Answered step by step

Verified Expert Solution

Question

1 Approved Answer

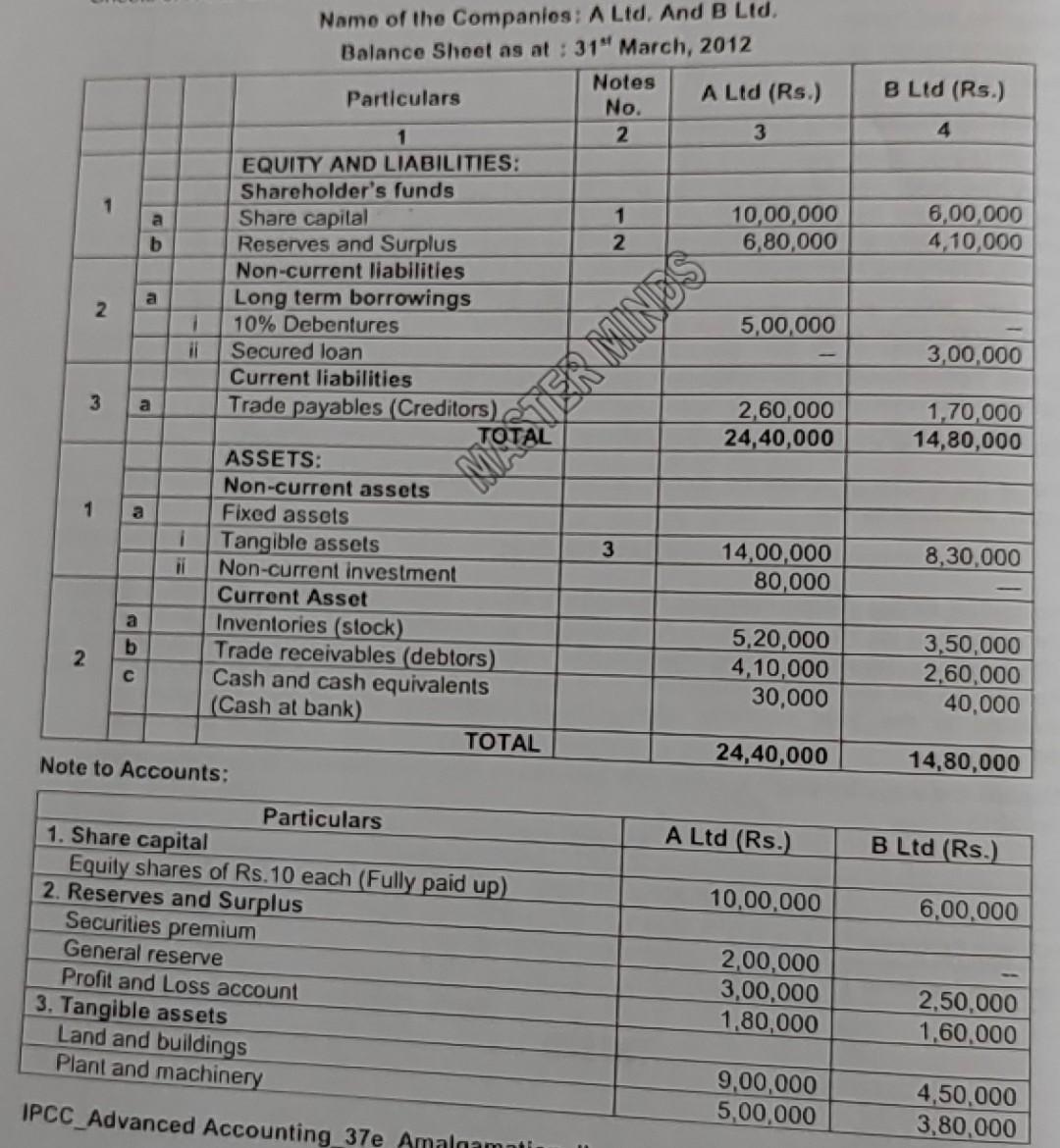

NO MISSING DATA 8 Ltd (Rs.) 4 6,00,000 4,10,000 3,00,000 Name of the Companies: A Ltd, And B Ltd. Balance Sheet as at : 31

NO MISSING DATA

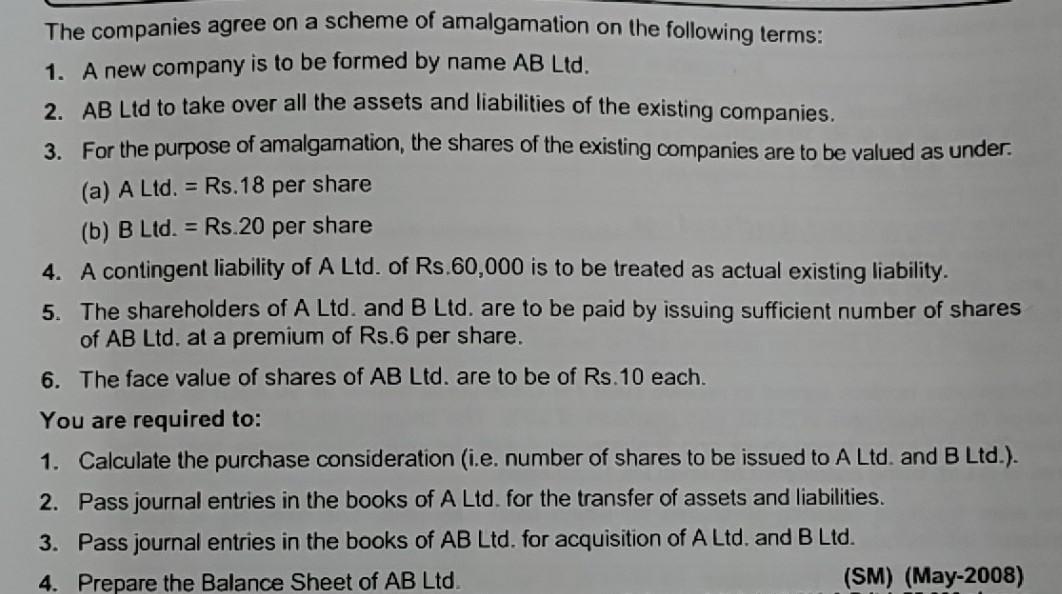

8 Ltd (Rs.) 4 6,00,000 4,10,000 3,00,000 Name of the Companies: A Ltd, And B Ltd. Balance Sheet as at : 31" March, 2012 Notes Particulars A Ltd (Rs.) No. 1 2 3 EQUITY AND LIABILITIES: Shareholder's funds a Share capital 1 10,00,000 b Reserves and Surplus 2 6,80,000 Non-current liabilities a Long term borrowings 2 1 10% Debentures 5,00,000 il Secured loan Current liabilities 3 Trade payables (Creditors) 2,60,000 24,40,000 ASSETS: Non-current assets 1 Fixed assets 1 Tangible assets 3 14,00,000 il Non-current investment 80,000 Current Asset Inventories (stock) 5,20,000 b 2 Trade receivables (debtors) 4,10,000 Cash and cash equivalents (Cash at bank) 30,000 TOTAL 24,40,000 Note to Accounts: a 1,70,000 14,80,000 No TER MINES a 8,30,000 a 3,50,000 2,60,000 40,000 14,80,000 A Ltd (Rs.) B Ltd (Rs.) 10,00,000 6,00.000 Particulars 1. Share capital Equily shares of Rs.10 each (Fully paid up) 2. Reserves and Surplus Securities premium General reserve Profit and Loss account 3. Tangible assets Land and buildings Plant and machinery 2,00,000 3,00,000 1,80,000 2,50.000 1,60,000 9,00,000 5,00,000 IPCC_Advanced Accounting 37e Amalgamatin 4,50.000 3,80,000 The companies agree on a scheme of amalgamation on the following terms: 1. A new company is to be formed by name AB Ltd. 2. AB Ltd to take over all the assets and liabilities of the existing companies. 3. For the purpose of amalgamation, the shares of the existing companies are to be valued as under. (a) A Ltd. = Rs. 18 per share (b) B Ltd. = Rs.20 per share 4. A contingent liability of A Ltd. of Rs.60,000 is to be treated as actual existing liability. 5. The shareholders of A Ltd. and B Ltd. are to be paid by issuing sufficient number of shares of AB Ltd. at a premium of Rs.6 per share. 6. The face value of shares of AB Ltd. are to be of Rs.10 each. You are required to: 1. Calculate the purchase consideration (i.e. number of shares to be issued to A Ltd. and B Ltd.). 2. Pass journal entries in the books of A Ltd. for the transfer of assets and liabilities. 3. Pass journal entries in the books of AB Ltd. for acquisition of A Ltd. and B Ltd. 4. Prepare the Balance Sheet of AB Ltd (SM) (May-2008)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started