Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(no need to write memo however if you could show/ explain how to get the work it would be appreciated) Job-Order Costing Case 20 22

(no need to write memo however if you could show/ explain how to get the work it would be appreciated)

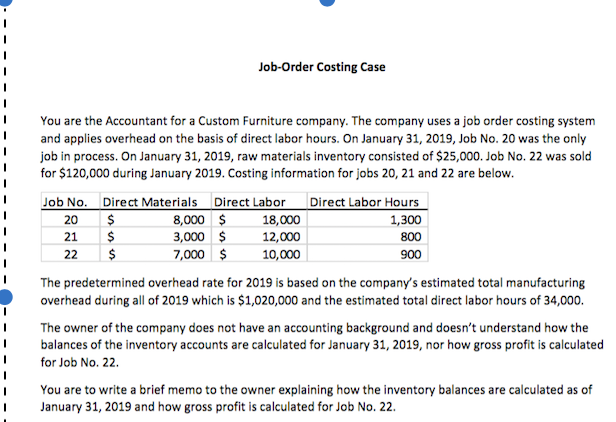

Job-Order Costing Case 20 22 You are the Accountant for a Custom Furniture company. The company uses a job order costing system and applies overhead on the basis of direct labor hours. On January 31, 2019, Job No. 20 was the only job in process. On January 31, 2019, raw materials inventory consisted of $25,000. Job No. 22 was sold for $120,000 during January 2019. Costing information for jobs 20, 21 and 22 are below. Job No. Direct Materials Direct Labor Direct Labor Hours $ 8,000 $ 18,000 1,300 21 $ 3,000 $ 12,000 800 $ 7,000 $ 10,000 900 The predetermined overhead rate for 2019 is based on the company's estimated total manufacturing overhead during all of 2019 which is $1,020,000 and the estimated total direct labor hours of 34,000. The owner of the company does not have an accounting background and doesn't understand how the balances of the inventory accounts are calculated for January 31, 2019, nor how gross profit is calculated for Job No. 22. You are to write a brief memo to the owner explaining how the inventory balances are calculated as of January 31, 2019 and how gross profit is calculated for Job No. 22Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started