Answered step by step

Verified Expert Solution

Question

1 Approved Answer

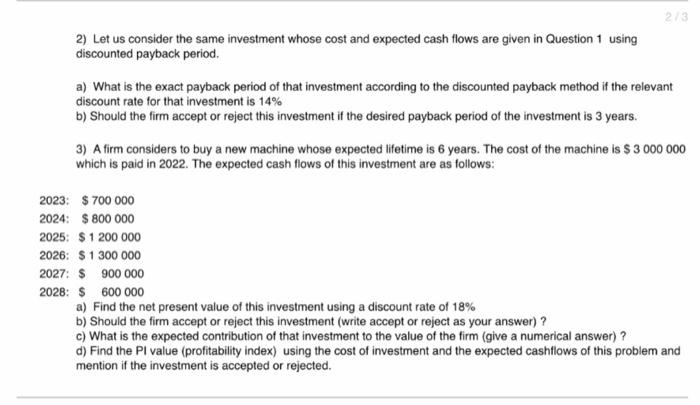

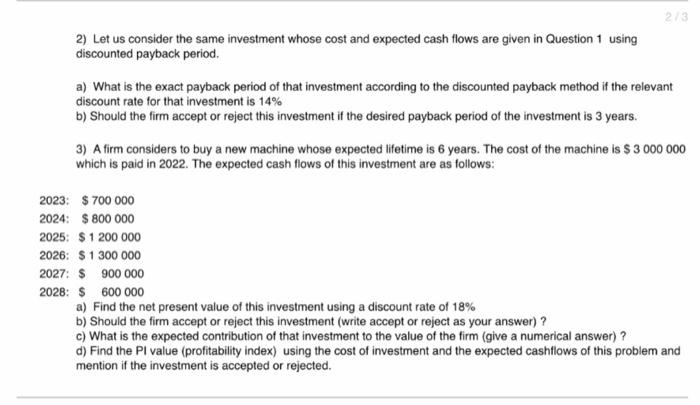

no excell 23 2) Let us consider the same investment whose cost and expected cash flows are given in Question 1 using discounted payback period.

no excell

23 2) Let us consider the same investment whose cost and expected cash flows are given in Question 1 using discounted payback period. a) What is the exact payback period of that investment according to the discounted payback method if the relevant discount rate for that investment is 14% b) Should the firm accept or reject this investment if the desired payback period of the investment is 3 years. 3) A firm considers to buy a new machine whose expected lifetime is 6 years. The cost of the machine is $ 3 000 000 which is paid in 2022. The expected cash flows of this investment are as follows: 2023: $ 700 000 2024: $ 800 000 2025: $ 1 200 000 2026: $ 1 300 000 2027: $ 900 000 2028: $ 600 000 a) Find the net present value of this investment using a discount rate of 18% b) Should the firm accept or reject this investment (write accept or reject as your answer) ? c) What is the expected contribution of that investment to the value of the firm (give a numerical answer) ? d) Find the Pl value (profitability index) using the cost of investment and the expected cashflows of this problem and mention if the investment is accepted or rejected. 23 2) Let us consider the same investment whose cost and expected cash flows are given in Question 1 using discounted payback period. a) What is the exact payback period of that investment according to the discounted payback method if the relevant discount rate for that investment is 14% b) Should the firm accept or reject this investment if the desired payback period of the investment is 3 years. 3) A firm considers to buy a new machine whose expected lifetime is 6 years. The cost of the machine is $ 3 000 000 which is paid in 2022. The expected cash flows of this investment are as follows: 2023: $ 700 000 2024: $ 800 000 2025: $ 1 200 000 2026: $ 1 300 000 2027: $ 900 000 2028: $ 600 000 a) Find the net present value of this investment using a discount rate of 18% b) Should the firm accept or reject this investment (write accept or reject as your answer) ? c) What is the expected contribution of that investment to the value of the firm (give a numerical answer) ? d) Find the Pl value (profitability index) using the cost of investment and the expected cashflows of this problem and mention if the investment is accepted or rejected

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started