No other information given other than whats listed

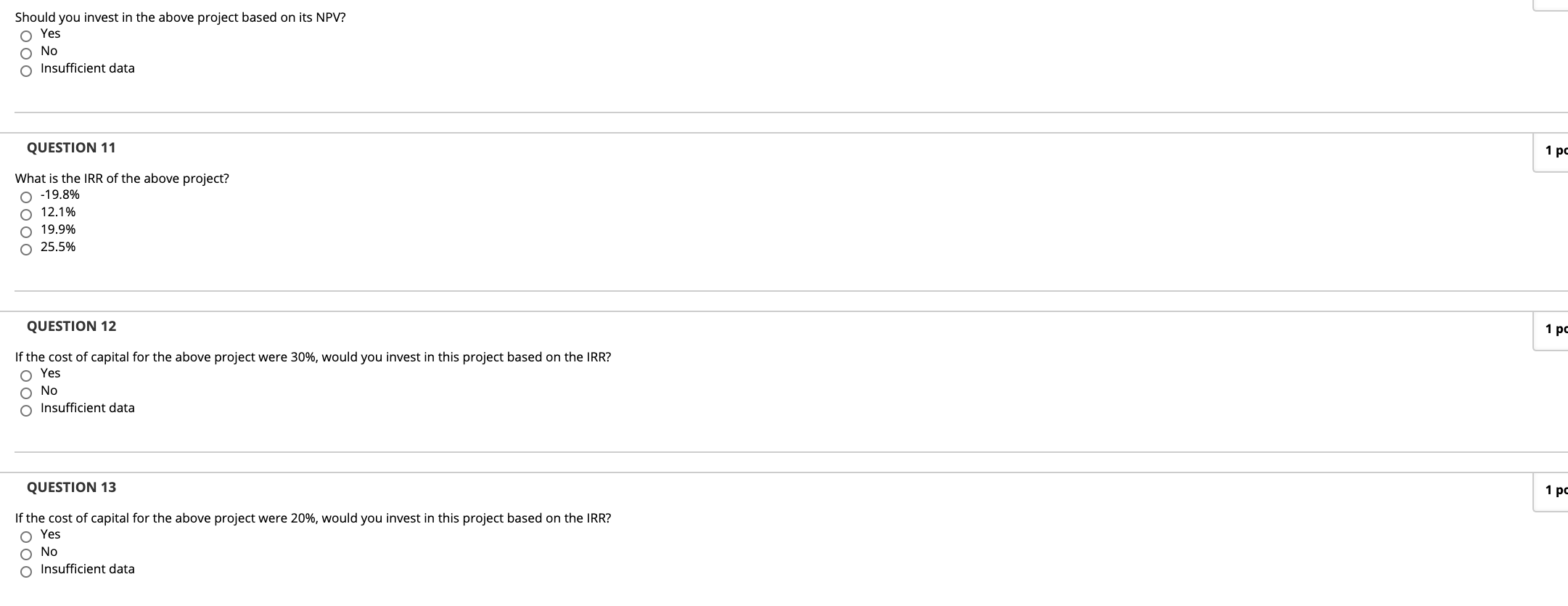

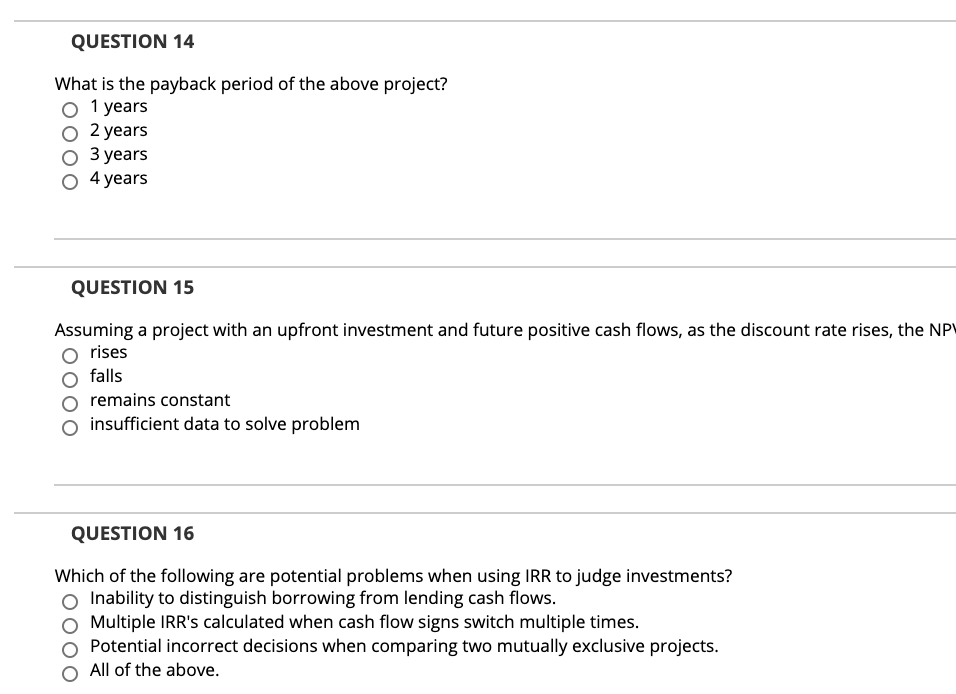

Should you invest in the above project based on its NPV? o Yes O No o Insufficient data QUESTION 11 1 pc What is the IRR of the above project? 0 -19.8% 12.1% O 19.9% 25.5% QUESTION 12 1 pc If the cost of capital for the above project were 30%, would you invest in this project based on the IRR? O Yes No Insufficient data QUESTION 13 1 pc If the cost of capital for the above project were 20%, would you invest in this project based on the IRR? Yes Insufficient data QUESTION 14 What is the payback period of the above project? 1 years 2 years O 3 years o 4 years QUESTION 15 Assuming a project with an upfront investment and future positive cash flows, as the discount rate rises, the NP Orises falls remains constant o insufficient data to solve problem QUESTION 16 Which of the following are potential problems when using IRR to judge investments? Inability to distinguish borrowing from lending cash flows. Multiple IRR's calculated when cash flow signs switch multiple times. Potential incorrect decisions when comparing two mutually exclusive projects. All of the above. Should you invest in the above project based on its NPV? o Yes O No o Insufficient data QUESTION 11 1 pc What is the IRR of the above project? 0 -19.8% 12.1% O 19.9% 25.5% QUESTION 12 1 pc If the cost of capital for the above project were 30%, would you invest in this project based on the IRR? O Yes No Insufficient data QUESTION 13 1 pc If the cost of capital for the above project were 20%, would you invest in this project based on the IRR? Yes Insufficient data QUESTION 14 What is the payback period of the above project? 1 years 2 years O 3 years o 4 years QUESTION 15 Assuming a project with an upfront investment and future positive cash flows, as the discount rate rises, the NP Orises falls remains constant o insufficient data to solve problem QUESTION 16 Which of the following are potential problems when using IRR to judge investments? Inability to distinguish borrowing from lending cash flows. Multiple IRR's calculated when cash flow signs switch multiple times. Potential incorrect decisions when comparing two mutually exclusive projects. All of the above