no explanation needed, please answer all the MCQs only

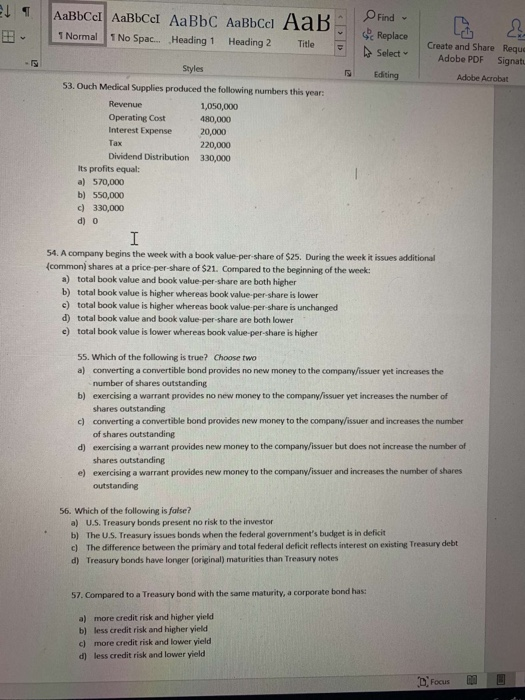

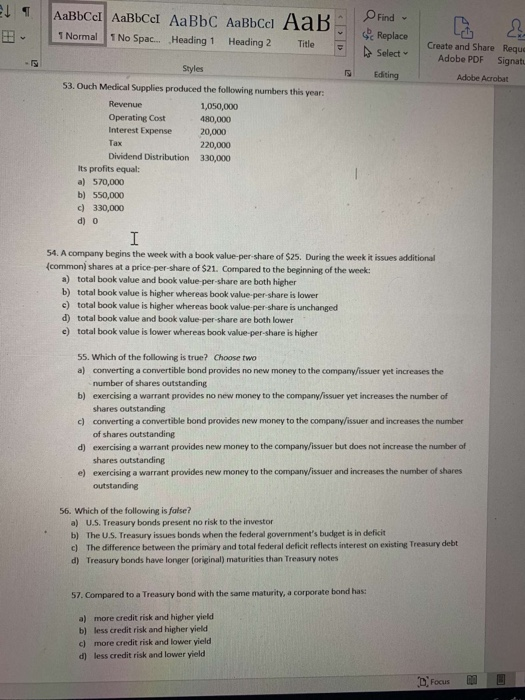

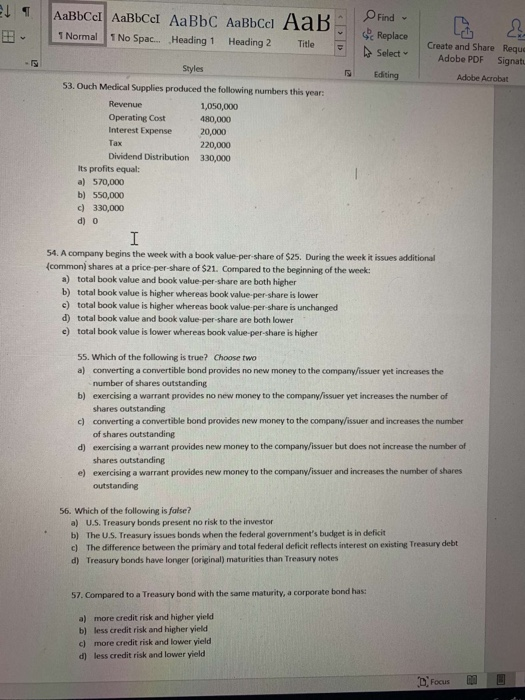

c l AaBbc 1 Normal 1 No Spac... Heading 1 Heading 2 Title Find c Replace Select Create and Share Reque Adobe PDF Signatu Adobe Acrobat Editing Styles 53. Ouch Medical Supplies produced the following numbers this year: Revenue 1,050,000 Operating cost 480,000 Interest Expense 20,000 Tax 220,000 Dividend Distribution 330,000 Its profits equal: a) 570,000 b) 550,000 c) 330,000 d) 0 54. A company begins the week with a book value-per-share of $25. During the week it issues additional common) shares at a price-per-share of $21. Compared to the beginning of the week: a) total book value and book value-per-share are both higher b) total book value is higher whereas book value-per-share is lower c) total book value is higher whereas book value-per-share is unchanged d) total book value and book value-per share are both lower c) total book value is lower whereas book value-per-share is higher 55. Which of the following is true? Choose two a) converting a convertible bond provides no new money to the company/issuer yet increases the number of shares outstanding b) exercising a warrant provides no new money to the company/issuer yet increases the number of shares outstanding c) converting a convertible bond provides new money to the company/issuer and increases the number of shares outstanding d) exercising a warrant provides new money to the company/issuer but does not increase the number of shares outstanding e) exercising a warrant provides new money to the company/issuer and increases the number of shares outstanding 56. Which of the following is false? a) U.S. Treasury bonds present no risk to the investor b) The U.S. Treasury issues bonds when the federal government's budget is in deficit C) The difference between the primary and total federal deficit reflects interest on existing Treasury debt d) Treasury bonds have longer (original) maturities than Treasury notes 57. Compared to a Treasury bond with the same maturity, a corporate bond has: a) more credit risk and higher yield b) less credit risk and higher yield c) more credit risk and lower yield d) less credit risk and lower yield Focus