Answered step by step

Verified Expert Solution

Question

1 Approved Answer

no hand-wtiting. show me the calculation please. Sky City supplies helicopters to corporate clients. (Click the icon to view additional information.) The company's results for

no hand-wtiting. show me the calculation please.

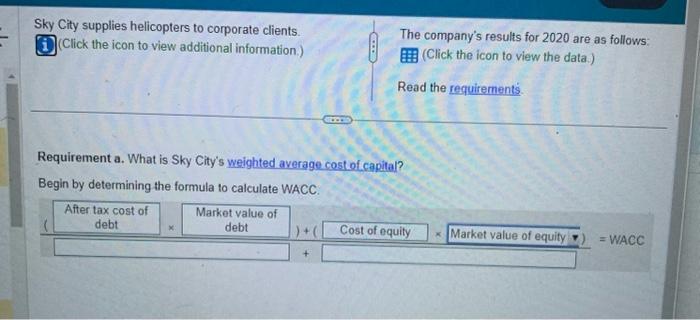

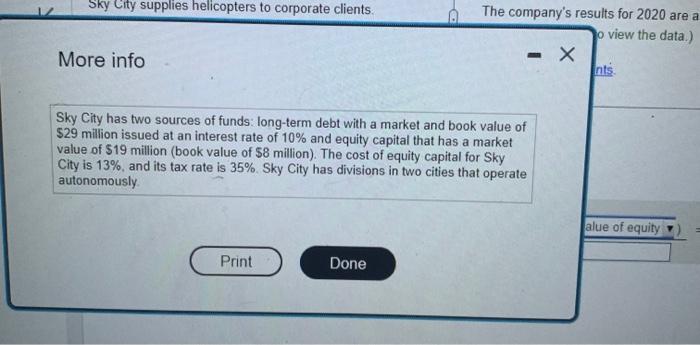

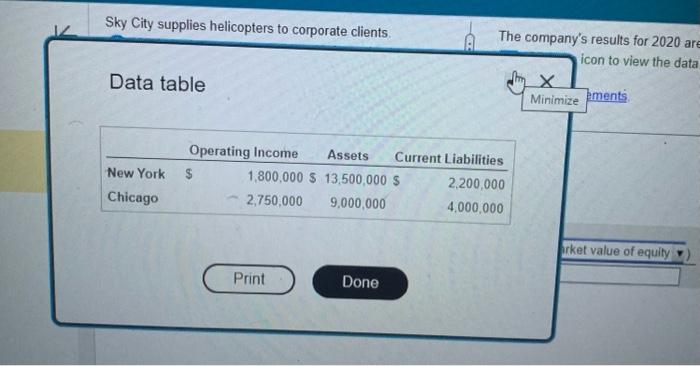

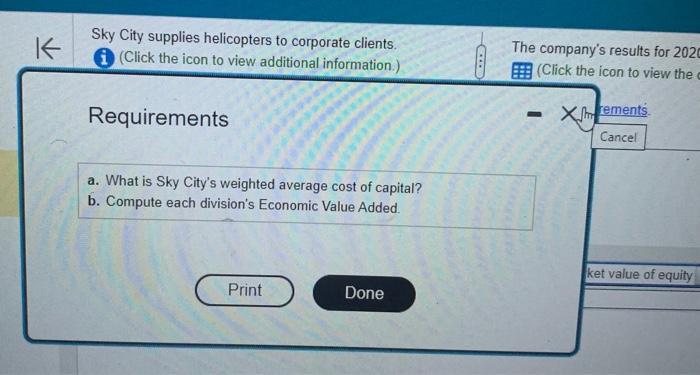

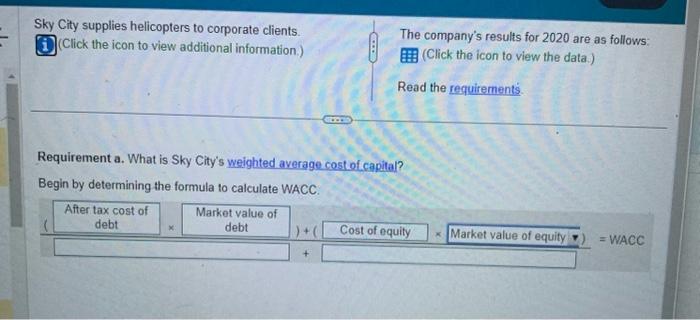

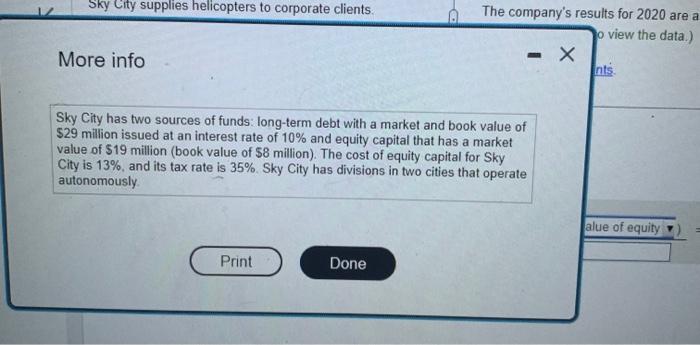

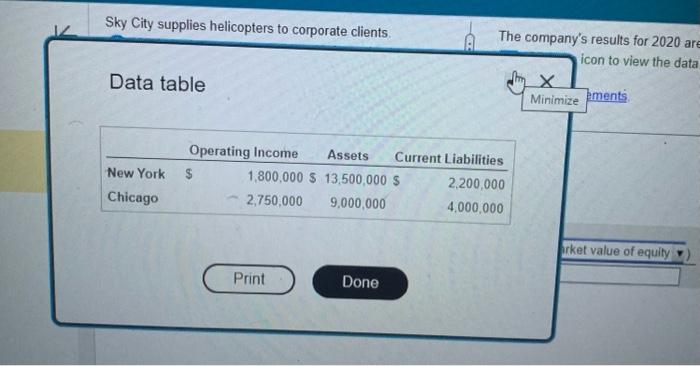

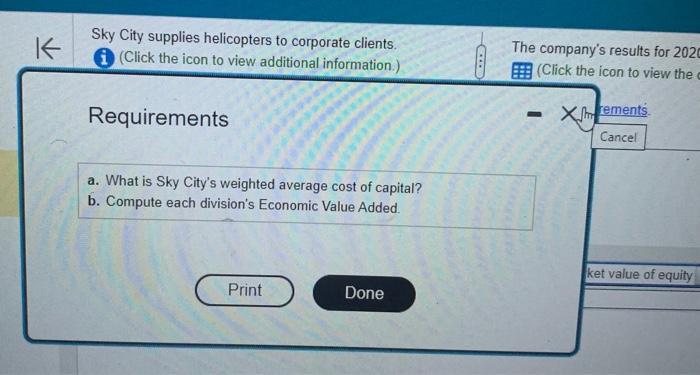

Sky City supplies helicopters to corporate clients. (Click the icon to view additional information.) The company's results for 2020 are as follows: I7. (Click the icon to view the data.) Read the requirements. Requirement a. What is Sky City's weighted average cost of capital? Begin by determining the formula to calculate WACC. More info Sky City has two sources of funds: long-term debt with a market and book value of $29 milion issued at an interest rate of 10% and equity capital that has a market value of $19 million (book value of $8 million). The cost of equity capital for Sky City is 13%, and its tax rate is 35%. Sky City has divisions in two cities that operate autonomously. Data table Sky City supplies helicopters to corporate clients. (i) (Click the icon to view additional information.) The company's results for 202 (Click the icon to view the Requirements a. What is Sky City's weighted average cost of capital? b. Compute each division's Economic Value Added

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started