Answered step by step

Verified Expert Solution

Question

1 Approved Answer

no need for explaination. just answer pls Q16-Q22 are based on the following information: You are leading a team on a M&A deal. Suddenly your

no need for explaination. just answer pls

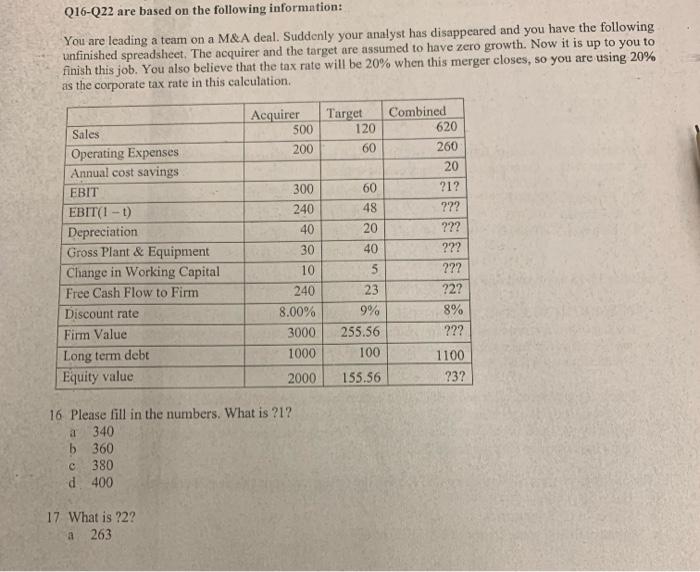

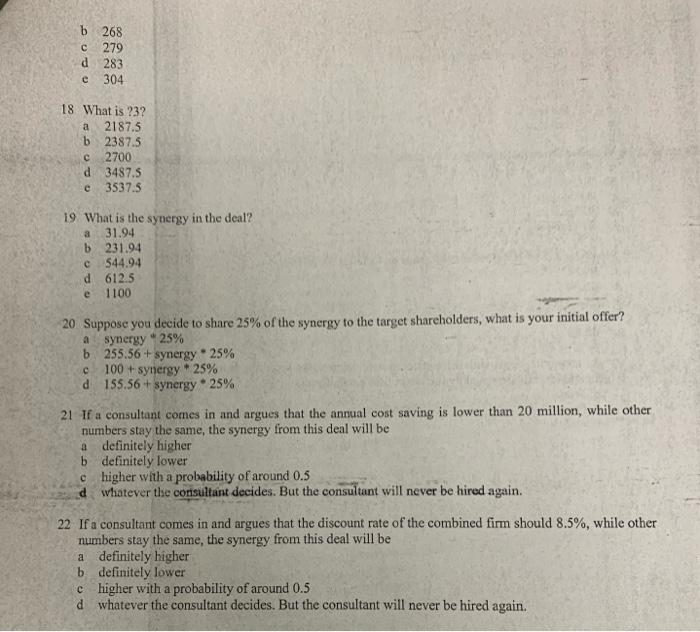

Q16-Q22 are based on the following information: You are leading a team on a M\&A deal. Suddenly your analyst has disappeared and you have the following unfinished spreadsheet. The acquirer and the target are assumed to have zero growth. Now it is up to you to finish this job. You also believe that the tax rate will be 20% when this merger closes, so you are using 20% as the corporate tax rate in this calculation. 16 Please fill in the numbers. What is ?1? a 340 b 360 c. 380 d. 400 17. What is ?2? a 263 bcde268279283304 18 What is ?3? abcde2187.52387.527003487.53537.5 19 What is the synergy in the deal? abcde31.94231.94544.94612.51100 20 Suppose you decide to share 25% of the synergy to the target shareholders, what is your initial offer? asynergy*25%b255.56+synergy25%o100+synergy25%d155.56+synergy25% 21 If a consultant comes in and argues that the annual cost saving is lower than 20 million, while other numbers stay the same, the synergy from this deal will be a definitely higher b definitely lower c higher with a probability of around 0.5 d whatever the consultant decides. But the consultant will never be hired again. 22 If a consultant comes in and argues that the discount rate of the combined firm should 8.5%, while other numbers stay the same, the synergy from this deal will be a definitely higher b definitely lower c higher with a probability of around 0.5 d whatever the consultant decides. But the consultant will never be hired again. Q16-Q22 are based on the following information: You are leading a team on a M\&A deal. Suddenly your analyst has disappeared and you have the following unfinished spreadsheet. The acquirer and the target are assumed to have zero growth. Now it is up to you to finish this job. You also believe that the tax rate will be 20% when this merger closes, so you are using 20% as the corporate tax rate in this calculation. 16 Please fill in the numbers. What is ?1? a 340 b 360 c. 380 d. 400 17. What is ?2? a 263 bcde268279283304 18 What is ?3? abcde2187.52387.527003487.53537.5 19 What is the synergy in the deal? abcde31.94231.94544.94612.51100 20 Suppose you decide to share 25% of the synergy to the target shareholders, what is your initial offer? asynergy*25%b255.56+synergy25%o100+synergy25%d155.56+synergy25% 21 If a consultant comes in and argues that the annual cost saving is lower than 20 million, while other numbers stay the same, the synergy from this deal will be a definitely higher b definitely lower c higher with a probability of around 0.5 d whatever the consultant decides. But the consultant will never be hired again. 22 If a consultant comes in and argues that the discount rate of the combined firm should 8.5%, while other numbers stay the same, the synergy from this deal will be a definitely higher b definitely lower c higher with a probability of around 0.5 d whatever the consultant decides. But the consultant will never be hired again

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started