Answered step by step

Verified Expert Solution

Question

1 Approved Answer

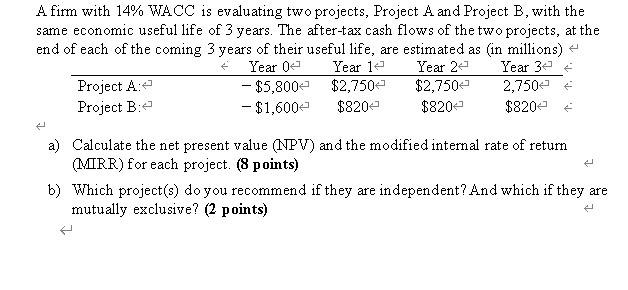

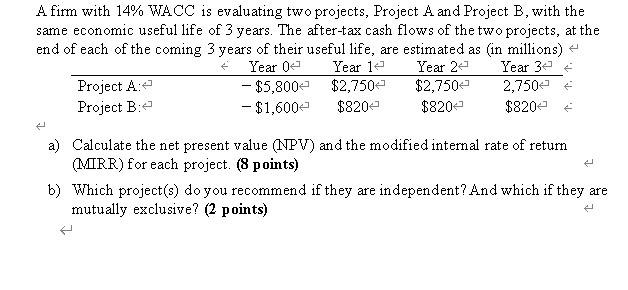

no excel plz A firm with 14% WACC is evaluating two projects, Project A and Project B, with the same economic useful life of 3

no excel plz

A firm with 14% WACC is evaluating two projects, Project A and Project B, with the same economic useful life of 3 years. The after-tax cash flows of the two projects, at the end of each of the coming 3 years of their useful life, are estimated as in millions) Year 0 Year 1e Year 22 Year 3e Project A: - $5,800 $2,7502 $2,750 2,75044 Project B: - $1,6002 $820e $820 $82024 a) Calculate the net present value (NPV) and the modified internal rate of return (MRR) for each project. (8 points) b) Which project(s) do you recommend if they are independent? And which if they are mutually exclusive? (2 points)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started