No need explanation, related to Malaysian Financial Reporting Standard, MFRS

No need explanation, related to Malaysian Financial Reporting Standard, MFRS

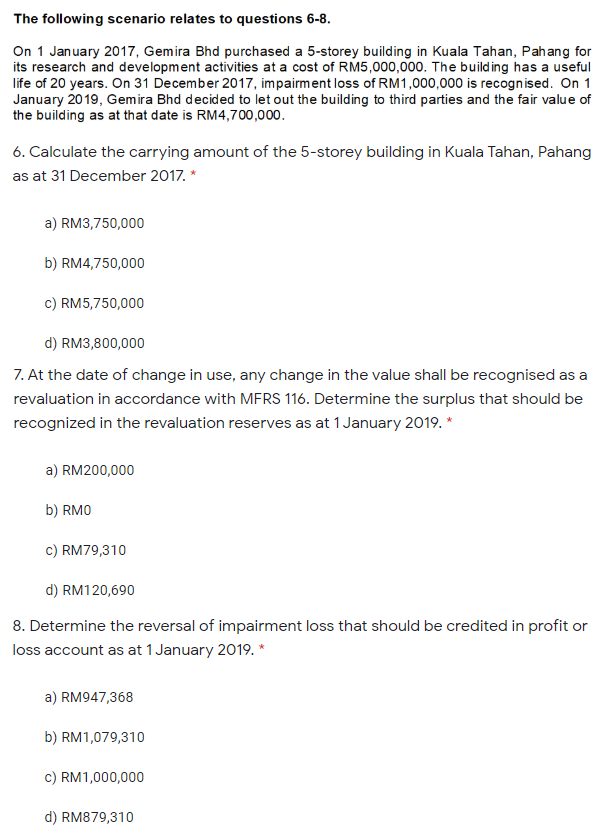

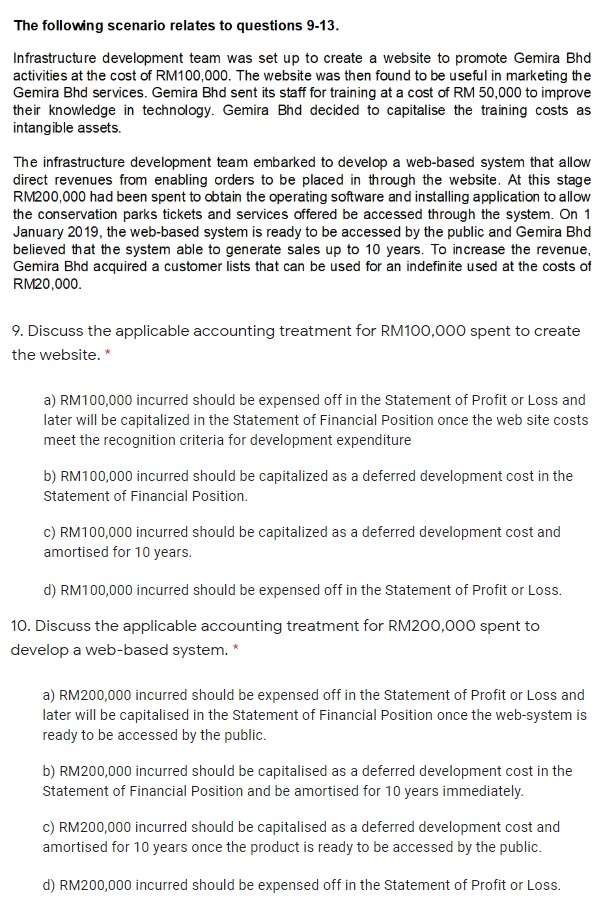

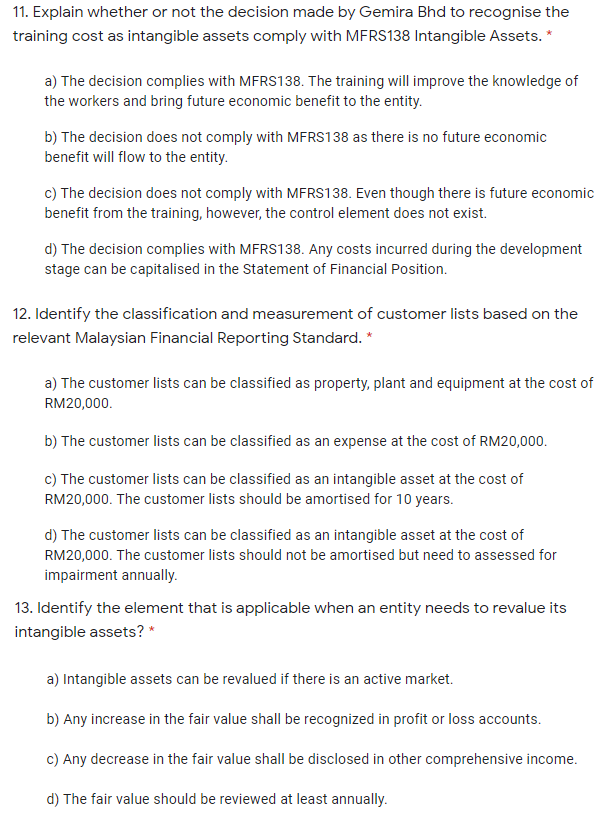

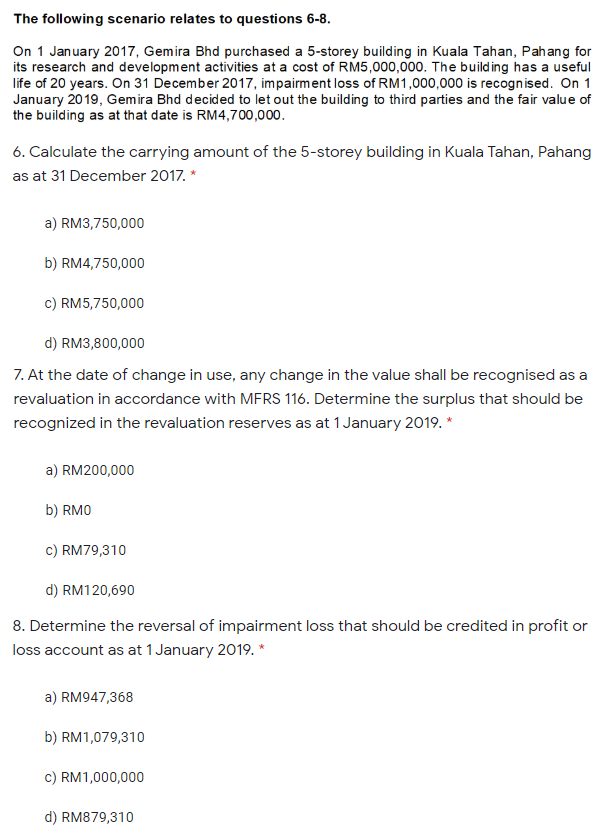

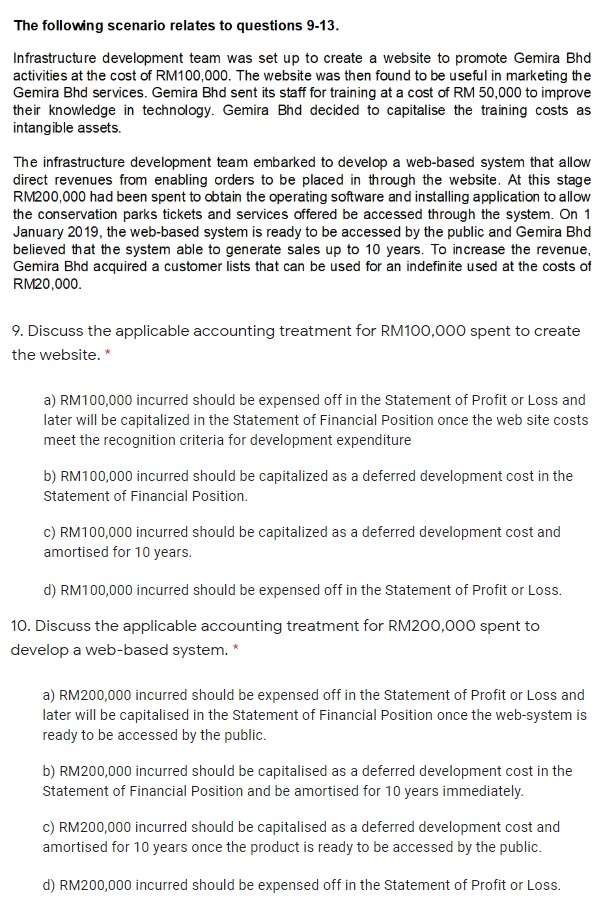

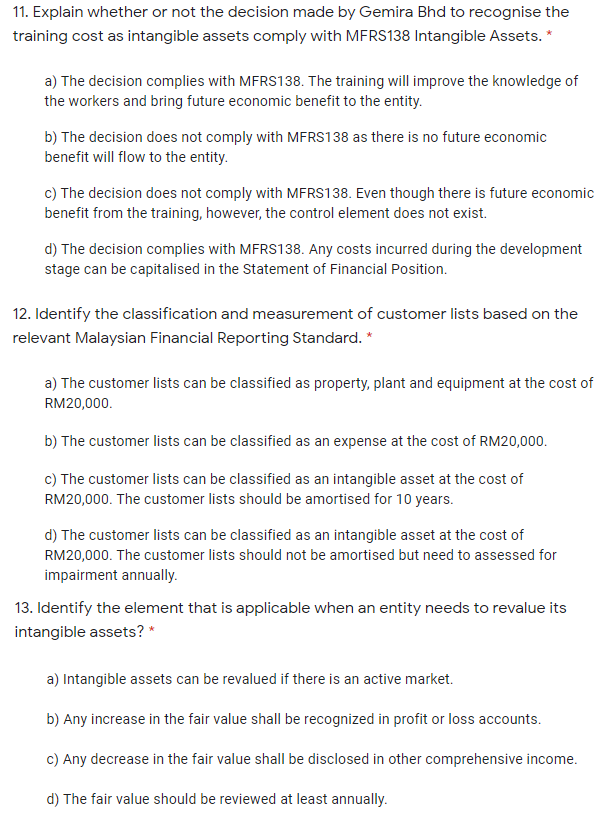

The following scenario relates to questions 6-8. On 1 January 2017, Gemira Bhd purchased a 5-storey building in Kuala Tahan, Pahang for its research and development activities at a cost of RM5,000,000. The building has a useful life of 20 years. On 31 December 2017, impairment loss of RM1,000,000 is recognised. On 1 January 2019, Gemira Bhd decided to let out the building to third parties and the fair value of the building as at that date is RM4,700,000. 6. Calculate the carrying amount of the 5-storey building in Kuala Tahan, Pahang as at 31 December 2017.* a) RM3,750,000 b) RM4,750,000 C) RM5,750,000 d) RM3,800,000 7. At the date of change in use, any change in the value shall be recognised as a revaluation in accordance with MERS 116. Determine the surplus that should be recognized in the revaluation reserves as at 1 January 2019.* a) RM200,000 b) RMO C) RM79,310 d) RM120,690 8. Determine the reversal of impairment loss that should be credited in profit or loss account as at 1 January 2019.* a) RM947,368 b) RM1,079,310 C) RM1,000,000 d) RM879,310 The following scenario relates to questions 9-13. Infrastructure development team was set up to create a website to promote Gemira Bhd activities at the cost of RM100,000. The website was then found to be useful in marketing the Gemira Bhd services. Gemira Bhd sent its staff for training at a cost of RM 50,000 to improve their knowledge in technology. Gemira Bhd decided to capitalise the training costs as intangible assets. The infrastructure development team embarked to develop a web-based system that allow direct revenues from enabling orders to be placed in through the website. At this stage RM200,000 had been spent to obtain the operating software and installing application to allow the conservation parks tickets and services offered be accessed through the system. On 1 January 2019, the web-based system is ready to be accessed by the public and Gemira Bhd believed that the system able to generate sales up to 10 years. To increase the revenue, Gemira Bhd acquired a customer lists that can be used for an indefinite used at the costs of RM20,000 9. Discuss the applicable accounting treatment for RM100,000 spent to create the website. * a) RM100,000 incurred should be expensed off in the Statement of Profit or Loss and later will be capitalized in the Statement of Financial Position once the web site costs meet the recognition criteria for development expenditure b) RM100,000 incurred should be capitalized as a deferred development cost in the Statement of Financial Position. C) RM100,000 incurred should be capitalized as a deferred development cost and amortised for 10 years. d) RM100,000 incurred should be expensed off in the Statement of Profit or Loss. 10. Discuss the applicable accounting treatment for RM200,000 spent to develop a web-based system.* a) RM200,000 incurred should be expensed off in the Statement of Profit or Loss and later will be capitalised in the Statement of Financial Position once the web-system is ready to be accessed by the public. b) RM200,000 incurred should be capitalised as a deferred development cost in the Statement of Financial Position and be amortised for 10 years immediately. C) RM200,000 incurred should be capitalised as a deferred development cost and amortised for 10 years once the product is ready to be accessed by the public. d) RM200,000 incurred should be expensed off in the Statement of Profit or Loss. 11. Explain whether or not the decision made by Gemira Bhd to recognise the training cost as intangible assets comply with MFRS138 Intangible Assets. * a) The decision complies with MFRS138. The training will improve the knowledge of the workers and bring future economic benefit to the entity. b) The decision does not comply with MFRS138 as there is no future economic benefit will flow to the entity. c) The decision does not comply with MFRS138. Even though there is future economic benefit from the training, however, the control element does not exist. d) The decision complies with MFRS138. Any costs incurred during the development stage can be capitalised in the Statement of Financial Position. 12. Identify the classification and measurement of customer lists based on the relevant Malaysian Financial Reporting Standard. * a) The customer lists can be classified as property, plant and equipment at the cost of RM20,000. b) The customer lists can be classified as an expense at the cost of RM20,000. c) The customer lists can be classified as an intangible asset at the cost of RM20,000. The customer lists should be amortised for 10 years. d) The customer lists can be classified as an intangible asset at the cost of RM20,000. The customer lists should not be amortised but need to assessed for impairment annually. 13. Identify the element that is applicable when an entity needs to revalue its intangible assets? * a) Intangible assets can be revalued if there is an active market. b) Any increase in the fair value shall be recognized in profit or loss accounts. C) Any decrease in the fair value shall be disclosed in other comprehensive income. d) The fair value should be reviewed at least annually

No need explanation, related to Malaysian Financial Reporting Standard, MFRS

No need explanation, related to Malaysian Financial Reporting Standard, MFRS