Answered step by step

Verified Expert Solution

Question

1 Approved Answer

No more Instructions Jersey Airlines is a small regional airline that is considering adding new routes to its operations. You have been tasked with identifying

No more

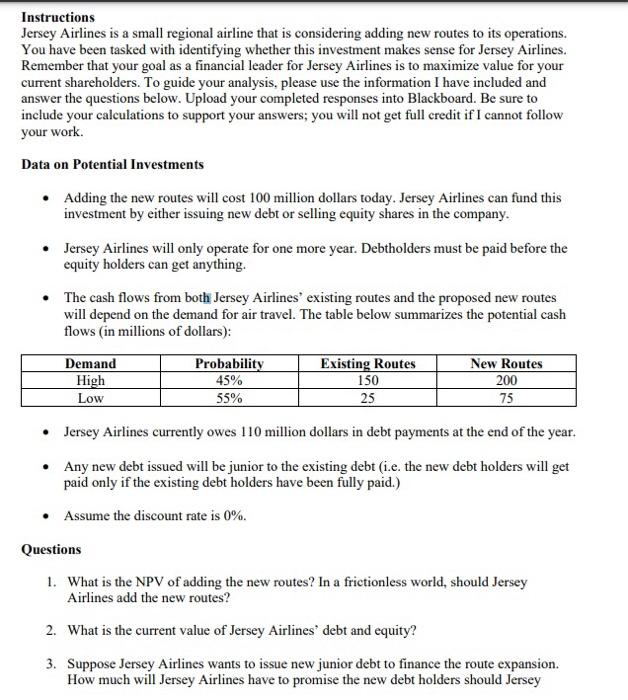

Instructions Jersey Airlines is a small regional airline that is considering adding new routes to its operations. You have been tasked with identifying whether this investment makes sense for Jersey Airlines. Remember that your goal as a financial leader for Jersey Airlines is to maximize value for your current shareholders. To guide your analysis, please use the information I have included and answer the questions below. Upload your completed responses into Blackboard. Be sure to include your calculations to support your answers; you will not get full credit if I cannot follow your work. Data on Potential Investments - Adding the new routes will cost 100 million dollars today. Jersey Airlines can fund this investment by either issuing new debt or selling equity shares in the company. - Jersey Airlines will only operate for one more year. Debtholders must be paid before the equity holders can get anything. - The cash flows from both Jersey Airlines' existing routes and the proposed new routes will depend on the demand for air travel. The table below summarizes the potential cash flows (in millions of dollars): - Jersey Airlines currently owes 110 million dollars in debt payments at the end of the year. - Any new debt issued will be junior to the existing debt (i.e. the new debt holders will get paid only if the existing debt holders have been fully paid.) - Assume the discount rate is 0%. Questions 1. What is the NPV of adding the new routes? In a frictionless world, should Jersey Airlines add the new routes? 2. What is the current value of Jersey Airlines' debt and equity? 3. Suppose Jersey Airlines wants to issue new junior debt to finance the route expansion. How much will Jersey Airlines have to promise the new debt holders should Jersey Airlines hope to raise 100 million dollars? (Remember they will only get paid after the existing debtholders are fully repaid.) 4. If Jersey Airlines issues the junior debt, how will that change the value of Jersey Airlines' old debt and equity? 5. Would Jersey Airlines' shareholders approve of the debt issuance? Why or why not? 6. Suppose instead Jersey Airlines wants to engage in a seasoned equity offering (SEO) and sell shares in the company to finance the route expansion. What percent of the company will Jersey Airlines have to sell to the new shareholders in order to raise 100 million dollars? 7. If Jersey Airlines engages in the SEO, how will that change the value of Jersey Airlines' old debt and old equity? 8. Would Jersey Airlines' existing shareholders approve of the SEO? Why or why not? 9. Explain how this problem highlights how the conflict between debt and equity can distort firm investment Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started