Answered step by step

Verified Expert Solution

Question

1 Approved Answer

NO NEED TO EXPLAIN ANSWER NOW Question 17 1 pts Due to COVID-19, Angel Corp. incurred huge losses. In order to continue its business operation,

NO NEED TO EXPLAIN ANSWER NOW

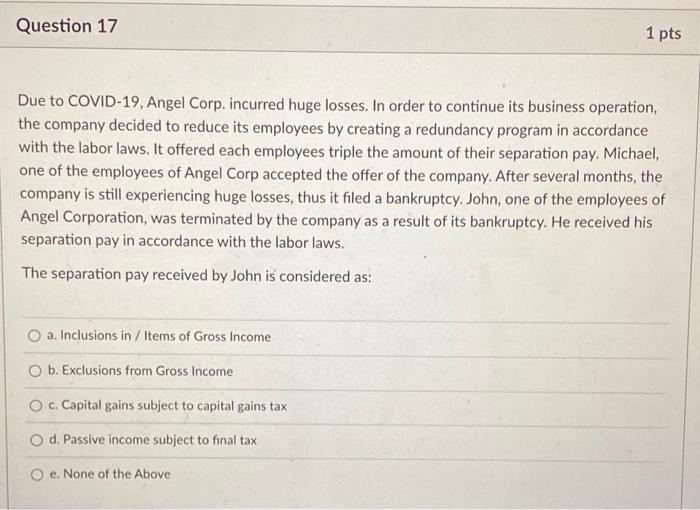

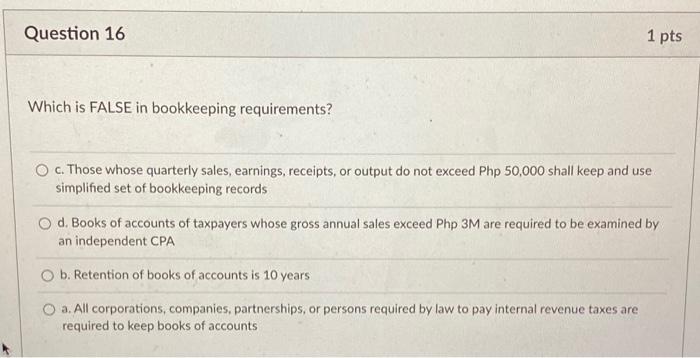

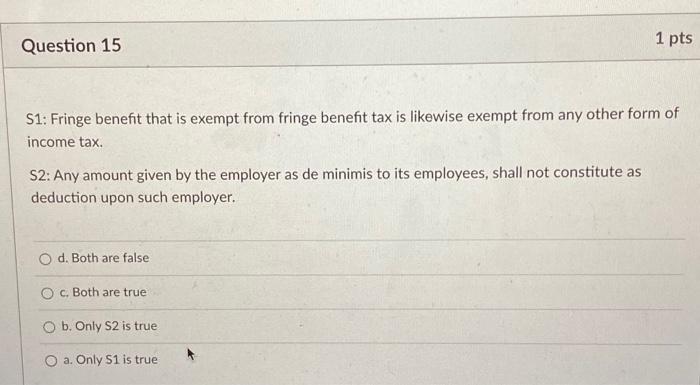

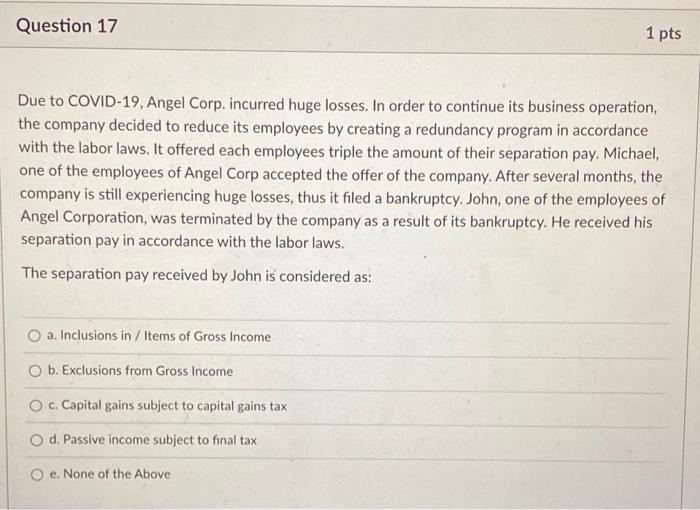

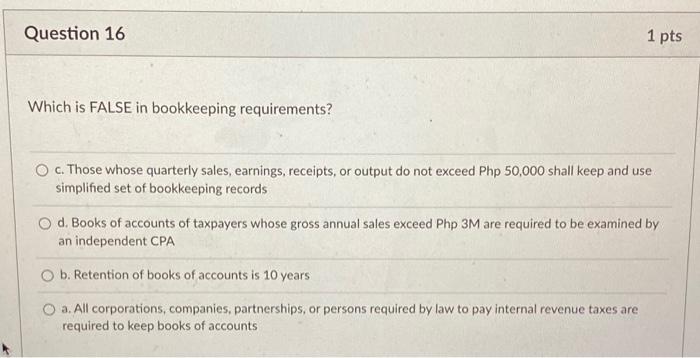

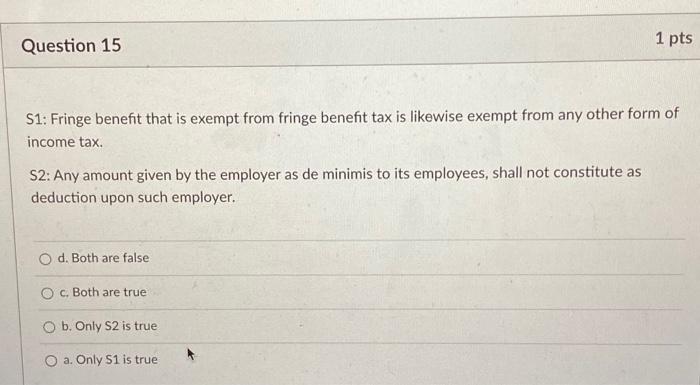

Question 17 1 pts Due to COVID-19, Angel Corp. incurred huge losses. In order to continue its business operation, the company decided to reduce its employees by creating a redundancy program in accordance with the labor laws. It offered each employees triple the amount of their separation pay. Michael, one of the employees of Angel Corp accepted the offer of the company. After several months, the company is still experiencing huge losses, thus it filed a bankruptcy. John, one of the employees of Angel Corporation, was terminated by the company as a result of its bankruptcy. He received his separation pay in accordance with the labor laws. The separation pay received by John is considered as: O a. Inclusions in / Items of Gross Income O b. Exclusions from Gross Income O c. Capital gains subject to capital gains tax d. Passive income subject to final tax Oe. None of the Above Question 16 1 pts Which is FALSE in bookkeeping requirements? O c. Those whose quarterly sales, earnings, receipts, or output do not exceed Php 50,000 shall keep and use simplified set of bookkeeping records O d. Books of accounts of taxpayers whose gross annual sales exceed Php 3M are required to be examined by an independent CPA O b. Retention of books of accounts is 10 years O a. All corporations, companies, partnerships, or persons required by law to pay internal revenue taxes are required to keep books of accounts Question 15 1 pts S1: Fringe benefit that is exempt from fringe benefit tax is likewise exempt from any other form of income tax. S2: Any amount given by the employer as de minimis to its employees, shall not constitute as deduction upon such employer. O d. Both are false O c. Both are true b. Only S2 is true O a. Only 51 is true

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started