No explanation necessary

No explanation necessary

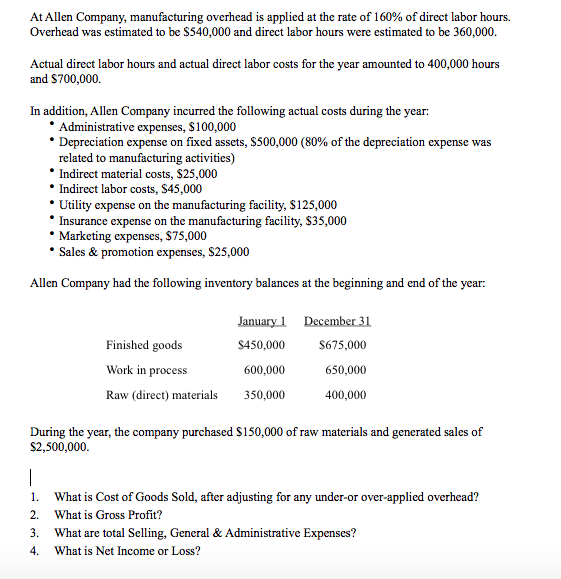

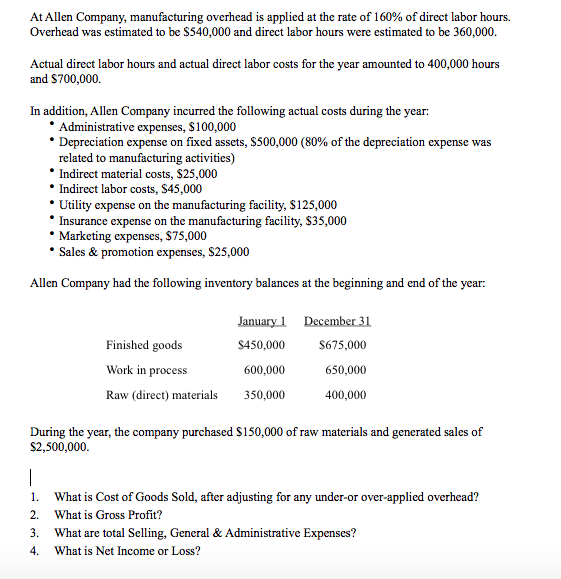

At Allen Company, manufacturing overhead is applied at the rate of 160% of direct labor hours. Overhead was estimated to be $540,000 and direct labor hours were estimated to be 360,000. Actual direct labor hours and actual direct labor costs for the year amounted to 400,000 hours and $700,000 In addition, Allen Company incurred the following actual costs during the year: Administrative expenses, $100,000 Depreciation expense on fixed assets, $500,000 (80% of the depreciation expense was related to manufacturing activities) Indirect material costs, $25,000 * Indirect labor costs, $45,000 Utility expense on the manufacturing facility, $125,000 Insurance expense on the manufacturing facility, $35,000 Marketing expenses, $75,000 Sales & promotion expenses, $25,000 Allen Company had the following inventory balances at the beginning and end of the year: Finished goods Work in process Raw (direct) materials January 1 $450,000 600,000 350,000 December 31 $675,000 650,000 400,000 During the year, the company purchased $150,000 of raw materials and generated sales of $2,500,000. 1. What is Cost of Goods Sold, after adjusting for any under-or over-applied overhead? 2. What is Gross Profit? 3. What are total Selling, General & Administrative Expenses? 4. What is Net Income or Loss? At Allen Company, manufacturing overhead is applied at the rate of 160% of direct labor hours. Overhead was estimated to be $540,000 and direct labor hours were estimated to be 360,000. Actual direct labor hours and actual direct labor costs for the year amounted to 400,000 hours and $700,000 In addition, Allen Company incurred the following actual costs during the year: Administrative expenses, $100,000 Depreciation expense on fixed assets, $500,000 (80% of the depreciation expense was related to manufacturing activities) Indirect material costs, $25,000 * Indirect labor costs, $45,000 Utility expense on the manufacturing facility, $125,000 Insurance expense on the manufacturing facility, $35,000 Marketing expenses, $75,000 Sales & promotion expenses, $25,000 Allen Company had the following inventory balances at the beginning and end of the year: Finished goods Work in process Raw (direct) materials January 1 $450,000 600,000 350,000 December 31 $675,000 650,000 400,000 During the year, the company purchased $150,000 of raw materials and generated sales of $2,500,000. 1. What is Cost of Goods Sold, after adjusting for any under-or over-applied overhead? 2. What is Gross Profit? 3. What are total Selling, General & Administrative Expenses? 4. What is Net Income or Loss

No explanation necessary

No explanation necessary