Answered step by step

Verified Expert Solution

Question

1 Approved Answer

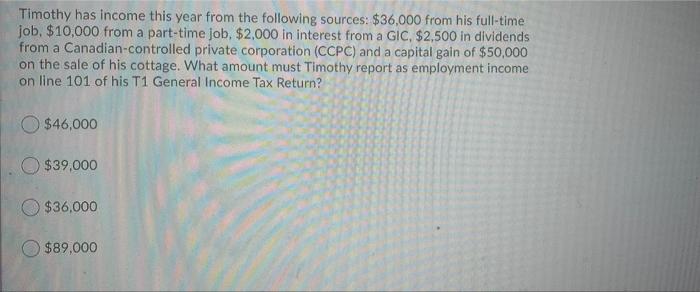

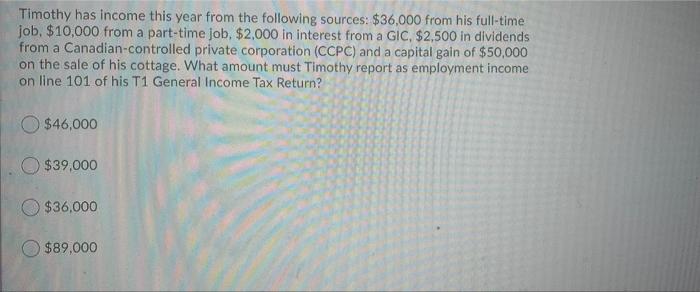

no explanation required. Timothy has income this year from the following sources: $36,000 from his full-time job, $10,000 from a part-time job. $2,000 in interest

no explanation required.

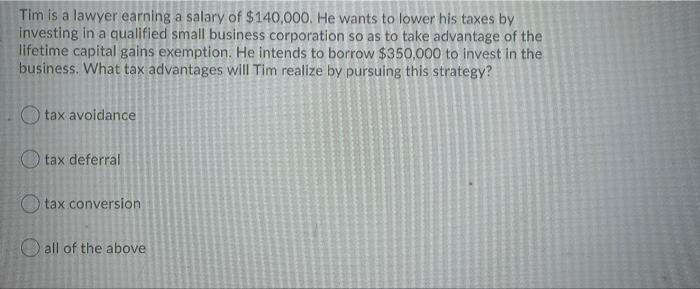

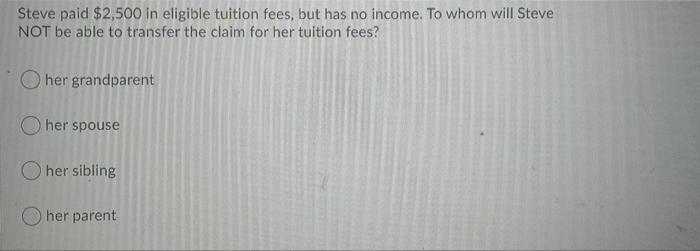

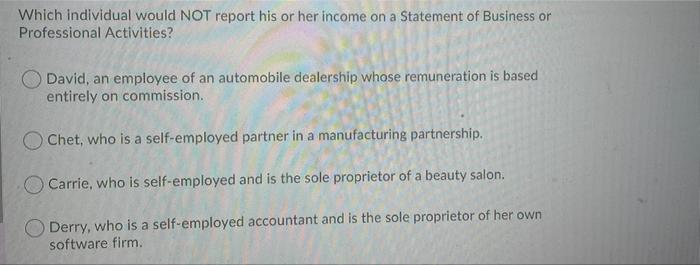

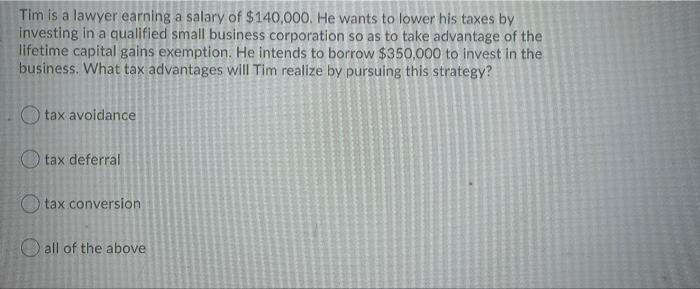

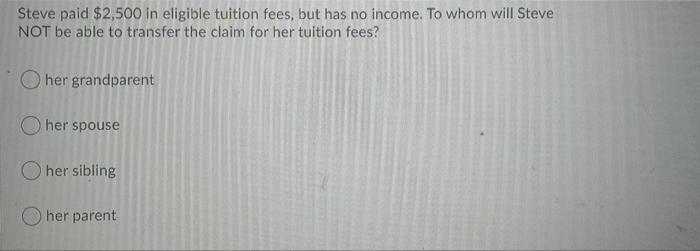

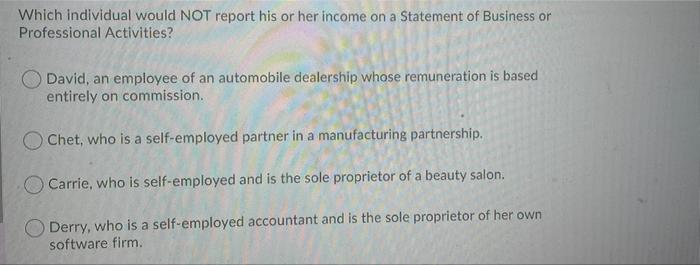

Timothy has income this year from the following sources: $36,000 from his full-time job, $10,000 from a part-time job. $2,000 in interest from a GIC, $2,500 in dividends from a Canadian-controlled private corporation (CCPC) and a capital gain of $50,000 on the sale of his cottage. What amount must Timothy report as employment income on line 101 of his T1 General Income Tax Return? $46,000 $39,000 $36,000 $89,000 Tim is a lawyer earning a salary of $140,000. He wants to lower his taxes by investing in a qualified small business corporation so as to take advantage of the lifetime capital gains exemption. He intends to borrow $350,000 to invest in the business. What tax advantages will Tim realize by pursuing this strategy? tax avoidance tax deferral tax conversion all of the above Steve paid $2,500 in eligible tuition fees, but has no income. To whom will Steve NOT be able to transfer the claim for her tuition fees? O her grandparent her spouse her sibling her parent Which individual would NOT report his or her income on a Statement of Business or Professional Activities? David, an employee of an automobile dealership whose remuneration is based entirely on commission. Chet, who is a self-employed partner in a manufacturing partnership. Carrie, who is self-employed and is the sole proprietor of a beauty salon. Derry, who is a self-employed accountant and is the sole proprietor of her own software firm

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started