No need explanation please. Just the answers =)

No need explanation please. Just the answers =)

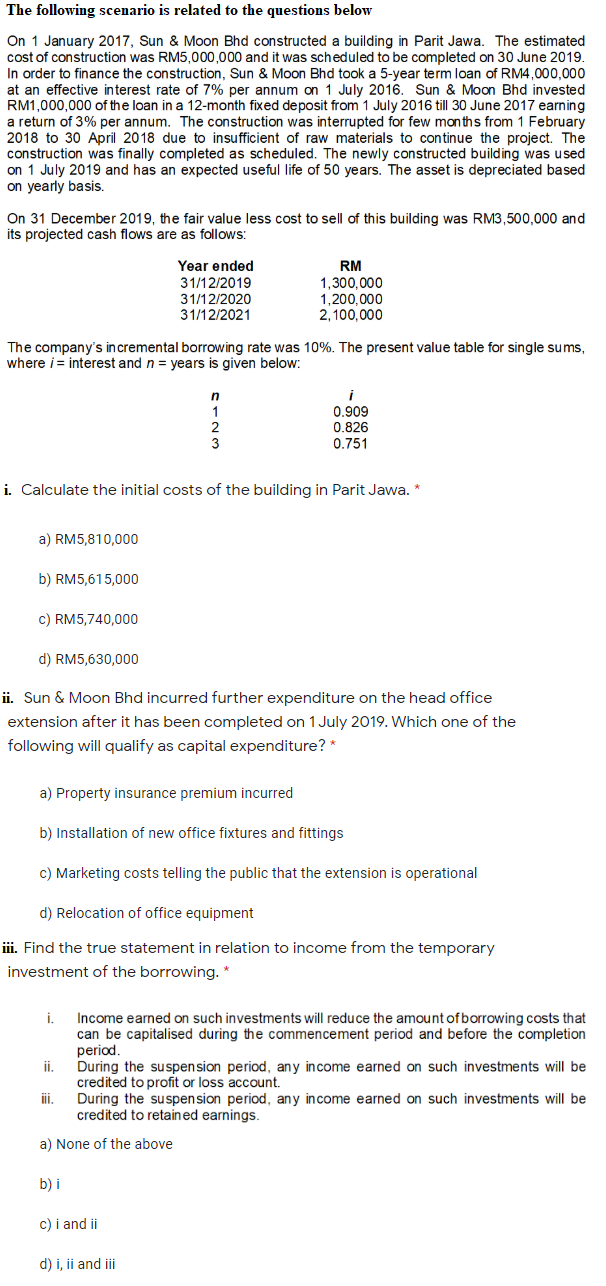

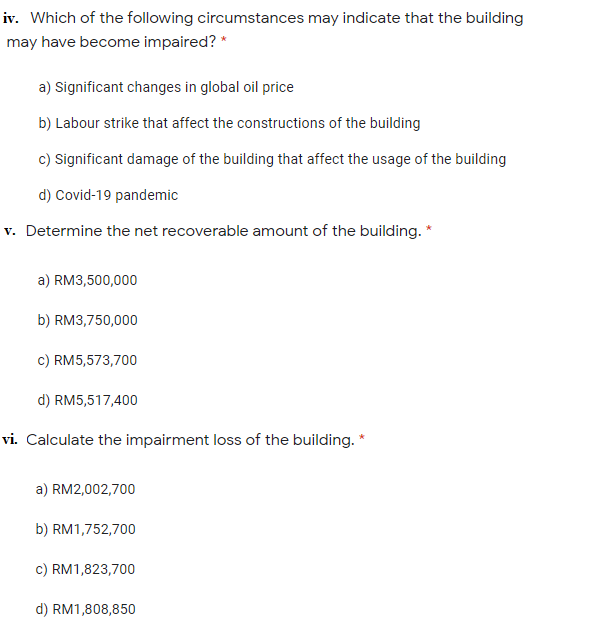

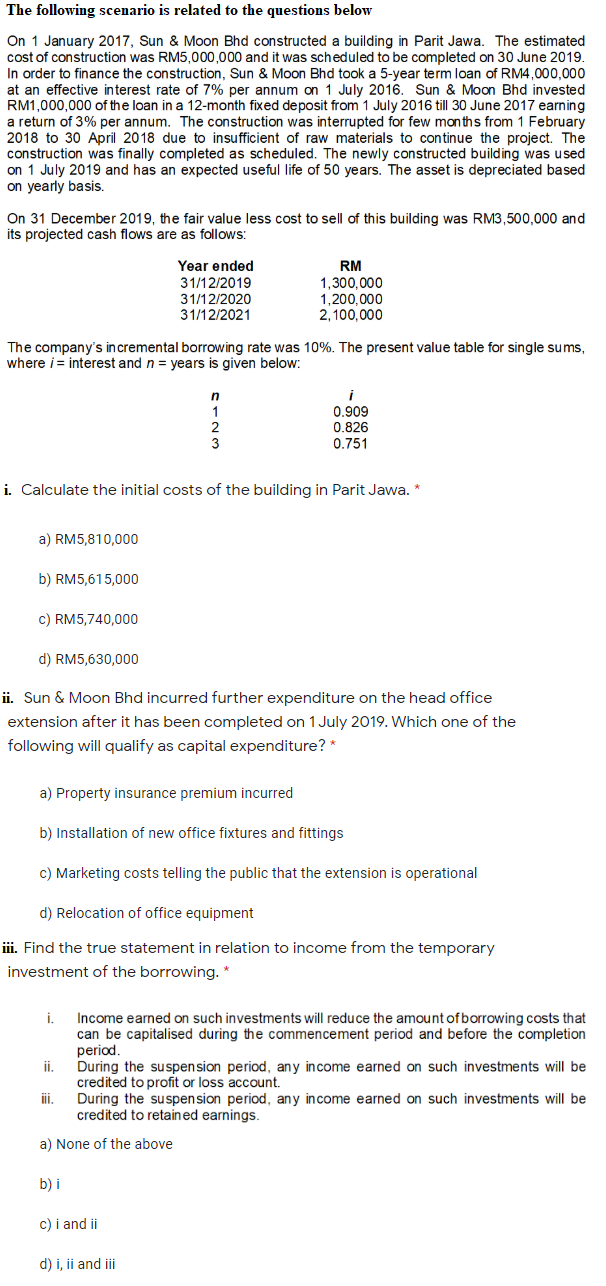

The following scenario is related to the questions below On 1 January 2017, Sun & Moon Bhd constructed a building in Parit Jawa. The estimated cost of construction was RM5,000,000 and it was scheduled to be completed on 30 June 2019. In order to finance the construction, Sun & Moon Bhd took a 5-year term loan of RM4,000,000 at an effective interest rate of 7% per annum on 1 July 2016. Sun & Moon Bhd invested RM1,000,000 of the loan in a 12-month fixed deposit from 1 July 2016 till 30 June 2017 earning a return of 3% per annum. The construction was interrupted for few months from 1 February 2018 to 30 April 2018 due to insufficient of raw materials to continue the project. The construction was finally completed as scheduled. The newly constructed building was used on 1 July 2019 and has an expected useful life of 50 years. The asset is depreciated based on yearly basis On 31 December 2019, the fair value less cost to sell of this building was RM3,500,000 and its projected cash flows are as follows: Year ended 31/12/2019 31/12/2020 31/12/2021 RM 1,300,000 1,200,000 2,100,000 The company's incremental borrowing rate was 10%. The present value table for single sums, where i = interest and n = years is given below: n i 0.909 0.826 0.751 i. Calculate the initial costs of the building in Parit Jawa.* a) RM5,810,000 b) RM5,615,000 c) RM5,740,000 d) RM5,630,000 ii. Sun & Moon Bhd incurred further expenditure on the head office extension after it has been completed on 1 July 2019. Which one of the following will qualify as capital expenditure?* a) Property insurance premium incurred b) Installation of new office fixtures and fittings c) Marketing costs telling the public that the extension is operational d) Relocation of office equipment i. Find the true statement in relation to income from the temporary investment of the borrowing. Income earned on such investments will reduce the amount of borrowing costs that can be capitalised during the commencement period and before the completion period. ii. During the suspension period, any income earned on such investments will be credited to profit or loss account. ili. During the suspension period, any income earned on such investments will be credited to retained earnings. a) None of the above b) i c) i and ii d) i, ii and iii iv. Which of the following circumstances may indicate that the building may have become impaired? * a) Significant changes in global oil price b) Labour strike that affect the constructions of the building c) Significant damage of the building that affect the usage of the building d) Covid-19 pandemic v. Determine the net recoverable amount of the building. * a) RM3,500,000 b) RM3,750,000 C) RM5,573,700 d) RM5,517,400 vi. Calculate the impairment loss of the building. * a) RM2,002,700 b) RM1,752,700 C) RM1,823,700 d) RM1,808,850

No need explanation please. Just the answers =)

No need explanation please. Just the answers =)