Answered step by step

Verified Expert Solution

Question

1 Approved Answer

no excel show calculations 2. (15 points). To offset the cost of buying a S75,000 house, a couple borrowed $12,500 from their parents at 6%

no excel show calculations

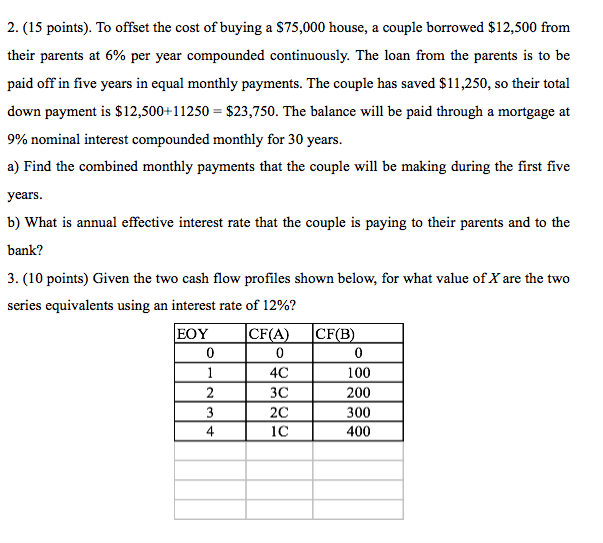

2. (15 points). To offset the cost of buying a S75,000 house, a couple borrowed $12,500 from their parents at 6% per year compounded continuously. The loan from the parents is to be paid off in five years in equal monthly payments. The couple has saved $11,250, so their total down payment is $12,500 $23,750. The balance will be paid through a mortgage at 9% nominal interest compounded monthly for 30 years a) Find the combined monthly payments that the couple will be making during the first five years b) What is annual effective interest rate that the couple is paying to their parents and to the bank? 3. (10 points) Given the two cash flow profiles shown below, for what value ofXare the two series equivalents using an interest rate of 12%? REO CFA CFB 100 AC 200 3C 300 2C ic 400

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started