Answered step by step

Verified Expert Solution

Question

1 Approved Answer

no excel IRR IS Merpreteu 3 You have been asked to evaluate the proposed acquisition of a new clinical labora tory test system. The system's

no excel

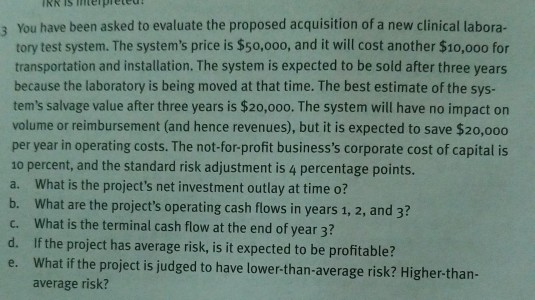

IRR IS Merpreteu 3 You have been asked to evaluate the proposed acquisition of a new clinical labora tory test system. The system's price is $50,000, and it will cost another $10,000 for transportation and installation. The system is expected to be sold after three years because the laboratory is being moved at that time. The best estimate of the sys- tem's salvage value after three years is $20,000. The system will have no impact on volume or reimbursement (and hence revenues), but it is expected to save $20,000 per year in operating costs. The not-for-profit business's corporate cost of capital is 10 percent, and the standard risk adjustment is 4 percentage points. a. What is the project's net investment outlay at time o? b. What are the project's operating cash flows in years 1, 2, and 3? c. What is the terminal cash flow at the end of year 3? d. If the project has average risk, is it expected to be profitable? e. What if the project is judged to have lower-than-average risk? Higher-than- average riskStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started