Answered step by step

Verified Expert Solution

Question

1 Approved Answer

no more informationplease answer a-ethanks 4 2 3. Alberto Electronics is an electronic manufacturer and has designed three new products: AE-I (h), AE-11 (hz) and

no more informationplease answer a-ethanks

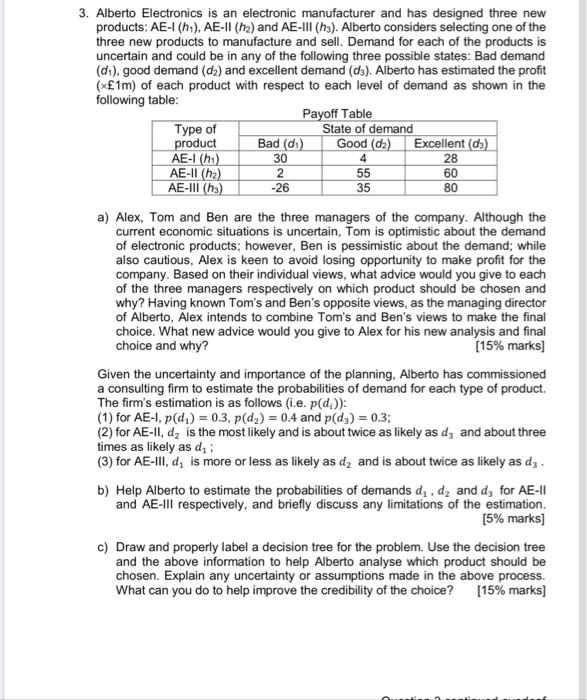

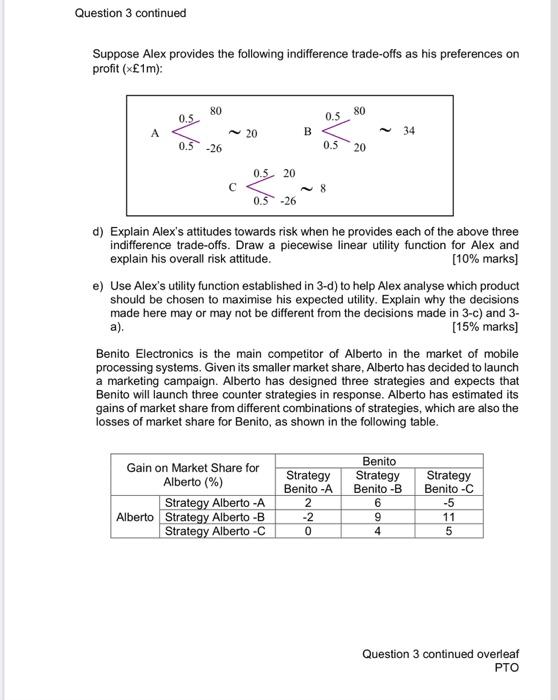

4 2 3. Alberto Electronics is an electronic manufacturer and has designed three new products: AE-I (h), AE-11 (hz) and AE-Ill (hu). Alberto considers selecting one of the three new products to manufacture and sell. Demand for each of the products is uncertain and could be in any of the following three possible states: Bad demand (da).good demand (da) and excellent demand (dz). Alberto has estimated the profit (*1m) of each product with respect to each level of demand as shown in the following table: Payoff Table Type of State of demand product Bad (d) Good (da) Excellent (ds) AE-I (hu) 30 28 AE-II (ha) 55 60 AE-III (hu) -26 35 80 a) Alex, Tom and Ben are the three managers of the company. Although the current economic situations is uncertain, Tom is optimistic about the demand of electronic products; however, Ben is pessimistic about the demand; while also cautious, Alex is keen to avoid losing opportunity to make profit for the company. Based on their individual views, what advice would you give to each of the three managers respectively on which product should be chosen and why? Having known Tom's and Ben's opposite views, as the managing director of Alberto, Alex intends to combine Tom's and Ben's views to make the final choice. What new advice would you give to Alex for his new analysis and final choice and why? [15% marks) Given the uncertainty and importance of the planning, Alberto has commissioned a consulting firm to estimate the probabilities of demand for each type of product. The firm's estimation is as follows (i.e. p(d)): (1) for AE-, p(d) = 0.3, p(dz) = 0.4 and p(dz) = 0.3; (2) for AE-II, d, is the most likely and is about twice as likely as dg and about three times as likely as di (3) for AE-III, d, is more or less as likely as d, and is about twice as likely as ds. b) Help Alberto to estimate the probabilities of demands d. d, and dy for AE-II and AE-III respectively, and briefly discuss any limitations of the estimation. [5% marks] c) Draw and properly label a decision tree for the problem. Use the decision tree and the above information to help Alberto analyse which product should be chosen. Explain any uncertainty or assumptions made in the above process. What can you do to help improve the credibility of the choice? [15% marks] Question 3 continued Suppose Alex provides the following indifference trade-offs as his preferences on profit (1m): 80 0. 0.5 80 A 20 B 34 0.5-26 0.5 20 0.5. 20 8 0.5 -26 d) Explain Alex's attitudes towards risk when he provides each of the above three indifference trade-offs. Draw a piecewise linear utility function for Alex and explain his overall risk attitude. [10% marks) e) Use Alex's utility function established in 3-d) to help Alex analyse which product should be chosen to maximise his expected utility. Explain why the decisions made here may or may not be different from the decisions made in 3-c) and 3- a) [15% marks] Benito Electronics is the main competitor of Alberto in the market of mobile processing systems. Given its smaller market share, Alberto has decided to launch a marketing campaign. Alberto has designed three strategies and expects that Benito will launch three counter strategies in response. Alberto has estimated its gains of market share from different combinations of strategies, which are also the losses of market share for Benito, as shown in the following table. Gain on Market Share for Alberto (%) Strategy Alberto -A Alberto Strategy Alberto -B Strategy Alberto -C Strategy Benito -A 2 -2 0 Benito Strategy Benito -B 6 9 4 Strategy Benito -C -5 11 5 Question 3 continued overleaf PTO 4 2 3. Alberto Electronics is an electronic manufacturer and has designed three new products: AE-I (h), AE-11 (hz) and AE-Ill (hu). Alberto considers selecting one of the three new products to manufacture and sell. Demand for each of the products is uncertain and could be in any of the following three possible states: Bad demand (da).good demand (da) and excellent demand (dz). Alberto has estimated the profit (*1m) of each product with respect to each level of demand as shown in the following table: Payoff Table Type of State of demand product Bad (d) Good (da) Excellent (ds) AE-I (hu) 30 28 AE-II (ha) 55 60 AE-III (hu) -26 35 80 a) Alex, Tom and Ben are the three managers of the company. Although the current economic situations is uncertain, Tom is optimistic about the demand of electronic products; however, Ben is pessimistic about the demand; while also cautious, Alex is keen to avoid losing opportunity to make profit for the company. Based on their individual views, what advice would you give to each of the three managers respectively on which product should be chosen and why? Having known Tom's and Ben's opposite views, as the managing director of Alberto, Alex intends to combine Tom's and Ben's views to make the final choice. What new advice would you give to Alex for his new analysis and final choice and why? [15% marks) Given the uncertainty and importance of the planning, Alberto has commissioned a consulting firm to estimate the probabilities of demand for each type of product. The firm's estimation is as follows (i.e. p(d)): (1) for AE-, p(d) = 0.3, p(dz) = 0.4 and p(dz) = 0.3; (2) for AE-II, d, is the most likely and is about twice as likely as dg and about three times as likely as di (3) for AE-III, d, is more or less as likely as d, and is about twice as likely as ds. b) Help Alberto to estimate the probabilities of demands d. d, and dy for AE-II and AE-III respectively, and briefly discuss any limitations of the estimation. [5% marks] c) Draw and properly label a decision tree for the problem. Use the decision tree and the above information to help Alberto analyse which product should be chosen. Explain any uncertainty or assumptions made in the above process. What can you do to help improve the credibility of the choice? [15% marks] Question 3 continued Suppose Alex provides the following indifference trade-offs as his preferences on profit (1m): 80 0. 0.5 80 A 20 B 34 0.5-26 0.5 20 0.5. 20 8 0.5 -26 d) Explain Alex's attitudes towards risk when he provides each of the above three indifference trade-offs. Draw a piecewise linear utility function for Alex and explain his overall risk attitude. [10% marks) e) Use Alex's utility function established in 3-d) to help Alex analyse which product should be chosen to maximise his expected utility. Explain why the decisions made here may or may not be different from the decisions made in 3-c) and 3- a) [15% marks] Benito Electronics is the main competitor of Alberto in the market of mobile processing systems. Given its smaller market share, Alberto has decided to launch a marketing campaign. Alberto has designed three strategies and expects that Benito will launch three counter strategies in response. Alberto has estimated its gains of market share from different combinations of strategies, which are also the losses of market share for Benito, as shown in the following table. Gain on Market Share for Alberto (%) Strategy Alberto -A Alberto Strategy Alberto -B Strategy Alberto -C Strategy Benito -A 2 -2 0 Benito Strategy Benito -B 6 9 4 Strategy Benito -C -5 11 5 Question 3 continued overleaf PTO Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started