Answered step by step

Verified Expert Solution

Question

1 Approved Answer

No need to show work, just please tell me which answer is right and answer all of them as they are related, i cannot do

No need to show work, just please tell me which answer is right and answer all of them

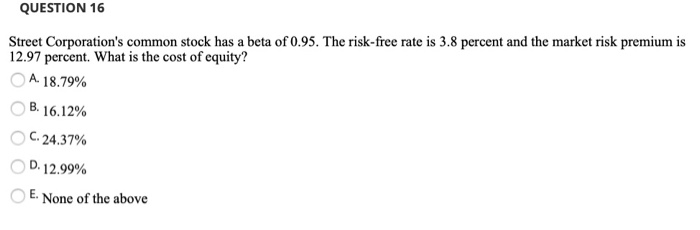

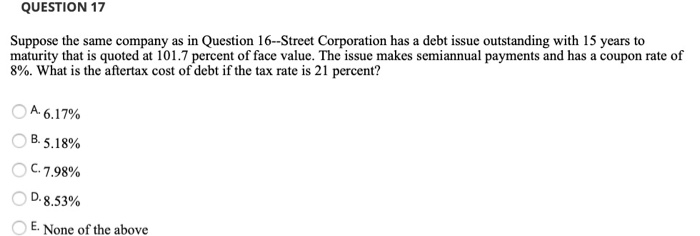

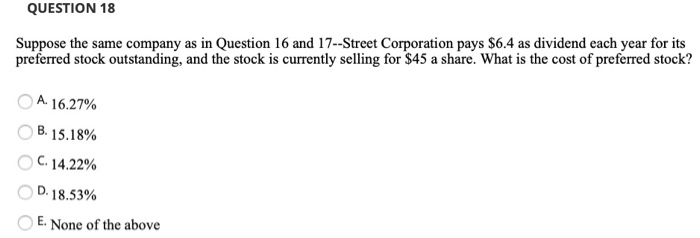

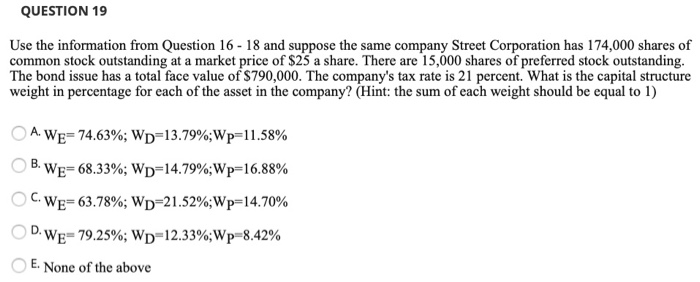

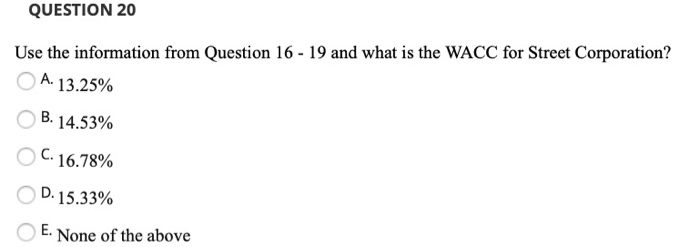

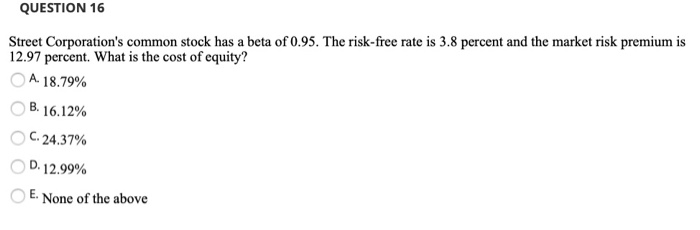

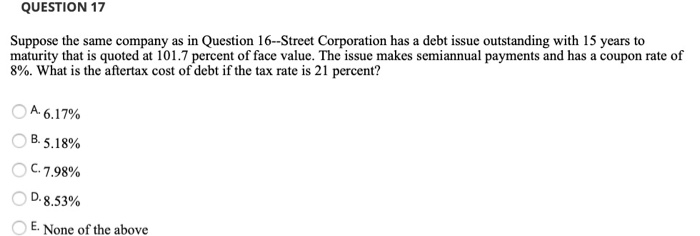

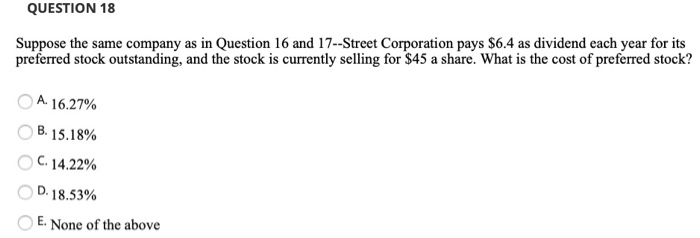

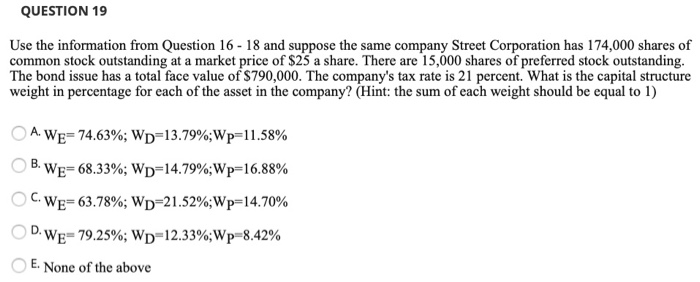

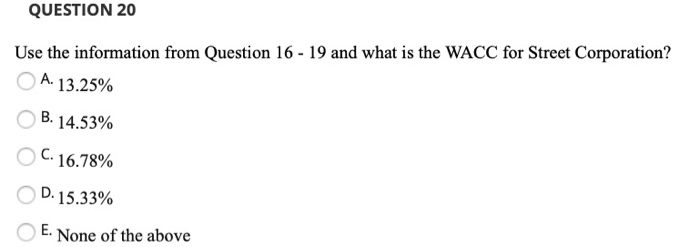

QUESTION 16 Street Corporation's common stock has a beta of 0.95. The risk-free rate is 3.8 percent and the market risk premium is 12.97 percent. What is the cost of equity? A. 18.79% B. 16.12% C. 24.37% D. 12.99% E. None of the above QUESTION 17 Suppose the same company as in Question 16--Street Corporation has a debt issue outstanding with 15 years to maturity that is quoted at 101.7 percent of face value. The issue makes semiannual payments and has a coupon rate of 8%. What is the aftertax cost of debt if the tax rate is 21 percent? A.6.17% B.5.18% C.7.98% D.8.53% E. None of the above QUESTION 18 Suppose the same company as in Question 16 and 17--Street Corporation pays $6.4 as dividend each year for its preferred stock outstanding, and the stock is currently selling for $45 a share. What is the cost of preferred stock? A. 16.27% B. 15.18% C. 14.22% 18.53% E. None of the above QUESTION 19 Use the information from Question 16 - 18 and suppose the same company Street Corporation has 174,000 shares of common stock outstanding at a market price of $25 a share. There are 15,000 shares of preferred stock outstanding. The bond issue has a total face value of $790,000. The company's tax rate is 21 percent. What is the capital structure weight in percentage for each of the asset in the company? (Hint: the sum of each weight should be equal to 1) B. A. WE= 74.63%; Wp=13.79%;Wp=11.58% WE=68.33%; Wp=14.79%;Wp=16.88% C. WE=63.78%; Wp=21.52%;Wp=14.70% D. WE=79.25%; Wp=12.33%;Wp=8.42% E. None of the above QUESTION 20 Use the information from Question 16 - 19 and what is the WACC for Street Corporation? A. 13.25% B. 14.53% C. 16.78% D. 15.33% E. None of the above as they are related, i cannot do them ASAP please

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started