52-WEEK YLD VOL NET HI LO STOCK (DIV) % PE 100s CLOSECHG **** 16.13 8.65 BiminiMtg 1.99e 217 5 1575 9.17 0.12 26.06 19.39

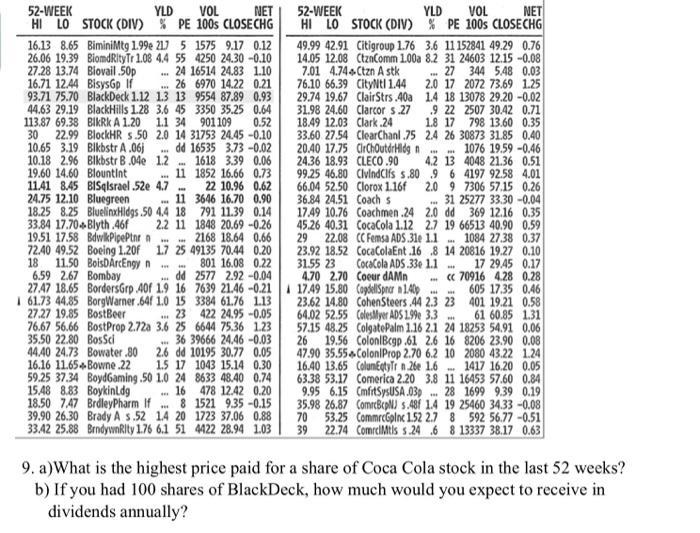

52-WEEK YLD VOL NET HI LO STOCK (DIV) % PE 100s CLOSECHG **** 16.13 8.65 BiminiMtg 1.99e 217 5 1575 9.17 0.12 26.06 19.39 BiomdRityTr 1.08 4.4 55 4250 24.30 -0.10 27.28 13.74 Biovail.50p 24 16514 24.83 1.10 16.71 12.44 BisysGp If 26 6970 14.22 0.21 93.71 75.70 1.3 13 9554 87.89 0.93 44.63 29.19 BlackHills 1.28 3.6 45 3350 35.25 0.64 113.87 69.38 BIKRKA 1.20 1.1 34 901109 0.52 30 22.99 BlockHR s.50 2.0 14 31753 24.45 -0.10 10.65 3.19 Bikbstr A.06j dd 16535 3.73 -0.02 BlackDeck 1.12 *** 10.18 2.96 Blkbstr B.04e 1.2 Blountint 1618 3.39 0.06 1852 16.66 0.73 22 10.96 0.62 3646 16.70 0.90 791 11.39 0.14 1848 20.69 -0.26 2168 18.64 0.66 Boeing 1.20f 1.7 25 49135 70.44 0.20 *** *** 801 16.08 0.22 2577 2.92 -0.04 7639 21.46 -0.21 3384 61.76 1.13 422 24.95 -0.05 6644 75.36 1.23 36 39666 24.46 -0.03 2.6 dd 10195 30.77 0.05 1.5 17 1043 15.14 0.30 8633 48.40 0.74 478 12.42 0.20 1521 9.35 -0.15 1723 37.06 0.88 4422 28.94 1.03 19.60 14.60 11.41 8.45 BISqIsrael 52e 24.75 12.10 Bluegreen *** BoisDArcEngy n *** 4.7. 11 *** 2.2 11 18.25 8.25 BluelinxHidgs.50 4.4 18 33.84 17.70+ Blyth.46f 19.51 17.58 BdwikPipePtnr n... 72.40 49.52 18 11.50 6.59 2.67 Bombay 27.47 18.65 *** 11 HE in *** 61.73 44.85 *** dd BordersGrp.40f 1.9 16 BorgWarner .64f 1.0 15 27.27 19.85 BostBeer 23 76.67 56.66 BostProp 2.72a 3.6 25 35.50 22.80 BosSci 44.40 24.73 Bowater .80 16.16 11.65+Bowne .22 59.25 37.34 BoydGaming .50 1.0 24 15.48 8.83 Boykinl.dg 16 18.50 7.47 BrdleyPharm If 8 39.90 26.30 Brady A s.52 1.4 20 33.42 25.88 BrndywnRity 1.76 6.1 51 *** *** 52-WEEK HI LO STOCK (DIV) NET YLD VOL % PE 100s CLOSECHG *** *** *** 31 25277 33.30 -0.04 *** 2.0 dd 369 12.16 0.35 49.99 42.91 Citigroup 1.76 3.6 11152841 49.29 0.76 14.05 12.08 (tznComm 1.00a 8.2 31 24603 12.15 -0.08 7.01 4.74+Ctzn A stk 27 344 5.48 0.03 76.10 66.39 CityNtl 1.44 2.0 17 2072 73.69 1.25 29.74 19.67 ClairStrs.40a 1.4 18 13078 29.20 -0.02 31.98 24.60 Clarcor s.27 .9 22 2507 30.42 0.71 18.49 12.03 Clark.24 1.8 17 798 13.60 0.35 33.60 27.54 ClearChanl .75 2.4 26 30873 31.85 0.40 20.40 17.75 CirChOutdrHidg n 1076 19.59-0.46 24.36 18.93 CLECO.90 4.2 13 4048 21.36 0.51 99.25 46.80 ClvindClfs s.80 9 6 4197 92.58 4.01 66.04 52.50 Clorox 1.16f 2.0 9 7306 57.15 0.26 36.84 24.51 Coach s 17.49 10.76 Coachmen .24 45.26 40.31 CocaCola 1.12 2.7 19 66513 40.90 0.59 29 22.08 CC Femsa ADS.31e 1.1. 1084 27.38 0.37 23.92 18.52 CocaColaEnt .16 8 14 20816 19.27 0.10 31.55 23 CocaCola ADS.33e 1.1.. 17 29.45 0.17 4.70 2.70 Coeur dAMn cc 70916 4.28 0.28 17.49 15.80 CapdellSpnar 1.40p 605 17.35 0.46 23.62 14.80 CohenSteers .44 2.3 23 401 19.21 0.58 64.02 52.55 ColesMyer ADS 1.99 3.3... 61 60.85 1.31 57.15 48.25 ColgatePalm 1.16 2.1 24 18253 54.91 0.06 26 19.56 ColonlBcgp.61 2.6 16 8206 23.90 0.08 47.90 35.55+ ColoniProp 2.70 6.2 10 2080 43.22 1.24 16.40 13.65 ColumEqtyTr n.26e 1.6 63.38 53.17 Comerica 2.20 3.8 11 16453 57.60 0.84 9.95 6.15 CmfitSysUSA.03p 28 1699 9.39 0.19 35.98 26.87 ComrcBcpNJ s.48f 1.4 19 25460 34.33 -0.08 70 53.25 CommrcGplnc 1.52 2.7 8 592 56.77 -0.51 39 22.74 ComrciMtls s.24 6 8 13337 38.17 0.63 *** HE 1417 16.20 0.05 *** 9. a) What is the highest price paid for a share of Coca Cola stock in the last 52 weeks? b) If you had 100 shares of BlackDeck, how much would you expect to receive in dividends annually?

Step by Step Solution

3.56 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

4 Clorox has PE ratio of 9 while the Closing Market Price o...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started