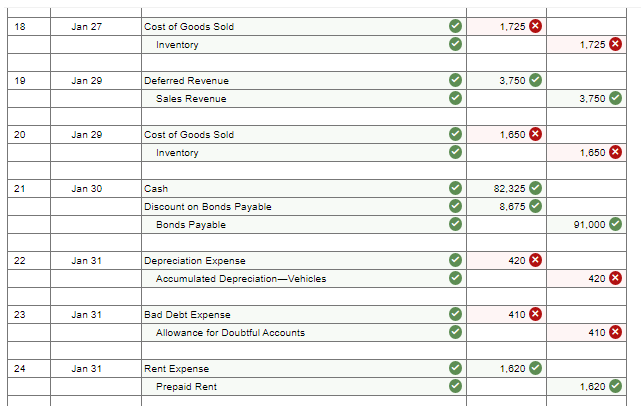

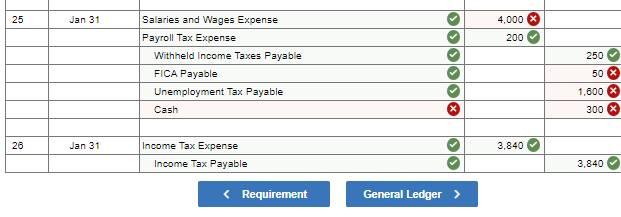

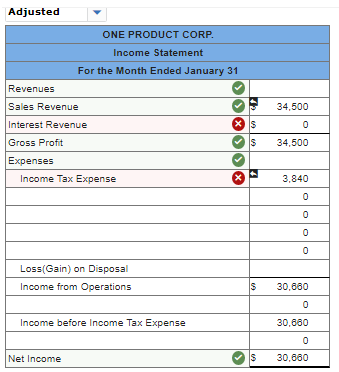

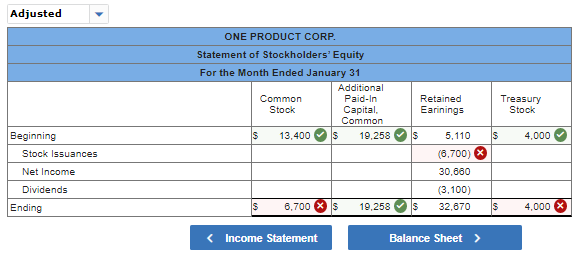

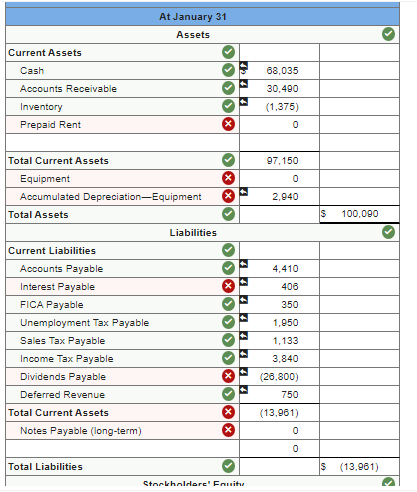

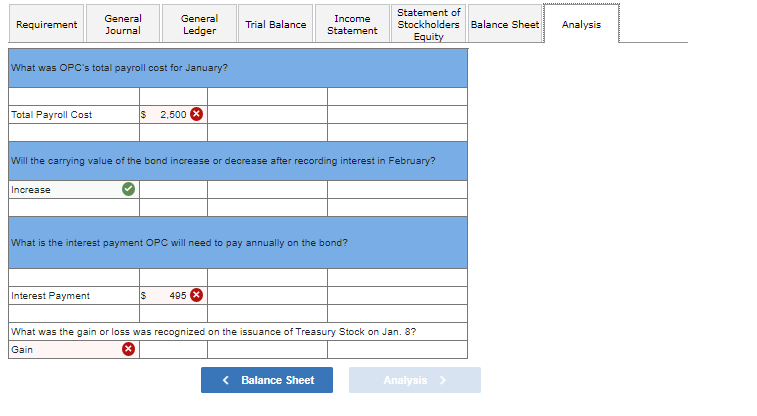

No Date General Journal Debit Credit 1 Jan 01 Salaries and Wages Payable 1.600 Cash 1,800 2 Jan 02 0 8,000 Vehicles Cash 8,000 3 Jan 03 500 Withheld Income Taxes Payable FICA Payable Cash >> 800 1,100 4 Jan 04 Dividends 6,700 00 Dividends Payable 6.700 5 Jan 05 Allowance for Doubtful Accounts 955 Accounts Receivable 955 6 Jan 06 Accounts Receivable 27,825 Sales Revenue 000 26.250 Sales Tax Payable 1.575 7 Jan 06 Cost of Goods Sold 11,860 11.860 Inventory Sales Tax Payable Cash X 712 712 X 8 Jan 07 > 500 Sales Tax Payable Cash 500 9 Jan 08 Cash 2,400 Treasury Stock 2.400 00 00 10 Jan 09 9,400 Cash Accounts Receivable 9,400 11 Jan 10 Dividends Payable 0 33.500 Cash 33,500 12 Jan 11 4,410 Inventory Accounts Payable >> 4,410 13 Jan 15 210 Accumulated Depreciation-Equipment Depreciation Expense 210 14 Jan 15 >> 24.400 5,250 Cash Accumulated Depreciation-Equipment Gain on Disposal of PPE Equipment 3,450 X 26.200 15 Jan 16 4,000 200 250 Salaries and Wages Expense Payroll Tax Expense Withheld Income Taxes Payable FICA Payable Unemployment Tax Payable Cash 300 50 1,800 16 Jan 17 22.100 497 X Notes Payable (long-term) Interest Expense Interest Payable Cash COL 91 X 22,888 17 Jan 27 4.770 Accounts Receivable Sales Revenue Sales Tax Payable SOI 4.500 270 18 Jan 27 Cost of Goods Sold 1.725 Inventory 1.725 19 Jan 20 3.750 Deferred Revenue Sales Revenue 3,750 20 Jan 29 1.650 X Cost of Goods Sold Inventory 1.650 21 Jan 30 Cash Discount on Bonds Payable Bonds Payable 82,325 8.875 91.000 22 Jan 31 420 X Depreciation Expense Accumulated Depreciation-Vehicles 420 23 Jan 31 410 Bad Debt Expense Allowance for Doubtful Accounts 410 X 24 Jan 31 1,820 Rent Expense Prepaid Rent 1,820 25 Jan 31 4.000 > 200 250 Salaries and Wages Expense Payroll Tax Expense Withheld Income Taxes Payable FICA Payable Unemployment Tax Payable Cash 50 X 1,800 X 300 26 Jan 31 3.840 Income Tax Expense Income Tax Payable 3,840 Adjusted ONE PRODUCT CORP. Income Statement For the Month Ended January 31 Revenues Sales Revenue 34,500 xs Interest Revenue Gross Profit IS 34,500 Expenses Income Tax Expense X 3.840 0 0 0 0 Loss(Gain) on Disposal Income from Operations $ 30.680 0 Income before Income Tax Expense 30.860 0 Net Income $ 30.660 Adjusted ONE PRODUCT CORP. Statement of Stockholders' Equity For the Month Ended January 31 Additional Common Paid-In Stock Capital Common IS 13.400 IS 19,258 Retained Earinings Treasury Stock IS IS 4,000 Beginning Stock Issuances 5,110 (6.700) Net Income Dividends 30.680 (3.100) 32,670 Ending IS 6.700 Xs 19.258 IS IS 4,000 At January 31 Assets Current Assets 68,035 Cash Accounts Receivable Inventory Prepaid Rent 30,490 (1,375) 0 97,150 0 Total Current Assets Equipment Accumulated Depreciation-Equipment Total Assets 2.940 IS 100,000 Liabilities 4,410 406 350 1,950 Current Liabilities Accounts Payable Interest Payable FICA Payable Unemployment Tax Payable Sales Tax Payable Income Tax Payable Dividends Payable Deferred Revenue Total Current Assets Notes Payable (long-term) 1,133 3,840 (26.800) 750 (13.961) 0 0 Total Liabilities IS (13.961) Stockholders' Frunitu Requirement General Journal General Ledger Trial Balance Income Statement Statement of Stockholders Balance Sheet Equity Analysis What was OPC's total payroll cost for January? Total Payroll Cost IS 2,500 Will the carrying value of the bond increase or decrease after recording interest in February? Increase What is the interest payment OPC will need to pay annually on the bond? Interest Payment IS 495 What was the gain or loss was recognized on the issuance of Treasury Stock on Jan. 8? Gain > 800 1,100 4 Jan 04 Dividends 6,700 00 Dividends Payable 6.700 5 Jan 05 Allowance for Doubtful Accounts 955 Accounts Receivable 955 6 Jan 06 Accounts Receivable 27,825 Sales Revenue 000 26.250 Sales Tax Payable 1.575 7 Jan 06 Cost of Goods Sold 11,860 11.860 Inventory Sales Tax Payable Cash X 712 712 X 8 Jan 07 > 500 Sales Tax Payable Cash 500 9 Jan 08 Cash 2,400 Treasury Stock 2.400 00 00 10 Jan 09 9,400 Cash Accounts Receivable 9,400 11 Jan 10 Dividends Payable 0 33.500 Cash 33,500 12 Jan 11 4,410 Inventory Accounts Payable >> 4,410 13 Jan 15 210 Accumulated Depreciation-Equipment Depreciation Expense 210 14 Jan 15 >> 24.400 5,250 Cash Accumulated Depreciation-Equipment Gain on Disposal of PPE Equipment 3,450 X 26.200 15 Jan 16 4,000 200 250 Salaries and Wages Expense Payroll Tax Expense Withheld Income Taxes Payable FICA Payable Unemployment Tax Payable Cash 300 50 1,800 16 Jan 17 22.100 497 X Notes Payable (long-term) Interest Expense Interest Payable Cash COL 91 X 22,888 17 Jan 27 4.770 Accounts Receivable Sales Revenue Sales Tax Payable SOI 4.500 270 18 Jan 27 Cost of Goods Sold 1.725 Inventory 1.725 19 Jan 20 3.750 Deferred Revenue Sales Revenue 3,750 20 Jan 29 1.650 X Cost of Goods Sold Inventory 1.650 21 Jan 30 Cash Discount on Bonds Payable Bonds Payable 82,325 8.875 91.000 22 Jan 31 420 X Depreciation Expense Accumulated Depreciation-Vehicles 420 23 Jan 31 410 Bad Debt Expense Allowance for Doubtful Accounts 410 X 24 Jan 31 1,820 Rent Expense Prepaid Rent 1,820 25 Jan 31 4.000 > 200 250 Salaries and Wages Expense Payroll Tax Expense Withheld Income Taxes Payable FICA Payable Unemployment Tax Payable Cash 50 X 1,800 X 300 26 Jan 31 3.840 Income Tax Expense Income Tax Payable 3,840 Adjusted ONE PRODUCT CORP. Income Statement For the Month Ended January 31 Revenues Sales Revenue 34,500 xs Interest Revenue Gross Profit IS 34,500 Expenses Income Tax Expense X 3.840 0 0 0 0 Loss(Gain) on Disposal Income from Operations $ 30.680 0 Income before Income Tax Expense 30.860 0 Net Income $ 30.660 Adjusted ONE PRODUCT CORP. Statement of Stockholders' Equity For the Month Ended January 31 Additional Common Paid-In Stock Capital Common IS 13.400 IS 19,258 Retained Earinings Treasury Stock IS IS 4,000 Beginning Stock Issuances 5,110 (6.700) Net Income Dividends 30.680 (3.100) 32,670 Ending IS 6.700 Xs 19.258 IS IS 4,000 At January 31 Assets Current Assets 68,035 Cash Accounts Receivable Inventory Prepaid Rent 30,490 (1,375) 0 97,150 0 Total Current Assets Equipment Accumulated Depreciation-Equipment Total Assets 2.940 IS 100,000 Liabilities 4,410 406 350 1,950 Current Liabilities Accounts Payable Interest Payable FICA Payable Unemployment Tax Payable Sales Tax Payable Income Tax Payable Dividends Payable Deferred Revenue Total Current Assets Notes Payable (long-term) 1,133 3,840 (26.800) 750 (13.961) 0 0 Total Liabilities IS (13.961) Stockholders' Frunitu Requirement General Journal General Ledger Trial Balance Income Statement Statement of Stockholders Balance Sheet Equity Analysis What was OPC's total payroll cost for January? Total Payroll Cost IS 2,500 Will the carrying value of the bond increase or decrease after recording interest in February? Increase What is the interest payment OPC will need to pay annually on the bond? Interest Payment IS 495 What was the gain or loss was recognized on the issuance of Treasury Stock on Jan. 8? Gain