NO EXPLANATION NEEDED, BUT PLEASE DO ALL. NEEDED IN 40 MINUTES

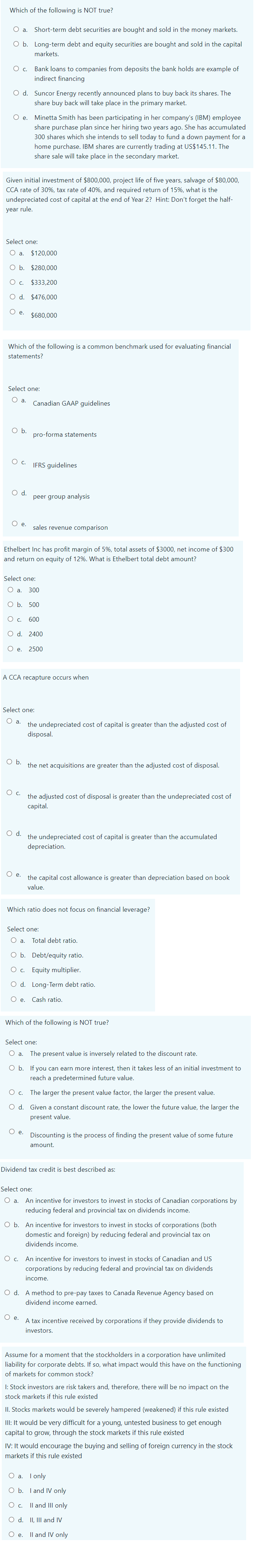

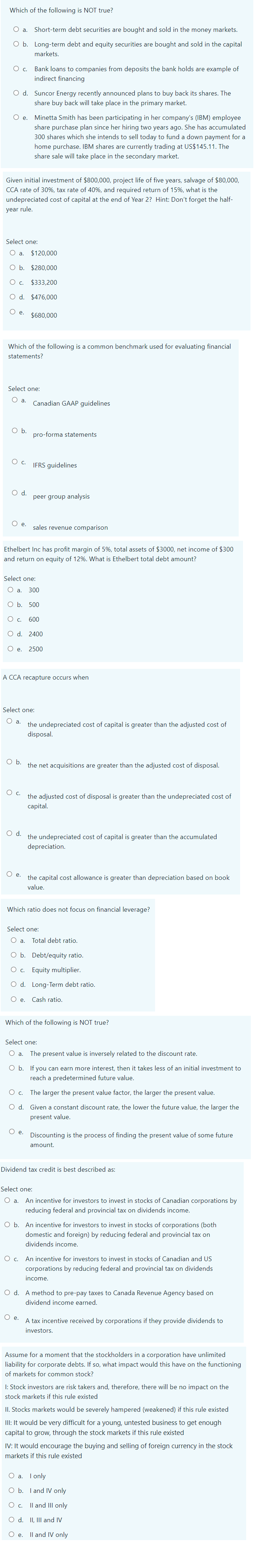

Which of the following is NOT true? O a. Short-term debt securities are bought and sold in the money markets. O b. Long-term debt and equity securities are bought and sold in the capital markets. O c. Bank loans to companies from deposits the bank holds are example of indirect financing O d. Suncor Energy recently announced plans to buy back its shares. The share buy back will take place in the primary market. O e. Minetta Smith has been participating in her company's (IBM) employee share purchase plan since her hiring two years ago. She has accumulated 300 shares which she intends to sell today to fund a down payment for a home purchase. IBM shares are currently trading at US$145.11. The share sale will take place in the secondary market. Given initial investment of $800,000, project life of five years, salvage of $80,000, CCA rate of 30%, tax rate of 40%, and required return of 15%, what is the undepreciated cost of capital at the end of Year 2? Hint: Don't forget the half- year rule. Select one: O a. $120,000 O b. $280,000 O c. $333,200 O d. $476,000 O e. $680,000 Which of the following is a common benchmark used for evaluating financial statements? Select one: O a. Canadian GAAP guidelines O b. pro-forma statements O c. IFRS guidelines O d. peer group analysis O e. sales revenue comparison Ethelbert Inc has profit margin of 5%, total assets of $3000, net income of $300 and return on equity of 12%. What is Ethelbert total debt amount? Select one: O a. 300 O b. 500 O c. 600 O d. 2400 O e. 2500 A CCA recapture occurs when Select one: O a. the undepreciated cost of capital is greater than the adjusted cost of disposal. ob. the net acquisitions are greater than the adjusted cost of disposal. O c. the adjusted cost of disposal is greater than the undepreciated cost of capital. O d. the undepreciated cost of capital is greater than the accumulated depreciation. O e. the capital cost allowance is greater than depreciation based on book value. Which ratio does not focus on financial leverage? Select one: O a. Total debt ratio. O b. Debt/equity ratio. O c. Equity multiplier. O d. Long-Term debt ratio. O e. Cash ratio. Which of the following is NOT true? Select one: O a. The present value is inversely related to the discount rate. O b. If you can earn more interest, then it takes less of an initial investment to reach a predetermined future value. O c. The larger the present value factor, the larger the present value. O d. Given a constant discount rate, the lower the future value, the larger the present value. O e. Discounting is the process of finding the present value of some future amount. Dividend tax credit is best described as: Select one: O a. An incentive for investors to invest in stocks of Canadian corporations by reducing federal and provincial tax on dividends income. O b. An incentive for investors to invest in stocks of corporations (both domestic and foreign) by reducing federal and provincial tax on dividends income. O c. An incentive for investors to invest in stocks of Canadian and US corporations by reducing federal and provincial tax on dividends income. O d. A method to pre-pay taxes to Canada Revenue Agency based on dividend income earned. O e. A tax incentive received by corporations if they provide dividends to investors. Assume for a moment that the stockholders in a corporation have unlimited liability for corporate debts. If so, what impact would this have on the functioning of markets for common stock? 1: Stock investors are risk takers and, therefore, there will be no impact on the stock markets if this rule existed II. Stocks markets would be severely hampered (weakened) if this rule existed III: It would be very difficult for a young, untested business to get enough capital to grow, through the stock markets if this rule existed IV: It would encourage the buying and selling of foreign currency in the stock markets if this rule existed O a. Tonly O b. I and IV only O c. Il and Ill only Od. II, III and IV O e. ll and IV only Which of the following is NOT true? O a. Short-term debt securities are bought and sold in the money markets. O b. Long-term debt and equity securities are bought and sold in the capital markets. O c. Bank loans to companies from deposits the bank holds are example of indirect financing O d. Suncor Energy recently announced plans to buy back its shares. The share buy back will take place in the primary market. O e. Minetta Smith has been participating in her company's (IBM) employee share purchase plan since her hiring two years ago. She has accumulated 300 shares which she intends to sell today to fund a down payment for a home purchase. IBM shares are currently trading at US$145.11. The share sale will take place in the secondary market. Given initial investment of $800,000, project life of five years, salvage of $80,000, CCA rate of 30%, tax rate of 40%, and required return of 15%, what is the undepreciated cost of capital at the end of Year 2? Hint: Don't forget the half- year rule. Select one: O a. $120,000 O b. $280,000 O c. $333,200 O d. $476,000 O e. $680,000 Which of the following is a common benchmark used for evaluating financial statements? Select one: O a. Canadian GAAP guidelines O b. pro-forma statements O c. IFRS guidelines O d. peer group analysis O e. sales revenue comparison Ethelbert Inc has profit margin of 5%, total assets of $3000, net income of $300 and return on equity of 12%. What is Ethelbert total debt amount? Select one: O a. 300 O b. 500 O c. 600 O d. 2400 O e. 2500 A CCA recapture occurs when Select one: O a. the undepreciated cost of capital is greater than the adjusted cost of disposal. ob. the net acquisitions are greater than the adjusted cost of disposal. O c. the adjusted cost of disposal is greater than the undepreciated cost of capital. O d. the undepreciated cost of capital is greater than the accumulated depreciation. O e. the capital cost allowance is greater than depreciation based on book value. Which ratio does not focus on financial leverage? Select one: O a. Total debt ratio. O b. Debt/equity ratio. O c. Equity multiplier. O d. Long-Term debt ratio. O e. Cash ratio. Which of the following is NOT true? Select one: O a. The present value is inversely related to the discount rate. O b. If you can earn more interest, then it takes less of an initial investment to reach a predetermined future value. O c. The larger the present value factor, the larger the present value. O d. Given a constant discount rate, the lower the future value, the larger the present value. O e. Discounting is the process of finding the present value of some future amount. Dividend tax credit is best described as: Select one: O a. An incentive for investors to invest in stocks of Canadian corporations by reducing federal and provincial tax on dividends income. O b. An incentive for investors to invest in stocks of corporations (both domestic and foreign) by reducing federal and provincial tax on dividends income. O c. An incentive for investors to invest in stocks of Canadian and US corporations by reducing federal and provincial tax on dividends income. O d. A method to pre-pay taxes to Canada Revenue Agency based on dividend income earned. O e. A tax incentive received by corporations if they provide dividends to investors. Assume for a moment that the stockholders in a corporation have unlimited liability for corporate debts. If so, what impact would this have on the functioning of markets for common stock? 1: Stock investors are risk takers and, therefore, there will be no impact on the stock markets if this rule existed II. Stocks markets would be severely hampered (weakened) if this rule existed III: It would be very difficult for a young, untested business to get enough capital to grow, through the stock markets if this rule existed IV: It would encourage the buying and selling of foreign currency in the stock markets if this rule existed O a. Tonly O b. I and IV only O c. Il and Ill only Od. II, III and IV O e. ll and IV only