Answered step by step

Verified Expert Solution

Question

1 Approved Answer

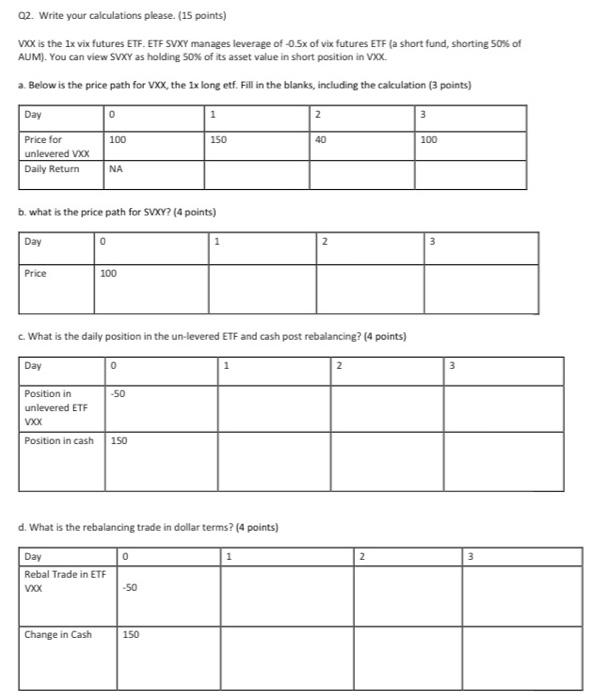

NO NEED TO ANSWER 02. Write your calculations please. (15 points) V>CX is the Ix vix futures ETF ETF SVXY manages leverage of 0.5x of

NO NEED TO ANSWER

02. Write your calculations please. (15 points) V>CX is the Ix vix futures ETF ETF SVXY manages leverage of 0.5x of vix futures ETF (a short fund, shorting 50% of AUM). You can view SVXY as holding 50% of its asset value in short position in VXX a. Below is the price path for VXX, the Ix long etf. Fill in the blanks, including the calculation (3 points) Day 0 1 2 3 100 150 40 100 Price for unlevered VXX Daily Return NA b. what is the price path for SVXY? (4 points) Day 0 1 2 3 Price 100 c. What is the daily position in the un-levered ETF and cash post rebalancing? (4 points) Day 0 2 3 -50 Position in unlevered ETF VOX Position in cash 150 d. What is the rebalancing trade in dollar terms? (4 points) 0 Rebal Trade in ETF Day VOX -50 Change in Cash 150 02. Write your calculations please. (15 points) V>CX is the Ix vix futures ETF ETF SVXY manages leverage of 0.5x of vix futures ETF (a short fund, shorting 50% of AUM). You can view SVXY as holding 50% of its asset value in short position in VXX a. Below is the price path for VXX, the Ix long etf. Fill in the blanks, including the calculation (3 points) Day 0 1 2 3 100 150 40 100 Price for unlevered VXX Daily Return NA b. what is the price path for SVXY? (4 points) Day 0 1 2 3 Price 100 c. What is the daily position in the un-levered ETF and cash post rebalancing? (4 points) Day 0 2 3 -50 Position in unlevered ETF VOX Position in cash 150 d. What is the rebalancing trade in dollar terms? (4 points) 0 Rebal Trade in ETF Day VOX -50 Change in Cash 150Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started