Answered step by step

Verified Expert Solution

Question

1 Approved Answer

no excel working out Question 6 (9 marks) The parts a) and b) below are independent questions which do not relate to each other. a)

no excel working out

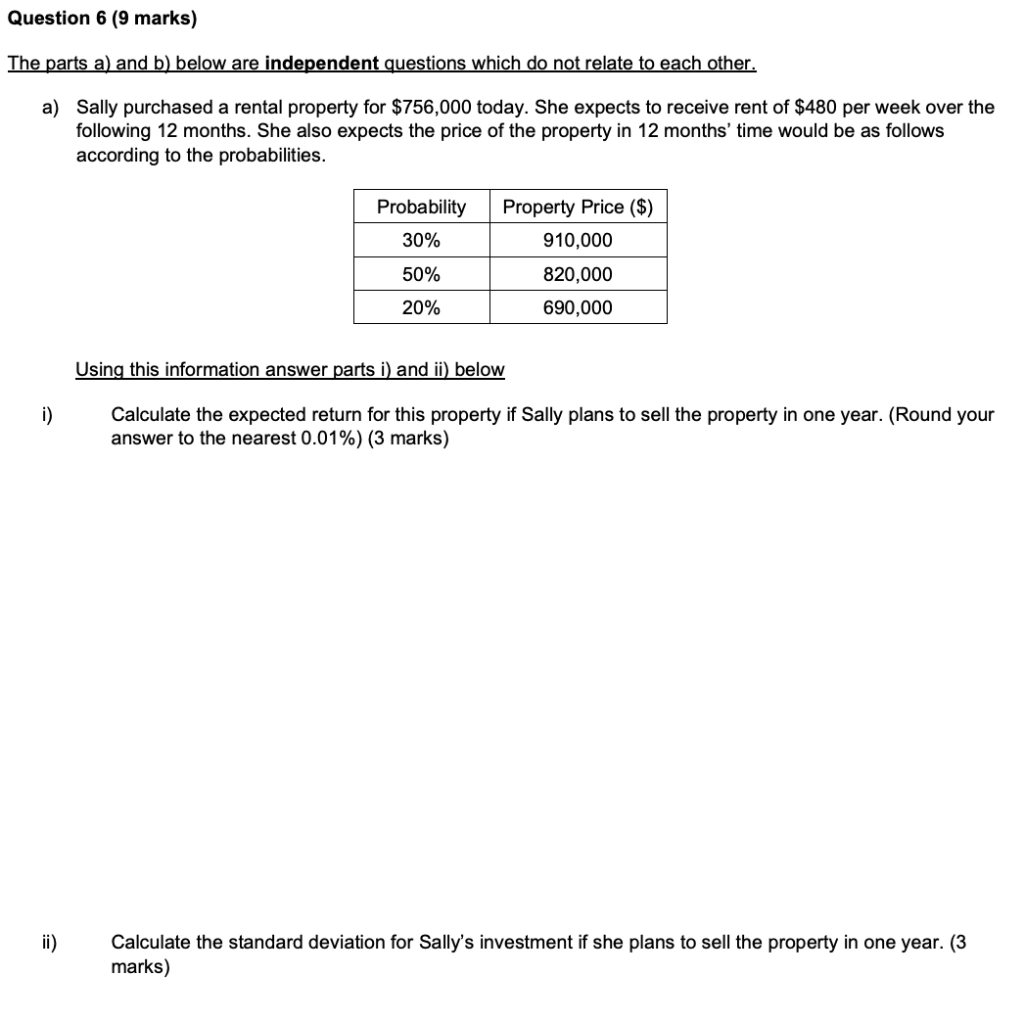

Question 6 (9 marks) The parts a) and b) below are independent questions which do not relate to each other. a) Sally purchased a rental property for $756,000 today. She expects to receive rent of $480 per week over the following 12 months. She also expects the price of the property in 12 months' time would be as follows according to the probabilities. i) ii) Probability 30% 50% 20% Property Price ($) 910,000 820,000 690,000 Using this information answer parts i) and ii) below Calculate the expected return for this property if Sally plans to sell the property in one year. (Round your answer to the nearest 0.01%) (3 marks) Calculate the standard deviation for Sally's investment if she plans to sell the property in one year. (3 marks) b) Vivienne has $10,000 cash she can use for investments. Company A's share has an expected return of 10% p.a. Company B's bond has an expected return of 5% p.a. Vivienne wants to set up a portfolio including the two assets. If Vivienne wans a return of 8% p.a. from her portfolio. How much should she invest in Company A's share and how much should she invest in Company B's bond? (Round your answers to the nearest cent.)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started