Answered step by step

Verified Expert Solution

Question

1 Approved Answer

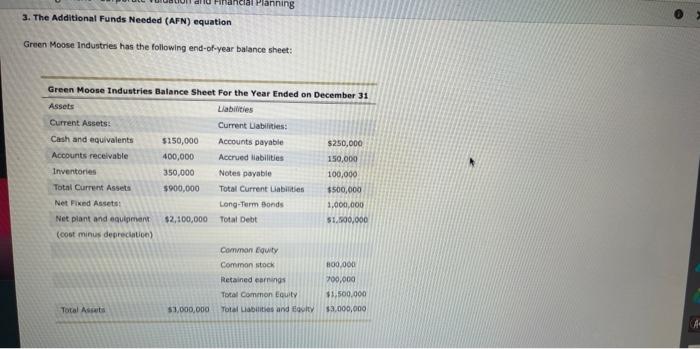

no more informatoon all is there 3. The Additional Funds Needed (AFN) equation Green Moose Industries has the following end-of-year balance sheet: Suppose Green Moose's

no more informatoon

all is there

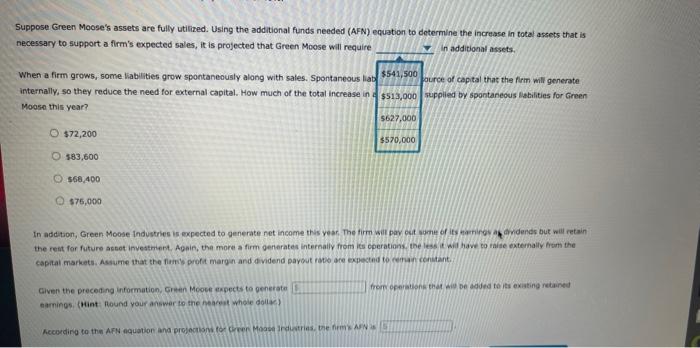

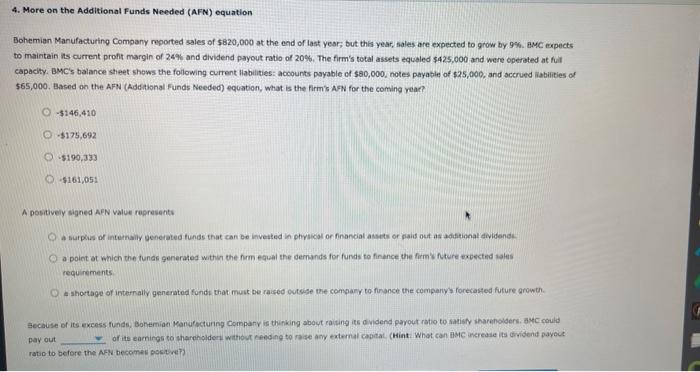

3. The Additional Funds Needed (AFN) equation Green Moose Industries has the following end-of-year balance sheet: Suppose Green Moose's assets are fully utilized. Using the additional funds needed (AFN) equation to determine the increase in total assets that is necessary to support a firm's expected sales, it is projected that Green Moose will require When a firm grow5, some liabilities grow spontaneously along with sales. Spontaneous liab $541,500 burce of captal that the firm will generate internally, so they reduce the need for external capital. How much of the total increase in {$513,000 supplied by spontaneous datbilities for Green Moose this year? In addition, Green Moose Industries is expected to generate net income this year. The firm wail pav out apme of ifs faphinovah ardends but wiil retain the rent for future assot investmient. Agein, the more a firm gentrates internally from its cperations. the less it wil have co taise externally fixm the Given the preceding intormation, Griten Mooce expects to penerate frorn opeibtions thet dis pe dades to its exiating retained tarnings (Mint Round your answer to the hearest whole dollyel Bohemian Manufacturing Company reported sales of 5820,000 at the end of last year; but this year, sales are expected to grow by 9%. BMC expects to maintain its curreat proft margin of 247 and dividend payout ratio of 20%. The firmis total assets equeled $425,000 and were operied at ful capacity. BMC's balance sheet shows the following current llabilities: accounts payable of 580,000, notes payable of $25,000, and accrued liabilies of 565,000, Based on the AFN (Addabional Funds Needed) equation, what is the firm's AFN for the coming year? A postively signed AFN value represents a surplis of internaily generated funds that can be invested in phyaical of financial askets or paid out as adthtionat dividendi. a point at which the funds generated within the fim equal the dernands for furds to finance the firmy future ixpscted asles reguirements 4 shortage of internaily generated fond that must be rased ovteige the compary to finance the cemparty? foresasted future growth. pay out of its earnirge so pharenolder without peeding to rase any eatermal copicat. (hint What can iMc wereaie its dividend payout ratio to before the AFY becomes fosh ret Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started