Answered step by step

Verified Expert Solution

Question

1 Approved Answer

No Excel Acme Co is considering building a factory either in a foreign country A or domestically. Acme cannot build both domestically and in country

No Excel

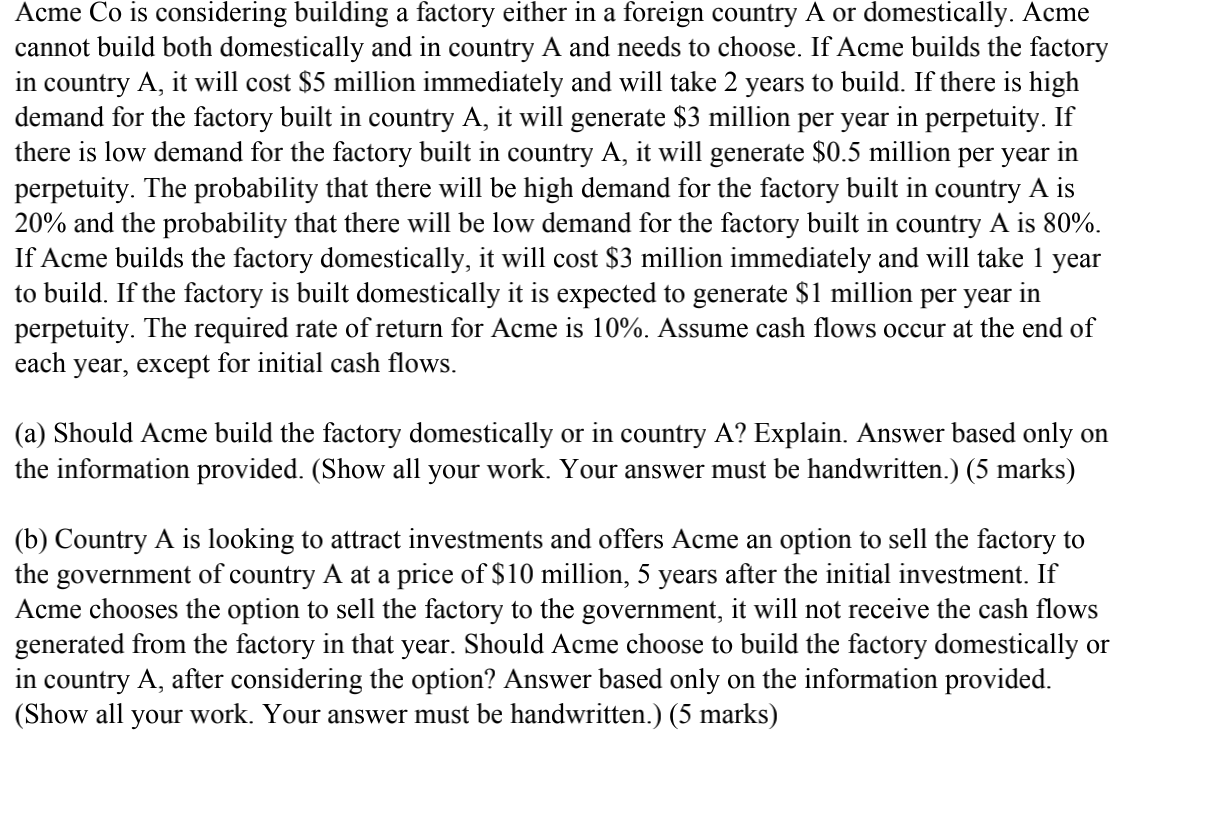

Acme Co is considering building a factory either in a foreign country A or domestically. Acme cannot build both domestically and in country A and needs to choose. If Acme builds the factory in country A, it will cost $5 million immediately and will take 2 years to build. If there is high demand for the factory built in country A, it will generate $3 million per year in perpetuity. If there is low demand for the factory built in country A, it will generate $0.5 million per year in perpetuity. The probability that there will be high demand for the factory built in country A is 20% and the probability that there will be low demand for the factory built in country A is 80%. If Acme builds the factory domestically, it will cost $3 million immediately and will take 1 year to build. If the factory is built domestically it is expected to generate $1 million per year in perpetuity. The required rate of return for Acme is 10%. Assume cash flows occur at the end of each year, except for initial cash flows. (a) Should Acme build the factory domestically or in country A? Explain. Answer based only on the information provided. (Show all your work. Your answer must be handwritten.) (5 marks) (b) Country A is looking to attract investments and offers Acme an option to sell the factory to the government of country A at a price of $10 million, 5 years after the initial investment. If Acme chooses the option to sell the factory to the government, it will not receive the cash flows generated from the factory in that year. Should Acme choose to build the factory domestically or in country A, after considering the option? Answer based only on the information provided. (Show all your work. Your answer must be handwritten.)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started