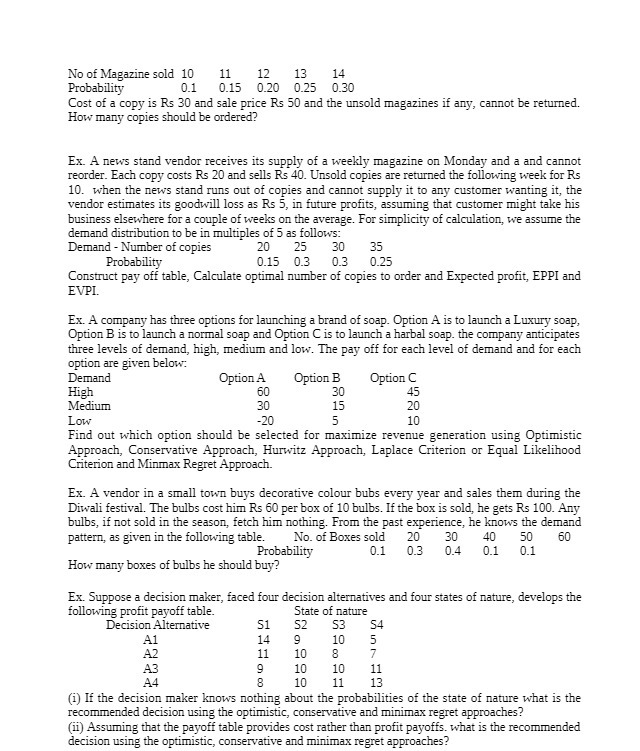

No of Magazine sold 10 11 12 13 14 Probability 0.1 0.15 0.20 0.25 0.30 Cost of a copy is Rs 30 and sale price Rs 50 and the unsold magazines if any, cannot be returned. How many copies should be ordered? Ex. A news stand vendor receives its supply of a weekly magazine on Monday and a and cannot reorder. Each copy costs Rs 20 and sells Rs 40. Unsold copies are returned the following week for Rs 10. when the news stand runs out of copies and cannot supply it to any customer wanting it, the vendor estimates its goodwill loss as Rs 5, in future profits, assuming that customer might take his business elsewhere for a couple of weeks on the average. For simplicity of calculation, we assume the demand distribution to be in multiples of 5 as follows: Demand - Number of copies 20 25 30 35 Probability 0.15 0.3 0.3 0.25 Construct pay off table, Calculate optimal number of copies to order and Expected profit, EPPI and EVPI. Ex. A company has three options for launching a brand of soap. Option A is to launch a Luxury soap, Option B is to launch a normal soap and Option C is to launch a harbal soap. the company anticipates three levels of demand, high, medium and low. The pay off for each level of demand and for each option are given below: Demand Option A Option B Option C High 60 30 45 Medium 30 15 20 Low -20 10 Find out which option should be selected for maximize revenue generation using Optimistic Approach, Conservative Approach, Hurwitz Approach, Laplace Criterion or Equal Likelihood Criterion and Minmax Regret Approach. Ex. A vendor in a small town buys decorative colour bubs every year and sales them during the Diwali festival. The bulbs cost him Rs 60 per box of 10 bulbs. If the box is sold, he gets Rs 100. Any bulbs, if not sold in the season, fetch him nothing. From the past experience, he knows the demand pattern, as given in the following table. No. of Boxes sold 20 30 40 50 60 Probability 0.1 0.3 0.4 0.1 0.1 How many boxes of bulbs he should buy? Ex. Suppose a decision maker, faced four decision alternatives and four states of nature, develops the following profit payoff table. State of nature Decision Alternative 51 52 53 54 A1 14 9 10 A2 11 10 8 A3 9 10 10 11 A4 CO 10 11 13 (i) If the decision maker knows nothing about the probabilities of the state of nature what is the recommended decision using the optimistic, conservative and minimax regret approaches? (ii) Assuming that the payoff table provides cost rather than profit payoffs. what is the recommended decision using the optimistic, conservative and minimax regret approaches