Answered step by step

Verified Expert Solution

Question

1 Approved Answer

no details are missing On 30 June 2014, January Ltd acquired all the issued capital of Wednesday Ltd for a cost of $950 000. At

no details are missing

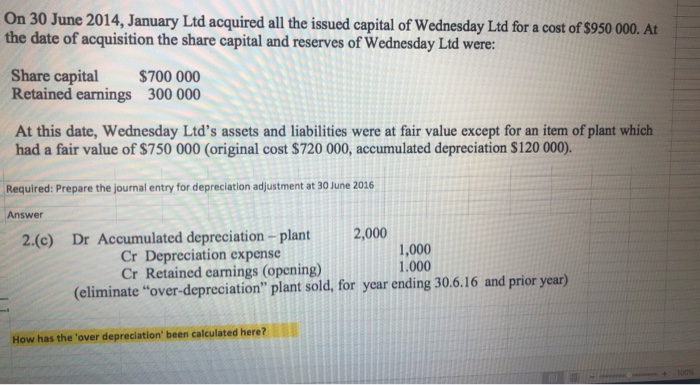

On 30 June 2014, January Ltd acquired all the issued capital of Wednesday Ltd for a cost of $950 000. At the date of acquisition the share capital and reserves of Wednesday Ltd were: Share capital $700 000 Retained earnings 300 000 At this date, Wednesday Ltd's assets and liabilities were at fair value except for an item of plant which had a fair value of $750 000 (original cost $720 000, accumulated depreciation $120 000). Required: Prepare the journal entry for depreciation adjustment at 30 June 2016 Answer 2.(c) Dr Accumulated depreciation - plant 2,000 Cr Depreciation expense 1,000 Cr Retained earnings (opening) 1.000 (eliminate "over-depreciation" plant sold, for year ending 30.6.16 and prior year) How has the 'over depreciation' been calculated here? On 30 June 2014, January Ltd acquired all the issued capital of Wednesday Ltd for a cost of $950 000. At the date of acquisition the share capital and reserves of Wednesday Ltd were: Share capital $700 000 Retained earnings 300 000 At this date, Wednesday Ltd's assets and liabilities were at fair value except for an item of plant which had a fair value of $750 000 (original cost $720 000, accumulated depreciation $120 000). Required: Prepare the journal entry for depreciation adjustment at 30 June 2016 Answer 2.(c) Dr Accumulated depreciation - plant 2,000 Cr Depreciation expense 1,000 Cr Retained earnings (opening) 1.000 (eliminate "over-depreciation" plant sold, for year ending 30.6.16 and prior year) How has the 'over depreciation' been calculated here Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started