Answered step by step

Verified Expert Solution

Question

1 Approved Answer

no need for explanation just the answer pls Qnestions 13-15 are based one the following news release from CSS Industries, Inc. on Nov. 3, 2017:

no need for explanation just the answer pls

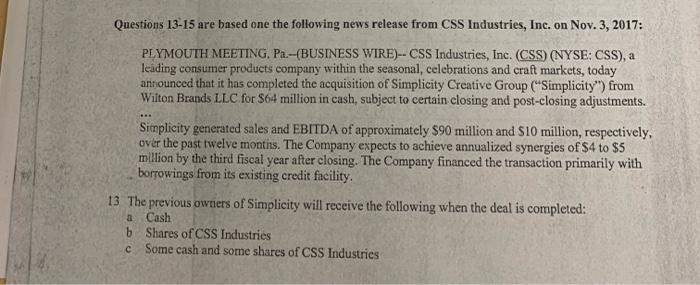

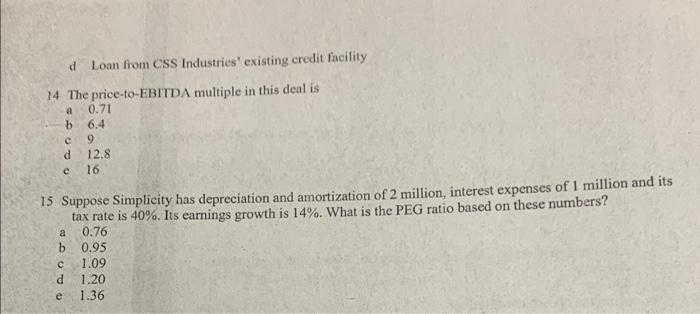

Qnestions 13-15 are based one the following news release from CSS Industries, Inc. on Nov. 3, 2017: PLYMOUTH MEETING, Pa.-(BUSINESS WIRE)- CSS Industries, Inc. (CSS) (NYSE: CSS), a leading consumer products company within the seasonal, celebrations and craft markets, today antiounced that it has completed the acquisition of Simplicity Creative Group ("Simplicity") from Witon Brands LLC for $64 million in cash, subject to certain closing and post-closing adjustments. Simplicity generated sales and EBITDA of approximately $90 million and $10 million, respectively, over the past twelve montins. The Company expects to achieve annualized synergies of $4 to $5 million by the third fiscal year after closing. The Company financed the transaction primarily with borrowings from its existing credit fucility. 13 The previous owners of Simplicity will receive the following when the deal is completed: a Cash b Shares of CSS Industries c. Some cash and some shares of CSS Industries d Loan from CSS Industries' existing credit facility 14 The price-to-EBITD A multiple in this deal is abcdc0.716.4912.816 15 Suppose Simplicity has depreciation and amortization of 2 million, interest expenses of 1 million and its tax rate is 40%. Its earnings growth is 14%. What is the PEG ratio based on these numbers? abcde0.760.951.091.201.36

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started