Answered step by step

Verified Expert Solution

Question

1 Approved Answer

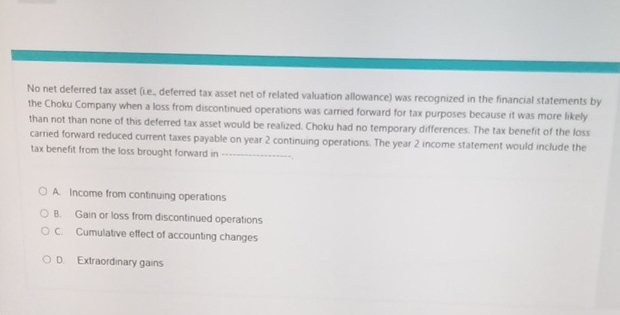

No net deferred tax asset ( ie , deferred tax asset net of related valuation allowance ) was recognized in the financial statements by the

No net deferred tax asset ie deferred tax asset net of related valuation allowance was recognized in the financial statements by

the Choku Company when a loss from discontinued operations was carned forward for tax purposes because it was more likely

than not than none of this deferred tax asset would be realized. Choku had no temporary differences. The tax benefit of the loss

carned forward reduced current taxes payable on year continuing operations. The year income statement would include the

tax benefit from the loss brought forward in

A Income from continuing operations

B Gain or loss from discontinued operations

C Cumulative effect of accounting changes

D Extraordinary gains

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started