Answered step by step

Verified Expert Solution

Question

1 Approved Answer

NO NEED TO EXPLAIN JUST correct ANSWER pls 1 pts Question 22 Which is TRUE? S1: Representation expense of a seller of goods is subject

NO NEED TO EXPLAIN JUST correct ANSWER pls

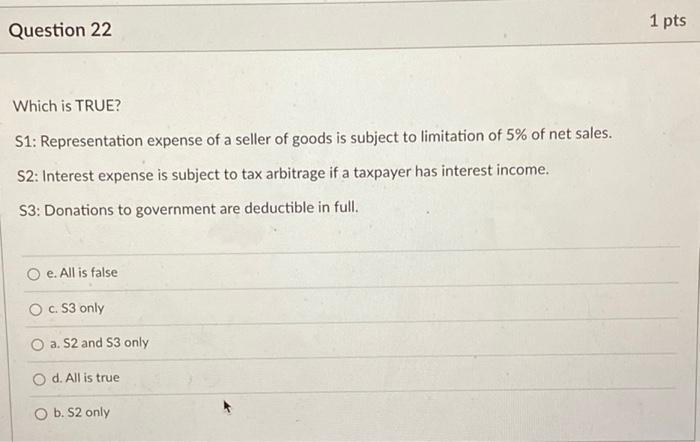

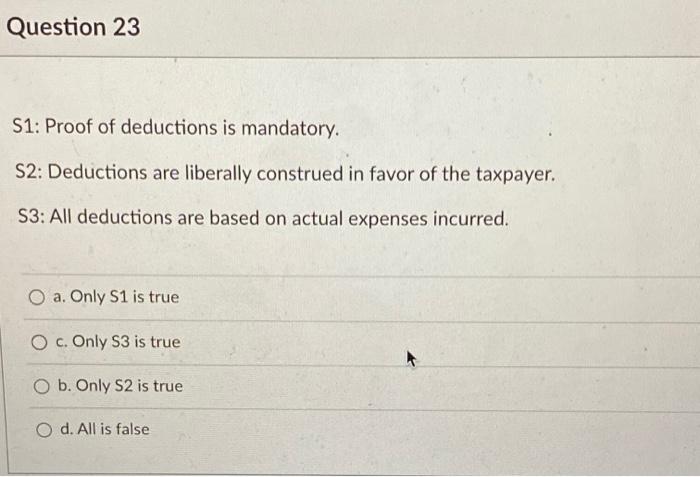

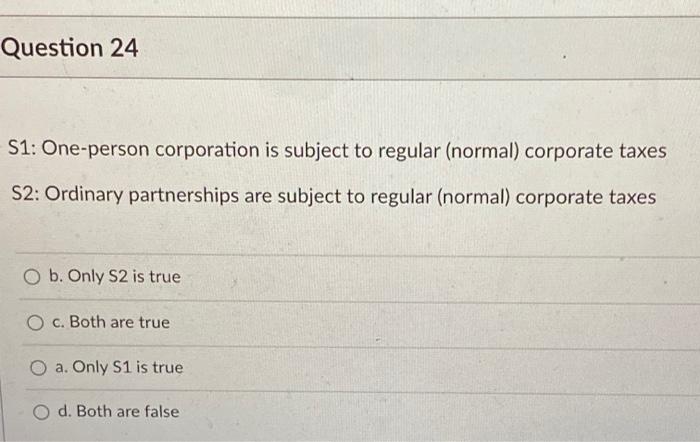

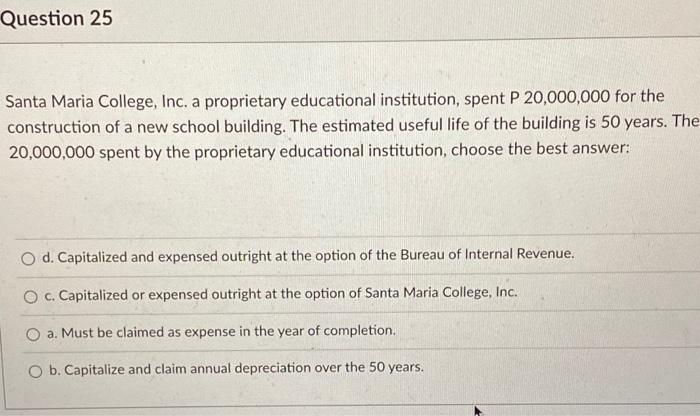

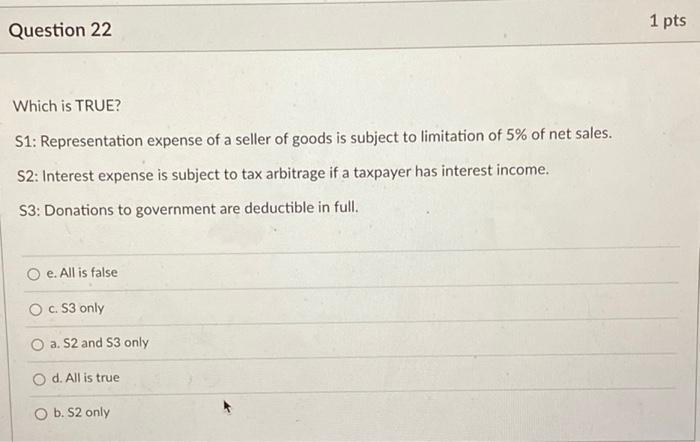

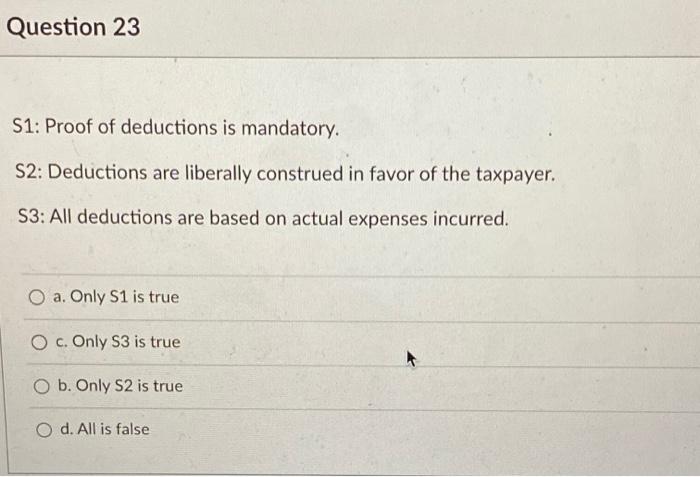

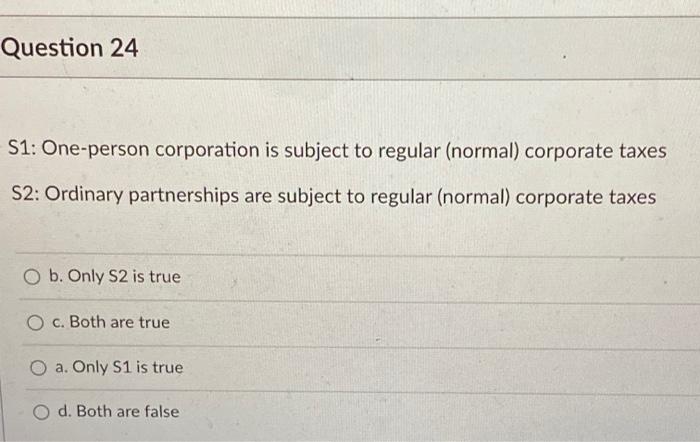

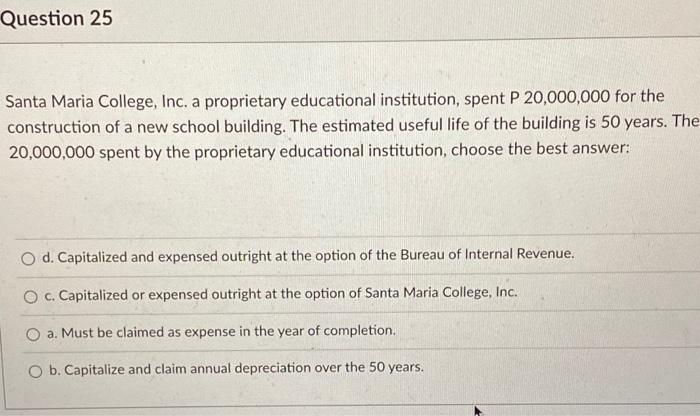

1 pts Question 22 Which is TRUE? S1: Representation expense of a seller of goods is subject to limitation of 5% of net sales. S2: Interest expense is subject to tax arbitrage if a taxpayer has interest income. S3: Donations to government are deductible in full. e. All is false O c. S3 only O a. S2 and 53 only O d. All is true O b. S2 only Question 23 S1: Proof of deductions is mandatory. S2: Deductions are liberally construed in favor of the taxpayer. S3: All deductions are based on actual expenses incurred. O a. Only S1 is true O c. Only S3 is true O b. Only S2 is true O d. All is false Question 24 S1: One-person corporation is subject to regular (normal) corporate taxes S2: Ordinary partnerships are subject to regular (normal) corporate taxes O b. Only S2 is true O c. Both are true O a. Only S1 is true O d. Both are false Question 25 Santa Maria College, Inc. a proprietary educational institution, spent P20,000,000 for the construction of a new school building. The estimated useful life of the building is 50 years. The 20,000,000 spent by the proprietary educational institution, choose the best answer: O d. Capitalized and expensed outright at the option of the Bureau of Internal Revenue. O c. Capitalized or expensed outright at the option of Santa Maria College, Inc. a. Must be claimed as expense in the year of completion. O b. Capitalize and claim annual depreciation over the 50 years

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started