Answered step by step

Verified Expert Solution

Question

1 Approved Answer

no one had helped, please i just need help with the trend analysis-IC AND BS. Please help Format Painter Clipboard - 5 Merge Center -

no one had helped, please i just need help with the trend analysis-IC AND BS. Please help

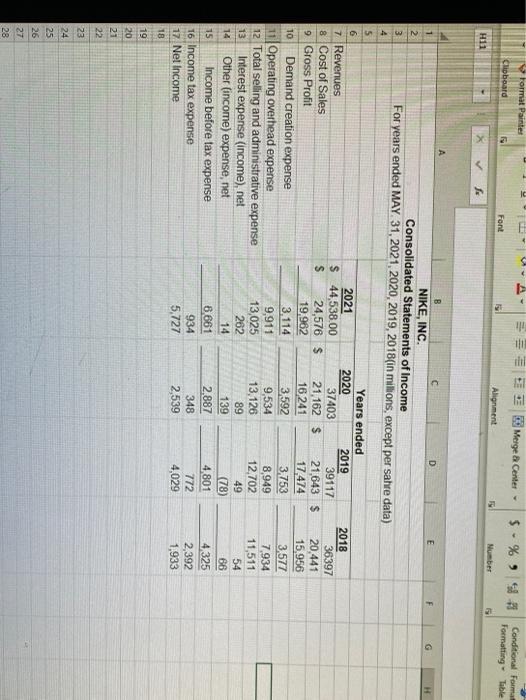

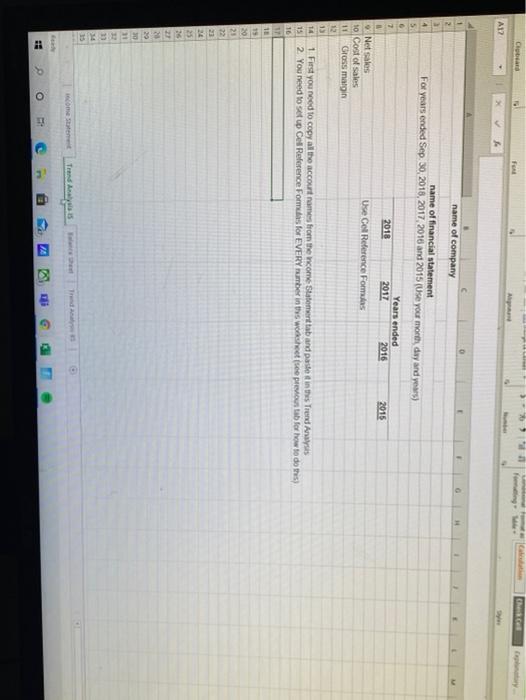

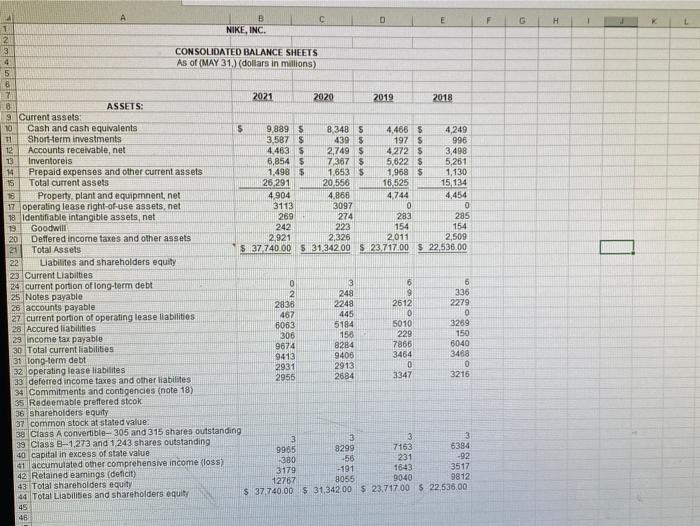

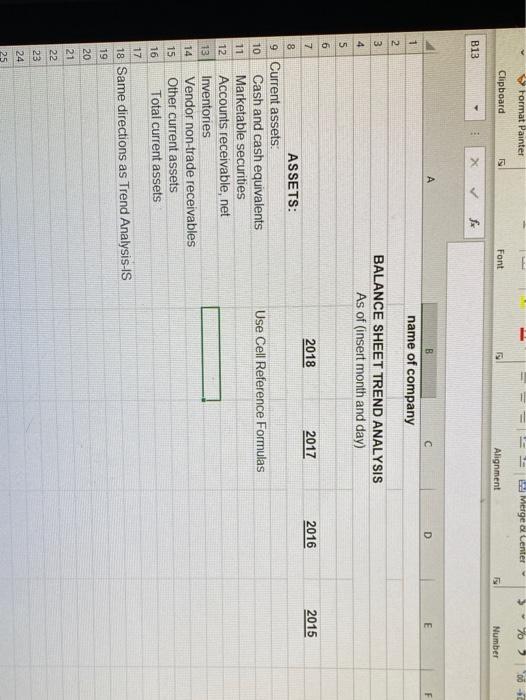

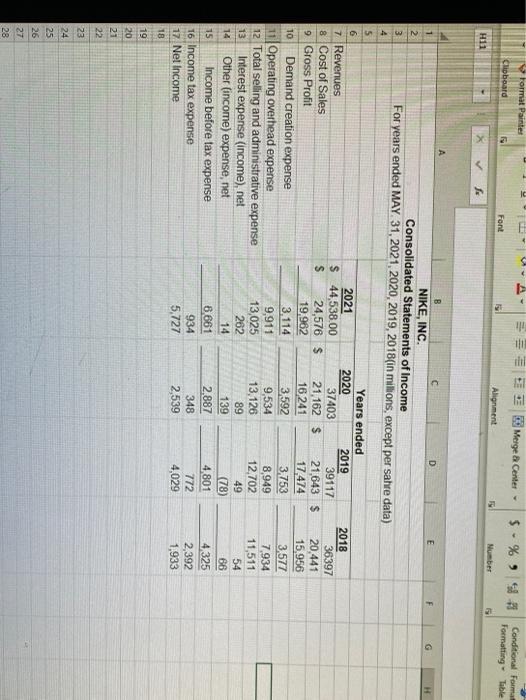

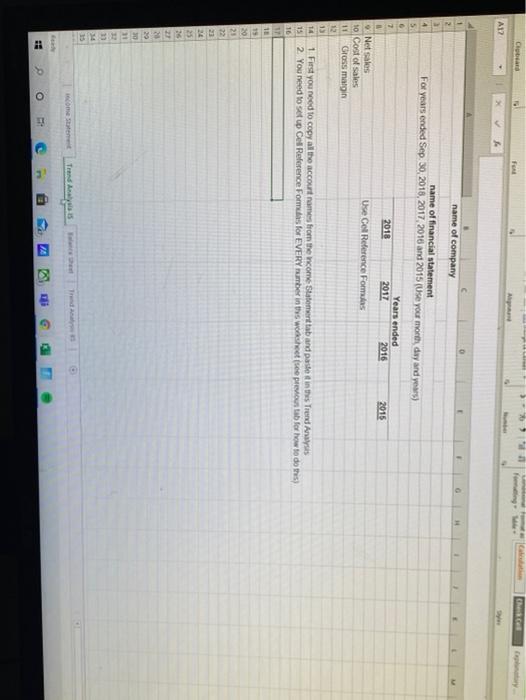

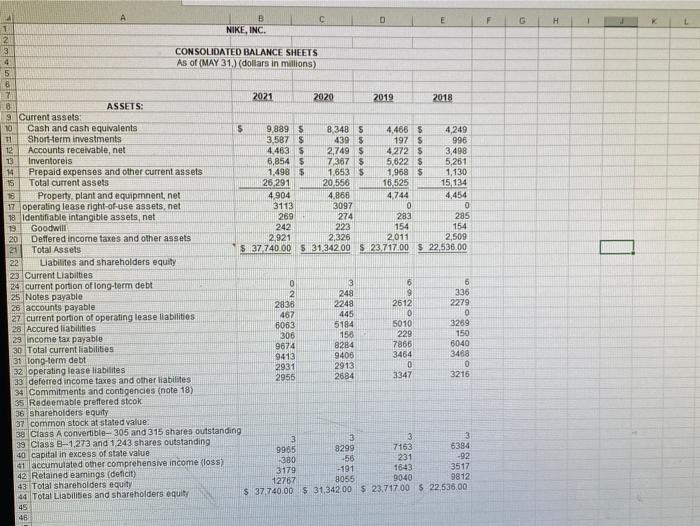

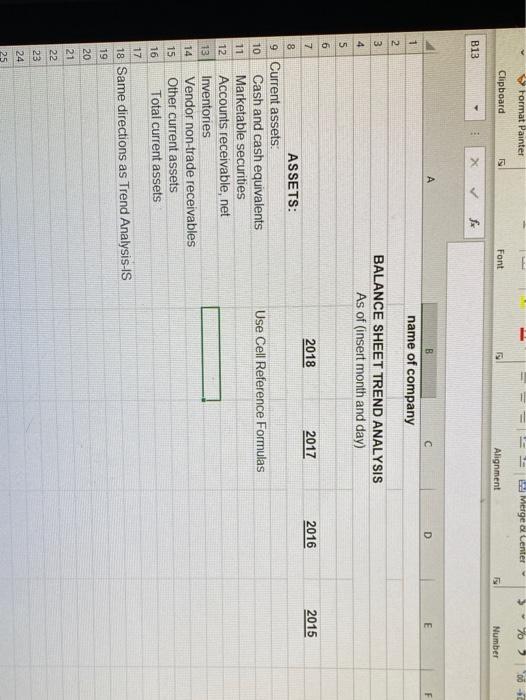

Format Painter Clipboard - 5 Merge Center - $ % 9 SA Conditional Forma Formatting Table Font Alignment Number H11 > 1 D 2 3 NIKE, INC. Consolidated Statements of Income For years ended MAY 31, 2021 2020,2019,2018(in milions, except per sahre data) 4 5 6 7 Revenues 8 Cost of Sales 9 Gross Profit 10 Demand creation expense 11 Operating overhead expense 12 Total selling and administrative expense 13 Interest expense (income), net 14 Other (income) expense, net 15 Income before tax expense 16 Income tax expense 17 Net Income 18 2021 $ 44,538.00 S 24,576 $ 19.962 3.114 9,911 13,025 262 14 8.661 934 5,727 Years ended 2020 2019 37403 39117 21,162 $ 21,643 $ 16 241 17,474 3592 3.753 9,534 8,949 13.126 12,702 89 49 139 (78) 2.887 4,801 348 772 2,539 4,029 2018 36397 20,441 15,956 3,577 7.934 11,511 54 66 4325 2,392 1,933 19 20 21 22 23 24 25 26 27 28 Chubad 9 Chence For A A12 name of company name of financial statement For years ended Sep 30, 2018, 2017 2016 and 2015 (Use your month day and years) 4 5 2018 2011 Years ended 2016 2015 Use Cel Reference Fomis Net sales 10 Cost of sales 11 Gross margin 12 14 15 1 First you need to copy all the account names from the income Statement tab and pasted in the Trend Analysis 2 You need to set up Cell Reference Formulas for EVERY number in this worksheetse previous tab for how to do this) 16 17 11 20 25 24 5 25 23 29 RARE come to Trond Analysis c O 3 22 e F H 1 A B 1 NIKE, INC. 2 3 CONSOLIDATED BALANCE SHEETS 4 As of (MAY 31.) (dollars in millions) 5 B 2021 2020 2019 2018 3 ASSETS: 9 Current assets 10 Cash and cash equivalents 5 9,889 5 8.348 5 4,466 5 4,249 11 Short-term investments 3,587 5 439 S 197 $ 996 12 Accounts receivable, net 4.463 5 2,749S 4272 $ 3,498 23 Inventoreis 6,854 $ 7,367 $ 5,622 $ 5,261 14 Prepaid expenses and other current assets 1,498 $ 1.6533 1.968 $ 1,130 15 Total current assets 26.291 20,556 16,525 15,134 16 Property, plant and equipment, net 4,904 4,866 4.744 4,454 17. operating lease right-of-use assets net 3113 3097 0 0 18 Identifiable intangible assets net 269 274 283 285 13 Goodwill 242 223 154 154 20 Deffered income taxes and other assets 2921 2,326 2011 2,509 21 Total Assets $ 37,740.00 $ 31, 34200 $ 23,717.00 $ 22,536.00 22 Liabilites and shareholders equity 23 Current Liabilties 24 current portion of long-term debt 0 3 6 6 25 Notes payable 2 248 9 336 26 accounts payable 2836 2248 2612 2279 467 445 0 27 current portion of operating lease liabilities 0 28 Accured liabilities 6063 5184 5010 3269 306 29 income tax payable 1156 229 150 9674 8284 7866 30. Total current liabilities 6040 9413 31 long-term debt 9406 3464 3468 2931 32 Operating lease liabilites 0 0 2955 33 deferred income taxes and other liabilites 2684 3347 34 Commitments and contigencies (note 18) 35 Redeemable preffered stcok 36 Shareholders equity 37 common stock at stated value 38 Class A convertible- 305 and 315 shares outstanding 3 3 3 3 39 Class 8-1,273 and 1,243 shares outstanding 9985 9299 7163 40 capital in excess of state value 6384 380 -56 231 -92 41 accumulated other comprehensive income (loss) 3179 -191 1643 3517 42 Retained eamings (deficit) 12767 3055 9040 9812 43 Total shareholders equity 44 Total Liabilities and shareholders oquity $ 37,740.00 $ 31 34200 $ 23.717.00 $ 22.536.00 49 46 2913 3216 Format Painter - Merge Center > % 0-0 Clipboard Font Alignment Number B13 X SA D E 1 name of company WN- BALANCE SHEET TREND ANALYSIS As of (insert month and day) 4 2018 2017 2016 2015 Use Cell Reference Formulas 6 7 8 ASSETS: 9 Current assets: 10 Cash and cash equivalents 11 Marketable securities 12 Accounts receivable, net 13 Inventories 14 Vendor non-trade receivables 15 Other current assets 16 Total current assets 17 18 Same directions as Trend Analysis-IS 19 20 21 22 23 24 25

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started