Answered step by step

Verified Expert Solution

Question

1 Approved Answer

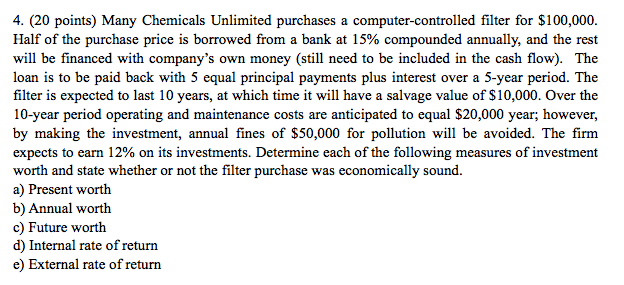

no excel show calculations 4. (20 points Many Chemicals Unlimited purchases a computer-controlled filter for $100,000. Half of the purchase price is borrowed from a

no excel show calculations

4. (20 points Many Chemicals Unlimited purchases a computer-controlled filter for $100,000. Half of the purchase price is borrowed from a bank at 15% compounded annually, and the rest will be financed with company's own money (still need to be included in the cash flow). The loan is to be paid back with 5 equal principal payments plus interest over a 5-year period. The filter is expected to last 10 years, at which time it will have a salvage value of $10,000. Over the 10-year period operating and maintenance costs are anticipated to equal $20,000 year; however, by making the investment, annual fines of $50,000 for pollution will be avoided. The firm expects to earn 12% on its investments. Determine each of the following measures of investment worth and state whether or not the filter purchase was economically sound a) Present worth b) Annual worth c Future worth d) Internal rate of return e External rate of return

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started