Answered step by step

Verified Expert Solution

Question

1 Approved Answer

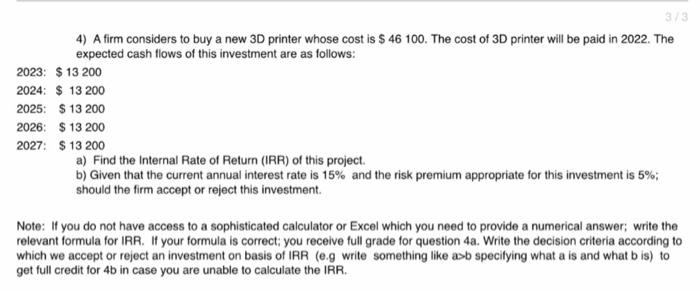

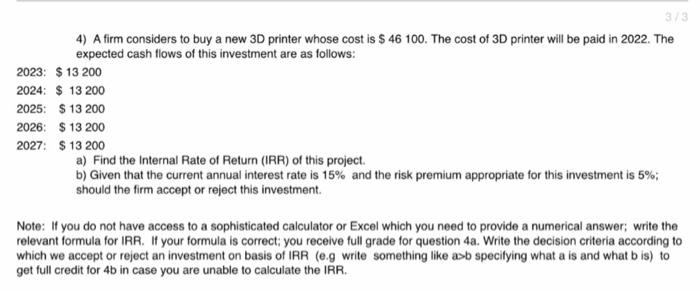

no excell 373 4) A firm considers to buy a new 3D printer whose cost is $ 46 100. The cost of 3D printer will

no excell

373 4) A firm considers to buy a new 3D printer whose cost is $ 46 100. The cost of 3D printer will be paid in 2022. The expected cash flows of this investment are as follows: 2023: $ 13200 2024: $ 13 200 2025: S13 200 2026: $13 200 2027: $ 13 200 a) Find the Internal Rate of Return (IRR) of this project. b) Given that the current annual interest rate is 15% and the risk premium appropriate for this investment is 5%; should the firm accept or reject this investment Note: If you do not have access to a sophisticated calculator or Excel which you need to provide a numerical answer; write the relevant formula for IRR. If your formula is correct; you receive full grade for question 4a. Write the decision criteria according to which we accept or reject an investment on basis of IRR (e.g write something like asb specifying what a is and what bis) to get full credit for 4b in case you are unable to calculate the IRR

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started