Answered step by step

Verified Expert Solution

Question

1 Approved Answer

no more info no more info Question 2 (13 points) Transbot Inc., an all-equity financed company, is a manufacturer whose core operation is the production

no more info

no more info

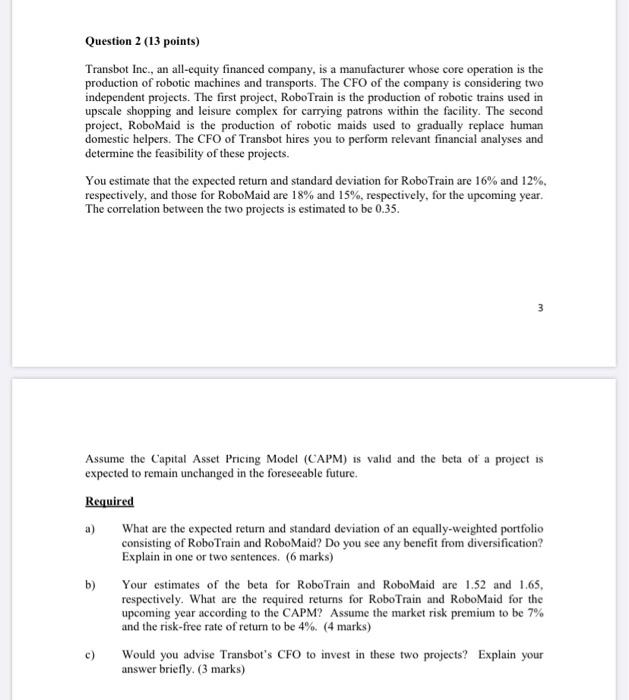

Question 2 (13 points) Transbot Inc., an all-equity financed company, is a manufacturer whose core operation is the production of robotic machines and transports. The CFO of the company is considering two independent projects. The first project, RoboTrain is the production of robotic trains used in upscale shopping and leisure complex for carrying patrons within the facility. The second project, RoboMaid is the production of robotic maids used to gradually replace human domestic helpers. The CFO of Transbot hires you to perform relevant financial analyses and determine the feasibility of these projects. You estimate that the expected return and standard deviation for RoboTrain are 16% and 12%, respectively, and those for RoboMaid are 18% and 15%, respectively, for the upcoming year. The correlation between the two projects is estimated to be 0.35. Assume the Capital Asset Pricing Model (CAPM) is valid and the beta of a project is expected to remain unchanged in the foreseeable future. Required a) What are the expected return and standard deviation of an equally-weighted portfolio consisting of RoboTrain and RoboMaid? Do you see any benefit from diversification? Explain in one or two sentences. (6 marks) b) Your estimates of the beta for RoboTrain and RoboMaid are 1.52 and 165, respectively. What are the required returns for RoboTrain and RoboMaid for the upcoming year according to the CAPM? Assume the market risk premium to be 7% and the risk-free rate of return to be 4% (4 marks) Would you advise Transbot's CFO to invest in these two projects? Explain your answer briefly. (3 marks) c) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started