Answered step by step

Verified Expert Solution

Question

1 Approved Answer

NO HAND WRITTEN SOLUTIONS. PLEASE TYPE THE ANSWER. IF YOU'RE NOT 100% SURE OF YOUR ANSWER, PLEASE DO NOT ATTEMPT. Question(3): A power plant is

NO HAND WRITTEN SOLUTIONS. PLEASE TYPE THE ANSWER.

IF YOU'RE NOT 100% SURE OF YOUR ANSWER, PLEASE DO NOT ATTEMPT.

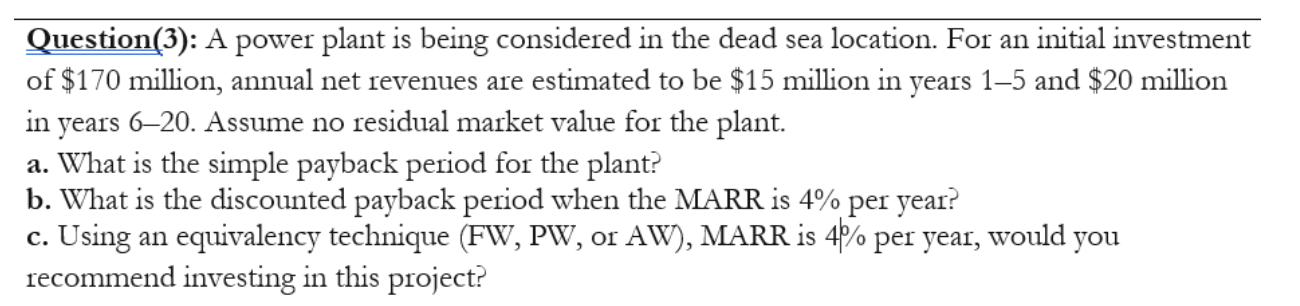

Question(3): A power plant is being considered in the dead sea location. For an initial investment of $170 million, annual net revenues are estimated to be $15 million in years 15 and $20 million in years 620. Assume no residual market value for the plant. a. What is the simple payback period for the plant? b. What is the discounted payback period when the MARR is 4% per year? c. Using an equivalency technique (FW, PW, or AW), MARR is 4% per year, would you recommend investing in this projectStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started